eCommerce: South Korea

Qoo10’s TMON and WeMakePrice Face Problems in the South Korean Market

TMON and WeMakePrice are facing problems in the South Korean eCommerce market. Are these isolated events or signs of trouble in the country's online shopping market? Find out.

Article by Cihan Uzunoglu | July 29, 2024

TMON & WeMakePrice Face Liquidity Problems: Key Insights

Refund Suspension: Due to severe liquidity issues, TMON and WeMakePrice have halted refunds in the South Korea's eCommerce market.

Acquisition Strategy Strains: Qoo10's push to expand its market presence and prepare for a Nasdaq IPO through aggressive acquisitions has led to major financial and operational challenges.

Seeking Financial Aid: To address a US$122.8 million debt crisis, Qoo10 is looking to secure US$50 million from its U.S. affiliate Wish, while local payment operators and the government offer support to affected customers and small business owners.

The South Korean eCommerce market, the fourth largest globally, is experiencing turbulence. South Korea's Fair Trade Commission recently announced an investigation into two major eCommerce platforms, Ticket Monster (TMON) and WeMakePrice, both owned by Singapore-based Qoo10.

The platforms are accused of withholding US$123 million owed to around 60,000 merchants.

Refund Issues of TMON and WeMakePrice

Both TMON and WeMakePrice are grappling with liquidity issues. As a result, they have halted refunds to consumers. Local banks have also suspended loan services to these platforms due to delayed payments, according to media reports.

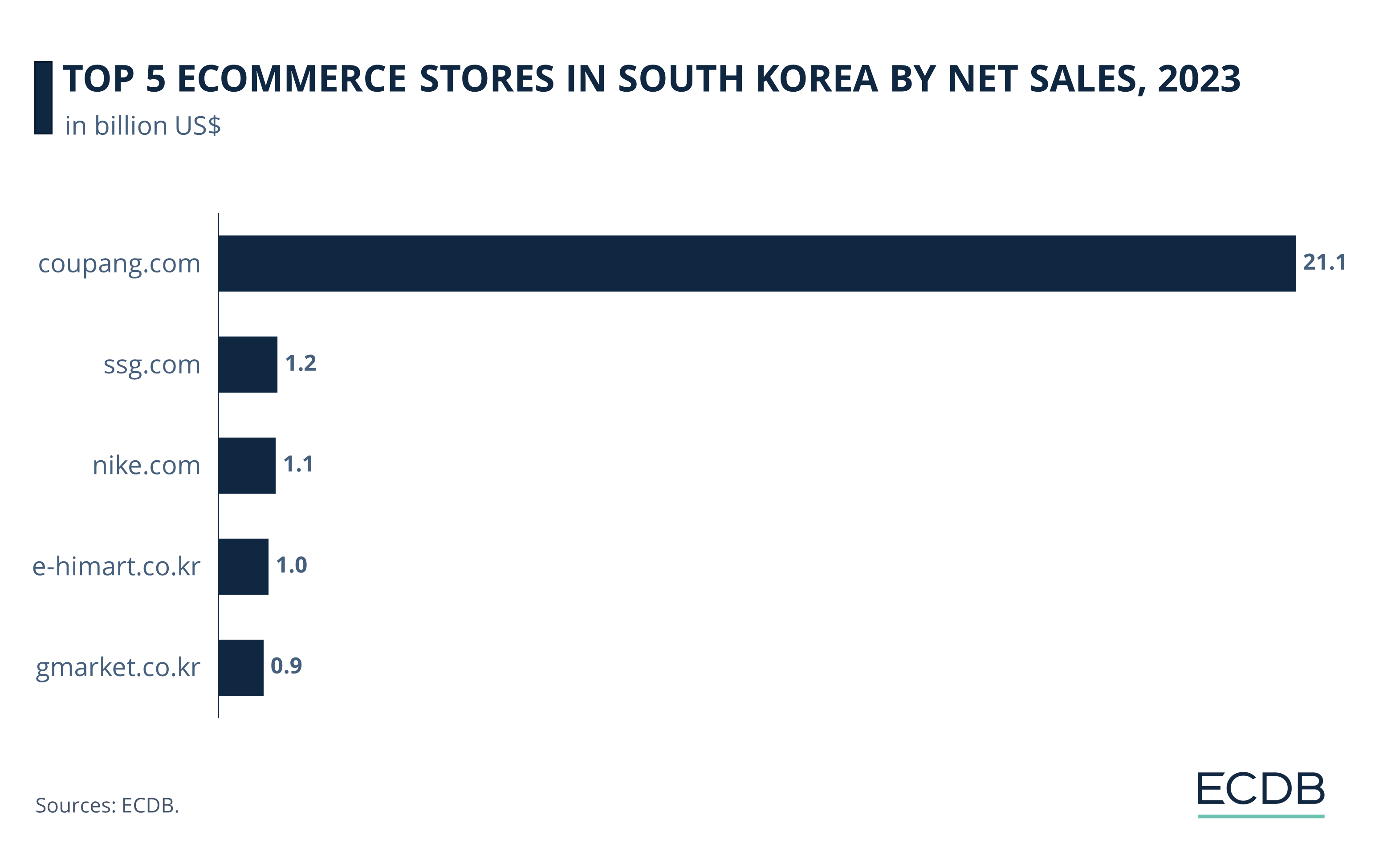

The South Korean eCommerce market is dominated by coupang.com, ssg.com, and nike.com.

By 2023, these stores accounted for two thirds (66.8%) of the market share of the top 100 stores in the South Korean eCommerce market.

With 2023 net sales of US$21.1 billion, coupang.com is in a league of its own.

Qoo10: Financial Challenges

The crisis has had immediate effects. InterPark Triple, which sells travel products on TMON and WeMakePrice, threatened to cease operations if payments were not made by July 25, 2024. Its parent company, Yanolja, has already stopped selling on both platforms.

Qoo10, which has been aggressively expanding through acquisitions, including TMON and WeMakePrice, is at the center of the controversy. These acquisitions aimed to bolster Qoo10's market presence and prepare for a Nasdaq IPO. However, they have also led to financial strain and operational challenges.

Like this insight? It is based on our regularly updated rankings. With our retailer and country rankings, you can learn valuable information about your specific market. Our product category rankings and benchmarks allow you to see where various businesses are currently evolving. This information can aid in your decision-making, whether you are a business developer, shop owner, or CEO of a large eCommerce brand. Stay a step ahead of the market with ECDB.

Funding Efforts & Market Response

In response to the crisis, Qoo10 is reportedly seeking US$50 million from its U.S. affiliate, Wish, acquired in February 2024. However, authorities doubt this will suffice to resolve the issues. The value of delayed payments is estimated at US$122.8 million, with TMON and WeMakePrice owing US$79.2 million and US$40.8 million, respectively.

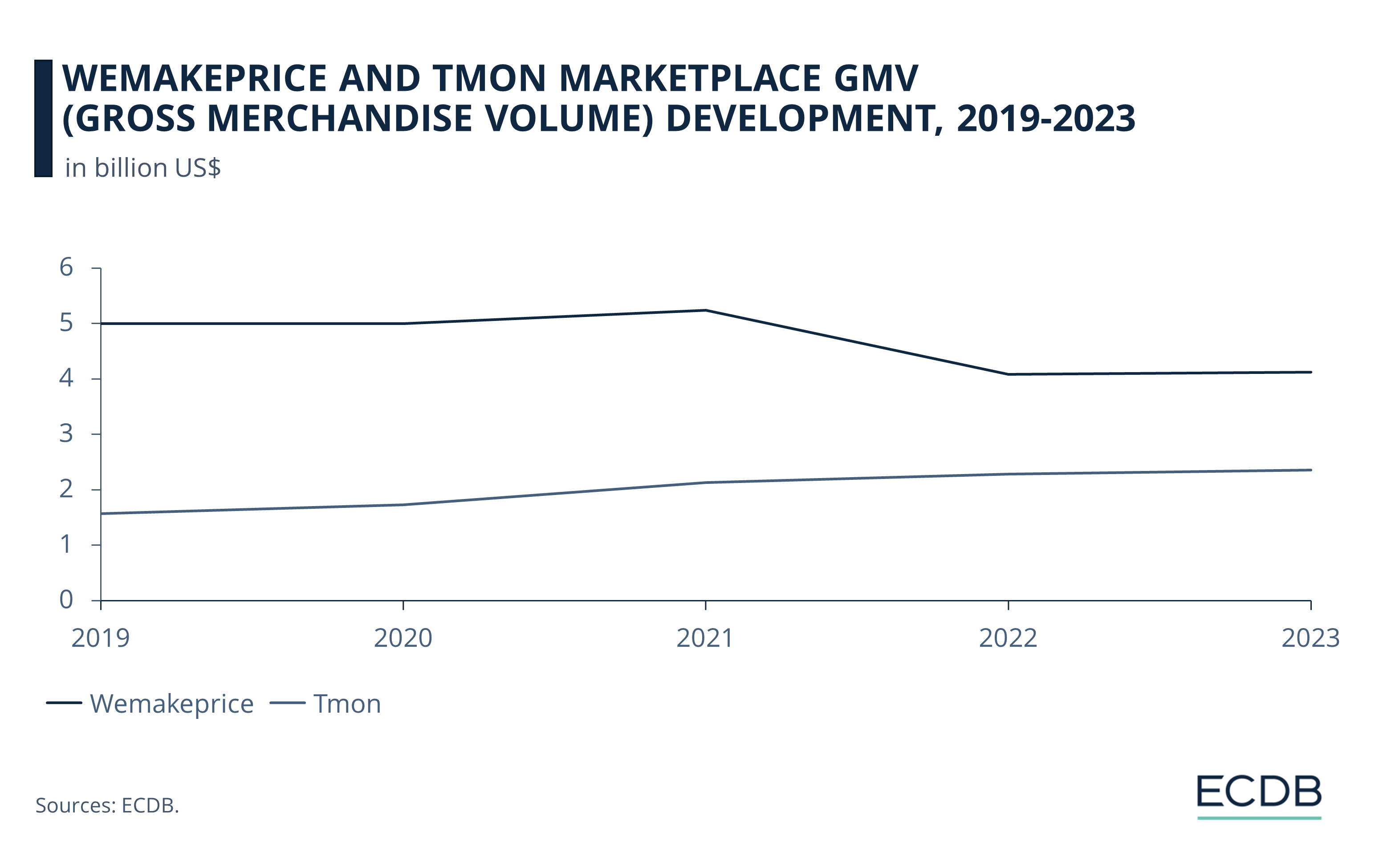

While the gap between WeMakePrice’s GMV and TMON’s was roughly US$3.4 billion in 2019, this difference was halved by the end of last year (US$1.7 billion).

Amid the crisis, local payment service operators like Naver Financial, Kakao Pay, and Toss have stepped in to compensate affected customers. The government is also considering support measures for small business owners impacted by the situation.

Qoo10 CEO Ku Young-bae has remained largely silent. He recently resigned from his role as CEO of Qxpress, a logistics provider under Qoo10, to distance himself from the crisis.

Sources: TechCrunch, The Korea Herald, ECDB

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

ByteDance Is Big on Personal Care, Powered by Content on Douyin and TikTok Shop

ByteDance Is Big on Personal Care, Powered by Content on Douyin and TikTok Shop

Deep Dive

Birkenstock Business Model: Marketing Strategy & eCommerce Sales

Birkenstock Business Model: Marketing Strategy & eCommerce Sales

Deep Dive

Kaspi to Acquire Stake in Hepsiburada, Expanding Presence in Turkey

Kaspi to Acquire Stake in Hepsiburada, Expanding Presence in Turkey

Deep Dive

Jumia Business Analysis: Top Markets, Revenue, GMV & eCommerce in Africa

Jumia Business Analysis: Top Markets, Revenue, GMV & eCommerce in Africa

Deep Dive

Wayfair’s Shopping Way Day: Analysis & Market Insights

Wayfair’s Shopping Way Day: Analysis & Market Insights

Back to main topics