eCommerce: Consumer Electronics

Online Consumer Electronics Market in the U.S: Top Stores, Revenue & Market Growth

Where do U.S. consumers buy electronics online: Amazon, Apple, or Walmart? Explore top stores, revenue, and market growth in our detailed analysis.

Article by Cihan Uzunoglu | August 15, 2024Download

Coming soon

Share

Online Consumer Electronics Market in the United States:

Key Insights

Market Dominance: Amazon leads the U.S. online consumer electronics market, far ahead of competitors. Key players like Apple, Walmart, and Best Buy also play crucial roles in shaping the competitive market.

Growth Trend: The U.S. online consumer electronics market has experienced rapid growth, especially during the pandemic, and is expected to keep expanding, with revenues projected to hit US$204 billion by 2028.

Share Fluctuations: The online share of the U.S. consumer electronics market grew steadily until 2020, followed by a dip, but it's set to rebound, reaching 57% by 2028.

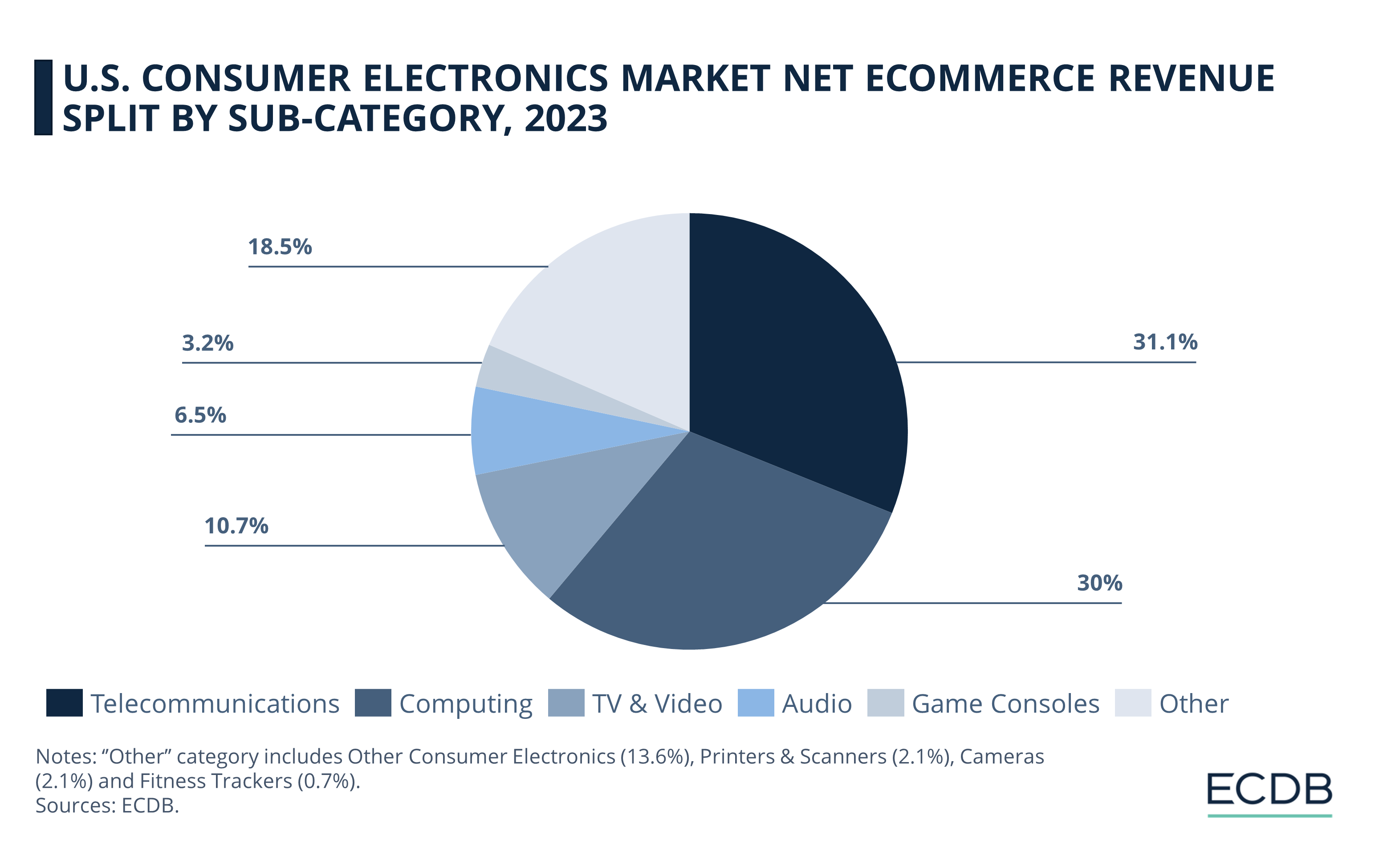

Category Shares: Telecommunications leads with a 31% share in the U.S. online consumer electronics market, followed closely by computing at 30%. Smaller shares are held by categories like TV & video, audio, and game consoles.

Will robots take over humanity? Not quite yet, but consumer electronics are already leading the charge in eCommerce.

The U.S. online consumer electronics market has undergone significant changes in recent years, especially following the pandemic.

Before exploring the market dynamics, let's first examine the key players shaping the industry.

Top Online Stores for Consumer Electronics

in the U.S.

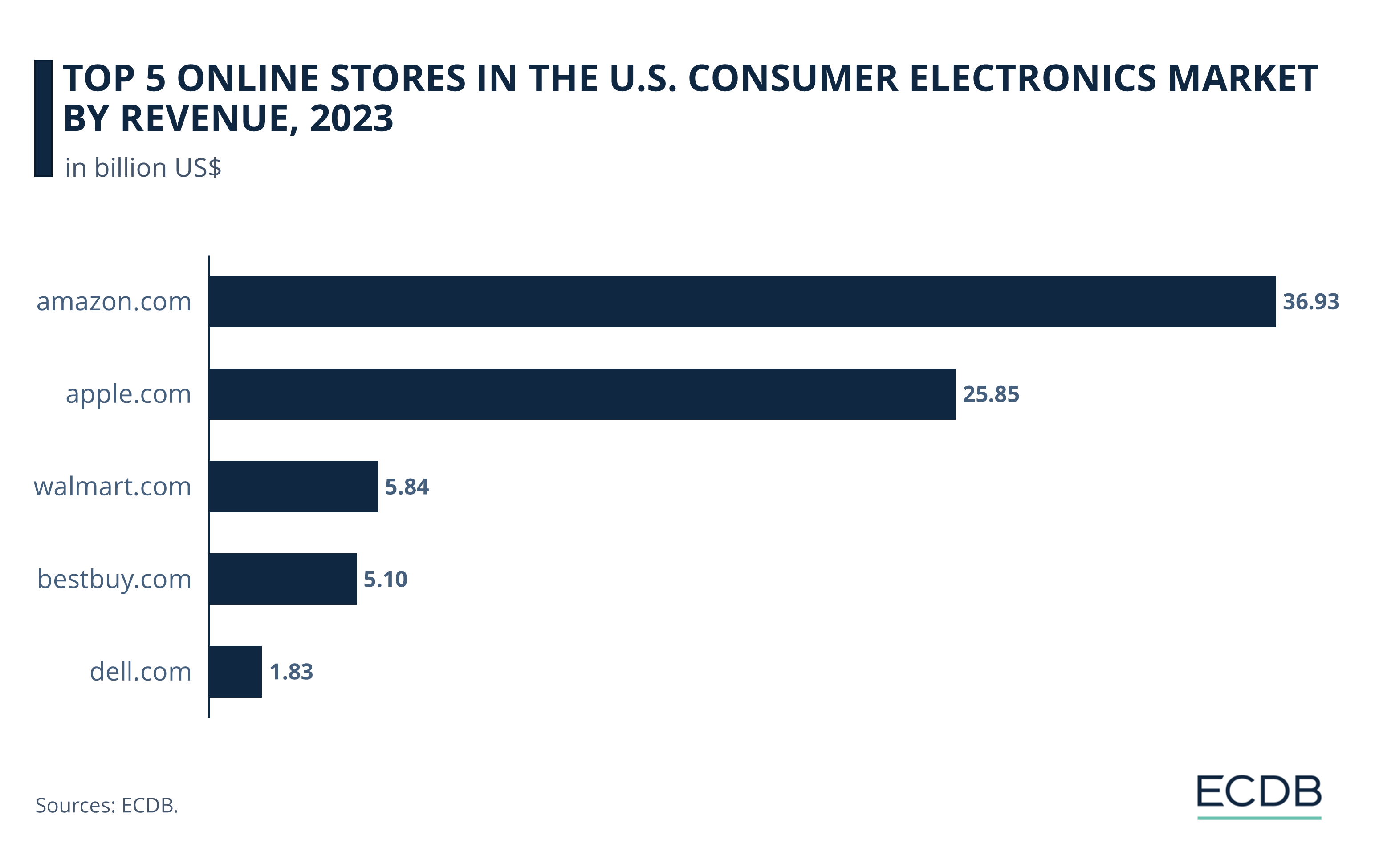

Looking at the top online stores in the U.S. consumer electronics market, we see a tiered competition:

Amazon.com leads the market at 2023 revenues of US$36.9 billion.

Apple.com follows relatively close at US$25.85 billion.

The rest of the top 5 consists of walmart.com, bestbuy.com, and dell.com, the first two with about US$5 billion in revenue, and the latter with US$1.8 billion by 2023.

To understand what makes these players the best, let's take a closer look.

1. Amazon.com

Amazon.com dominates the U.S. online consumer electronics market with nearly US$37 billion in revenue for 2023, solidifying its position as the market leader.

The platform's vast product selection, competitive pricing, and Prime membership perks contribute to its strong market presence. While its eCommerce sales have slightly declined as a percentage of overall revenue, Amazon continues to expand its influence, integrating new features like "Buy with Prime" to enhance the shopping experience across other platforms. Despite increasing competition, Amazon’s grip on the consumer electronics market remains unchallenged.

2. Apple.com

Apple.com generated US$26 billion in U.S. online consumer electronics sales in 2023, securing its position as the second-largest player in the market. Globally, the site pulled in US$47 billion, highlighting its substantial international influence.

Key drivers of Apple's online sales include the consistent popularity of its iPhone lineup and the recent introduction of the iPhone 15, which is expected to boost accessory sales as well. Despite some decline in overall product sales, Apple’s dominance in the market remains strong, particularly due to its robust service offerings and innovative product launches.

For your information: We regularly update our rankings with the latest data from our models, providing valuable insights to help improve your company. Which stores and companies are leading eCommerce? Which categories are driving bestsellers and high sales? Find out for yourself on our rankings for companies, stores, and marketplaces. Stay a step ahead of the market with ECDB.

3. Walmart.com

Walmart.com generated US$5.8 billion in U.S. online consumer electronics sales in 2023, placing it firmly in the second tier of top players.

Walmart has seen strong growth in its eCommerce segment, driven largely by its pickup and delivery services. While grocery remains a key driver for Walmart's online growth, the electronics category continues to be a significant contributor.

Walmart's strategy of integrating its vast physical store network with its online platform has helped it maintain a competitive edge in the market.

4. Bestbuy.com

Bestbuy.com generated US$5.1 billion in U.S. online consumer electronics sales in 2023, positioning it as a major player in the market.

In Q1 2024, Best Buy reported a 6.1% decline in online sales, bringing in US$2.52 billion. Despite this decrease, online sales still made up 30.8% of Best Buy’s total domestic revenue, slightly higher than the previous year's 30.5%. The company noted that the speed and efficiency of online delivery continued to improve, with 60% of packages delivered or available for pickup within one day. While overall sales were down, there were bright spots in categories like phones, services, and laptops.

5. Dell.com

Dell.com remains a key player in the U.S. online consumer electronics market, generating approximately US$1.6 billion in revenue in 2023.

Although this places it in the third tier among top online electronics stores, Dell continues to adapt to market demands, particularly in the B2B segment. Dell's focus on high-performance computing solutions, including AI-optimized servers and storage, has helped maintain its relevance in the industry.

Online Consumer Electronics Market

in the U.S: 50% Revenue Jump in 2020

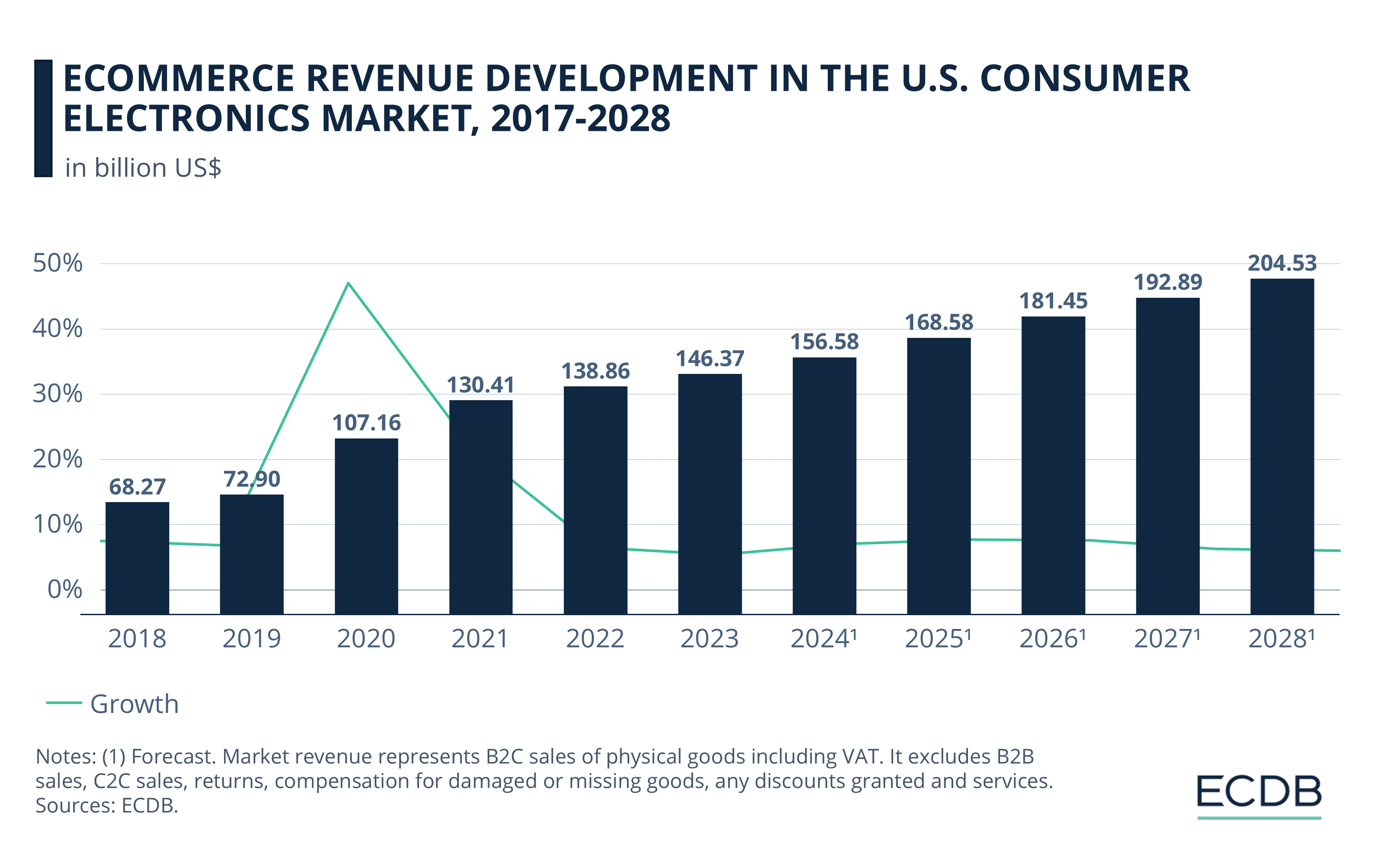

The online consumer electronics market in the U.S. has made significant progress, especially with a considerable increase during the pandemic.

Back in 2017, revenue stood at US$63.5 billion.

By 2019, this figure had risen to nearly US$73 billion, showing steady growth.

The pandemic marked a pivotal year for online consumer electronics in the country, reaching US$107 billion in 2020 with a dramatic 47% jump in revenue.

Post-pandemic, the growth continued: By 2023, the market revenue reached US$146.3 billion.

The upward trend is projected to continue, with the revenue forecast to increase to US$156.5 billion by the end of 2024.

The market is expected to keep growing strongly towards 2028, as the anticipated revenue is US$204.5 billion for that year.

Online Share Decline Since 2021

Expected to Reverse

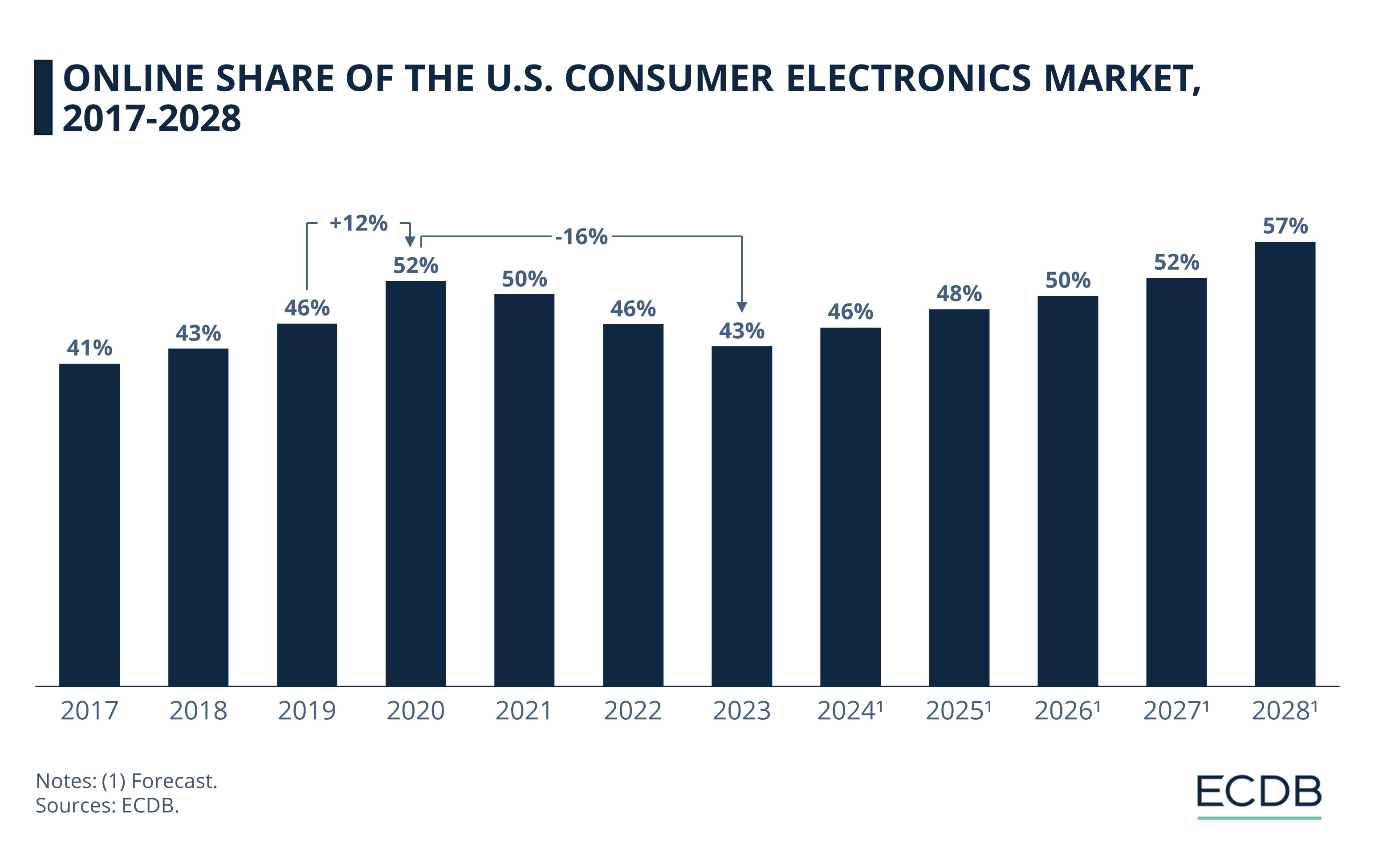

The online share of a market is a key metric for understanding the eCommerce dynamics of a particular industry and/or country.

In the case of the U.S. consumer electronics market, this share has experienced fluctuating trends in recent years. From 41% in 2017 to 52% in 2020, the market has seen a steady increase in online share.

However, from 2021 onwards, this share started to decline, reaching a low of 43% last year. However, the future seems optimistic for eCommerce.

The online share of the market is expected to reach 2020 levels by 2026, before increasing at a faster pace to reach 57% by 2028, according to our forecast.

Telecommunications and Computing Make Up Over Half of the Market

Looking at different sub-categories in the online consumer electronics market in the U.S., we see varying shares.

Telecommunications sit at the top with 31%,

Followed by Computing at 30%.

While TV & Video takes up 10% of the market,

Rest of the market is split between Audio (6.5%), Game Consoles (3.2%) and Other (18.5%).

Sources: GeekWire, Euromonitor, EnterpriseAppsToday, Digital Commerce 360, ECDB

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

eCommerce in Canada: Top Stores, Market Development & Trends

eCommerce in Canada: Top Stores, Market Development & Trends

Deep Dive

Top eCommerce Companies by Market Cap 2024

Top eCommerce Companies by Market Cap 2024

Deep Dive

Online Shopping in the United States: Where Consumers Prefer to Shop Online

Online Shopping in the United States: Where Consumers Prefer to Shop Online

Deep Dive

Alibaba Competitors: Which Companies Are Alibaba’s Biggest eCommerce Rivals?

Alibaba Competitors: Which Companies Are Alibaba’s Biggest eCommerce Rivals?

Deep Dive

The Global B2B eCommerce Market: Why It Is Beneficial to Sell to Other Businesses

The Global B2B eCommerce Market: Why It Is Beneficial to Sell to Other Businesses

Back to main topics