eCommerce: Sports & Online Shopping

NFL in eCommerce: Online Store Analysis, Partnerships & Strategy

Learn about how the NFL is engaging in eCommerce through partnerships and innovative online store strategies, featuring collaborations with Fanatics and Amazon.

Article by Cihan Uzunoglu | August 06, 2024Download

Coming soon

Share

NFL in eCommerce: Key Insights

Online Store Growth:

Nflshop.com is expected to grow, reaching US$250 million by 2025 after a recent decline, driven by strong brand recognition from Fanatics and targeting a diverse U.S. market.

Fandom Demographics:

NFL fandom varies by gender, age, and income: 51% of men are avid fans, 42% of women are non-fans, 41% of ages 35-44 are loyal followers, and 45% of those earning above US$100K are die-hard fans.

Fanatics Partnerships:

Fanatics secured 10-year deals with the Cowboys and Vikings, enhancing NFL eCommerce. The Cowboys partnership expands retail reach, while the Vikings deal boosts online, mobile, and physical store experiences.

Social Commerce Initiatives:

The NFL partnered with Instagram to sell New Era draft day hats directly through the platform. Amazon's first Black Friday NFL game broadcast aimed to strengthen its partnership with the NFL and attract more shoppers. The league also teamed up with Roblox to launch a virtual storefront targeting younger fans.

The National Football League (NFL) is a major player in American sports culture, both on and off the field. The NFL's push into eCommerce is driven by its diverse fan base, spanning various ages and income levels.

Adapting to these changes is crucial for the NFL. It's not just about selling more jerseys; it's about understanding who their fans are and what they want. So, where does the NFL stand in eCommerce today, and where is it headed?

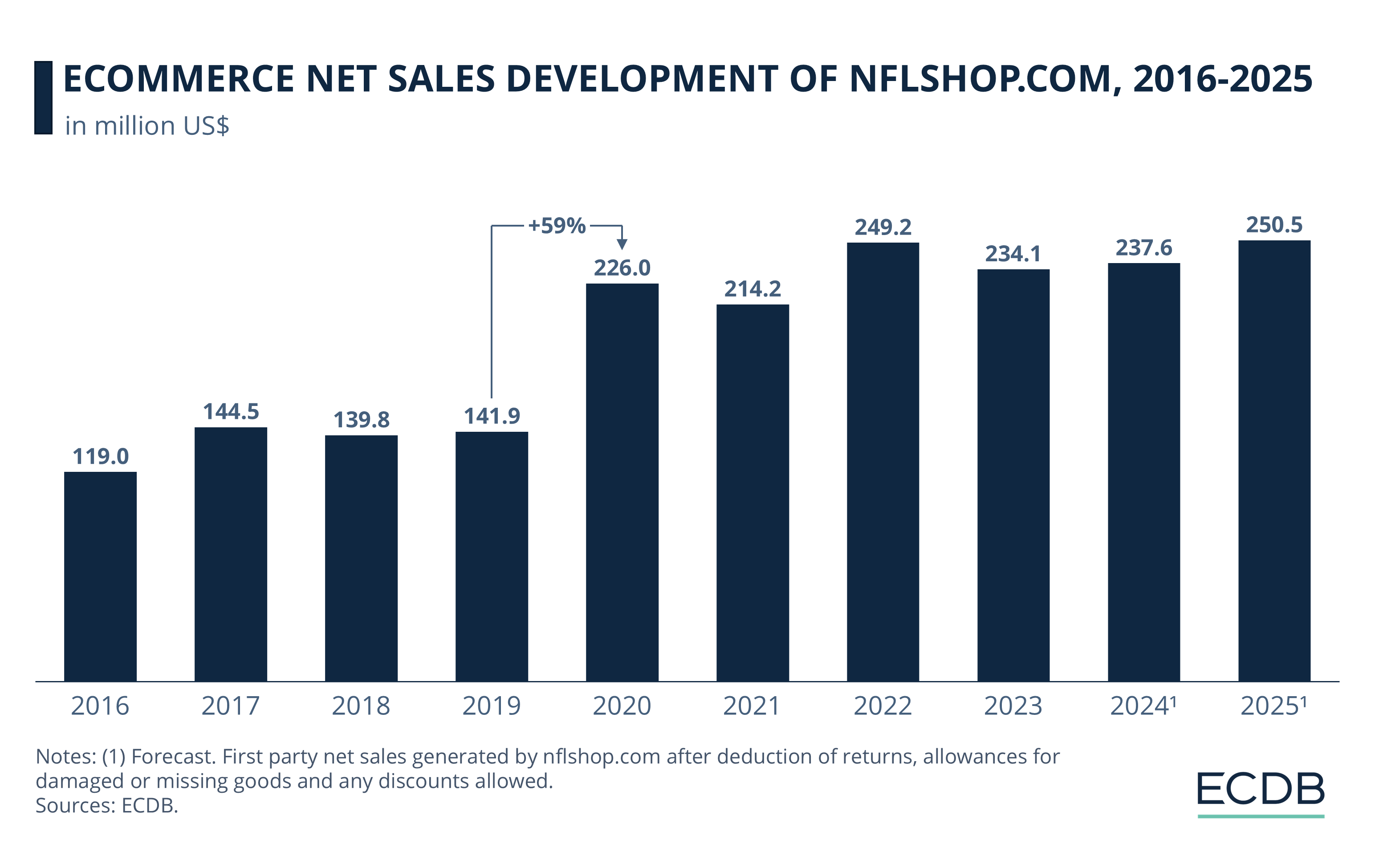

Nflshop.com Sales: Growth Will Continue After Decline Last Year

The NFL is both keen to leverage and increasingly capitalize on eCommerce as a vital revenue stream. Launched in 2013, the online store has primarily focused on the U.S. market, leaving other countries like the UK to account for only a small share of its eCommerce net sales.

Let's have a look at the sales data for nflshop.com:

Making a 21% jump in 2017, the online store's revenue was around the US$140 million mark until 2020.

In the first year of the pandemic, the store experienced a significant leap, reaching a year-over-year growth rate of almost 60%, which brought net sales to US$226 million from US$142 million the previous year.

Although the online store experienced a 5% decline in 2021, nflshop.com would peak in 2022, bringing in US$249 million in net sales.

After a 6% drop in net sales last year, we expect the online store to continue to grow this year and next, reaching US$250 million by 2025.

But who is NFL primarily targeting? Fanatics, which manages nflshop.com, boasts a brand awareness of 46% among sports and outdoor online shop users in the U.S. This strong brand recognition could play a pivotal role in attracting a wider audience to the NFL's online store.

Stay Informed: Our rankings are continuously updated with the newest data from our models, offering valuable insights to enhance your business strategy. Curious about which stores and companies are at the forefront of eCommerce? Want to know which categories are leading in sales and popularity? Discover the answers in our rankings for companies, stores, and marketplaces. Keep ahead of the competition with ECDB.

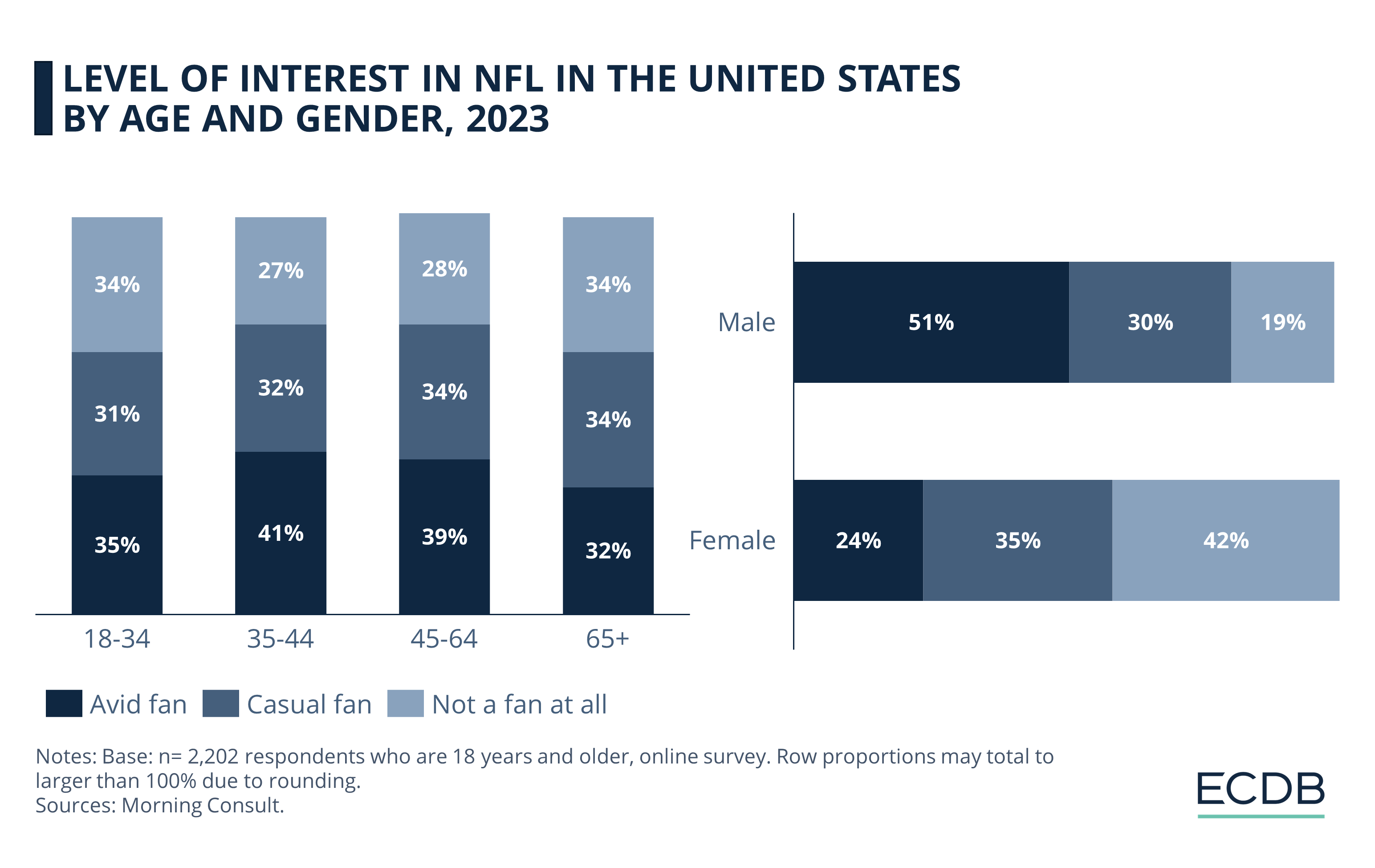

Demographics of the NFL Fan Base in the U.S.

According to an April 2023 survey from Morning Consult, patterns of NFL fandom vary markedly across gender, age, and income, providing insights that could refine targeted eCommerce efforts:

Men are predominantly avid NFL fans (51%), making them a promising target for online sports merchandise. Women, in contrast, mainly identify as non-fans (42%), suggesting specialized engagement strategies might be more effective for this group.

Young adults (18-34) exhibit a balanced fan distribution, while those aged 35-44 have the highest percentage of loyal NFL followers at 41%. As consumers age, however, their enthusiasm for the NFL appears to wane, signaling the need for a more diversified eCommerce approach for older demographics.

Those with higher incomes (above US$100,000) are more often die-hard football fans (45%), potentially indicating a higher spending capability on premium items. In contrast, those earning less than US$50,000 are largely non-fans (37%).

With this in mind, how is the league tailoring its eCommerce initiatives to reach this diverse demographic?

NFL in eCommerce: Fanatics' Role & Cowboys and Vikings Deals

Over the years, Fanatics has gradually tightened its grip on NFL eCommerce. Two 10-year deals, one with the Dallas Cowboys and another with the Minnesota Vikings, have fortified Fanatics' position as a central player in the league's merchandising ecosystem.

One of the NFL's most valuable franchises, The Dallas Cowboys - the most followed National Football League team account on Facebook with over 8 million fans - inked a 10-year exclusive merchandise agreement with Fanatics in 2021, set to run until 2031. This was a considerable milestone for both entities. By partnering with Fanatics, the Dallas Cowboys are leveraging their significant brand strength to expand into a broader retail network.

Beyond the NFL, Fanatics – currently estimated to be worth US$31 billion – has rapidly expanded its global reach through a series of acquisitions. The company has recently moved into the Latin American and European markets by acquiring Fexpro and EPI respectively. These acquisitions give the NFL added confidence in Fanatics' ability to manage their online retail operations effectively.

In a similar vein, the Minnesota Vikings also signed a 10-year omnichannel merchandise and retail partnership with Fanatics back in March 2022. What distinguishes the Vikings' agreement from Fanatics’ other partnerships is the promise of a full retail experience that spans online, mobile, and physical store locations.

Since then, the Minnesota Vikings have revamped their online store using Fanatics' in-house cloud commerce platform, promising better customer experiences and more payment options, while Fanatics also commits to upgrading the team's physical store locations.

NFL in Social Commerce: Instagram Collaboration

What happens when the league branches out of its traditional sphere and taps into social media for sales?

In 2019, the NFL and Instagram joined forces, innovatively blending sports enthusiasm with digital retail capabilities. This partnership, unveiled ahead of the critical NFL draft event, let fans buy New Era draft day hats directly through Instagram.

The collaboration involved no financial exchanges between Instagram and the NFL, it rather aimed to boost fan engagement and open a new avenue for sports-related sales. The move was a landmark in seamlessly integrating shopping into football's social experience, showcasing the growing harmony among sports, social media, and eCommerce.

While the Instagram collaboration presents an innovative blend of social engagement and shopping, another dimension opens up when a behemoth like Amazon steps into the NFL's eCommerce arena.

Amazon's Black Friday NFL Broadcast

Amazon's broadcast of its first NFL game on Black Friday last year represents a significant development in the NFL's eCommerce initiatives. The move was designed to fortify Amazon's partnership with the NFL and broaden the league's role in American holiday customs.

Black Friday has traditionally been a pinnacle day for shopping in the U.S. By teaming up with Amazon for a live game broadcast, the NFL strategically situated itself to attract more customers. In turn, this alignment boosted traffic to Amazon's platform, enhancing the NFL's licensing revenue and merchandise sales.

NFL Teams Up with Roblox to Target Younger Fans

In a strategic move to tap into the burgeoning metaverse, the NFL has launched a virtual storefront on Roblox, a popular online gaming platform primarily targeting younger audiences. This digital venture allows Roblox users to purchase official virtual helmets for all 32 NFL teams using the game's virtual currency, Robux.

The move is particularly relevant given that – as per the April 2023 survey referred to earlier – among Gen Z, born between 1997 and 2012, only about a quarter (26%) identify as avid NFL fans, and a significant 47% are not fans at all.

The NFL's entry into Roblox aims to directly engage this younger demographic, whose engagement with the league is lower than other generations. In collaboration with its retail partner Fanatics, the NFL is not only branching into the virtual world but also exploring new avenues like sports betting. Far from a mere experiment, this strategy reflects the NFL's concerted effort to diversify revenue streams and adapt to evolving fan habits.

Source: Morning Consult, Facebook, Sportcal, SportsPro Media, CNBC, Amazon, Hypebeast, Statista, ECDB

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

Largest Product Categories in German eCommerce: Fashion Tops the List

Largest Product Categories in German eCommerce: Fashion Tops the List

Deep Dive

Walmart Expands Pet Care Services

Walmart Expands Pet Care Services

Deep Dive

Monthly eCommerce Market Revenue Growth: Online Retail Sales (September 2024)

Monthly eCommerce Market Revenue Growth: Online Retail Sales (September 2024)

Deep Dive

Online Toys Market: Top Stores & Market Development

Online Toys Market: Top Stores & Market Development

Deep Dive

Bad Dragon Business Analysis: Net Sales, Revenue & Market Development

Bad Dragon Business Analysis: Net Sales, Revenue & Market Development

Back to main topics