eCommerce: Fastest Growing Markets

Mexico eCommerce Market: Top Stores & Market Trends

Mexico's eCommerce market is experiencing steep growth, making it one of the fastest growing online markets in the world. Ever wonder what factors contribute to its outstanding position? And which are the top eCommerce stores? ECDB has the answers.

Article by Nadine Koutsou-Wehling | July 16, 2024Download

Coming soon

Share

Mexico eCommerce Market: Key Insights

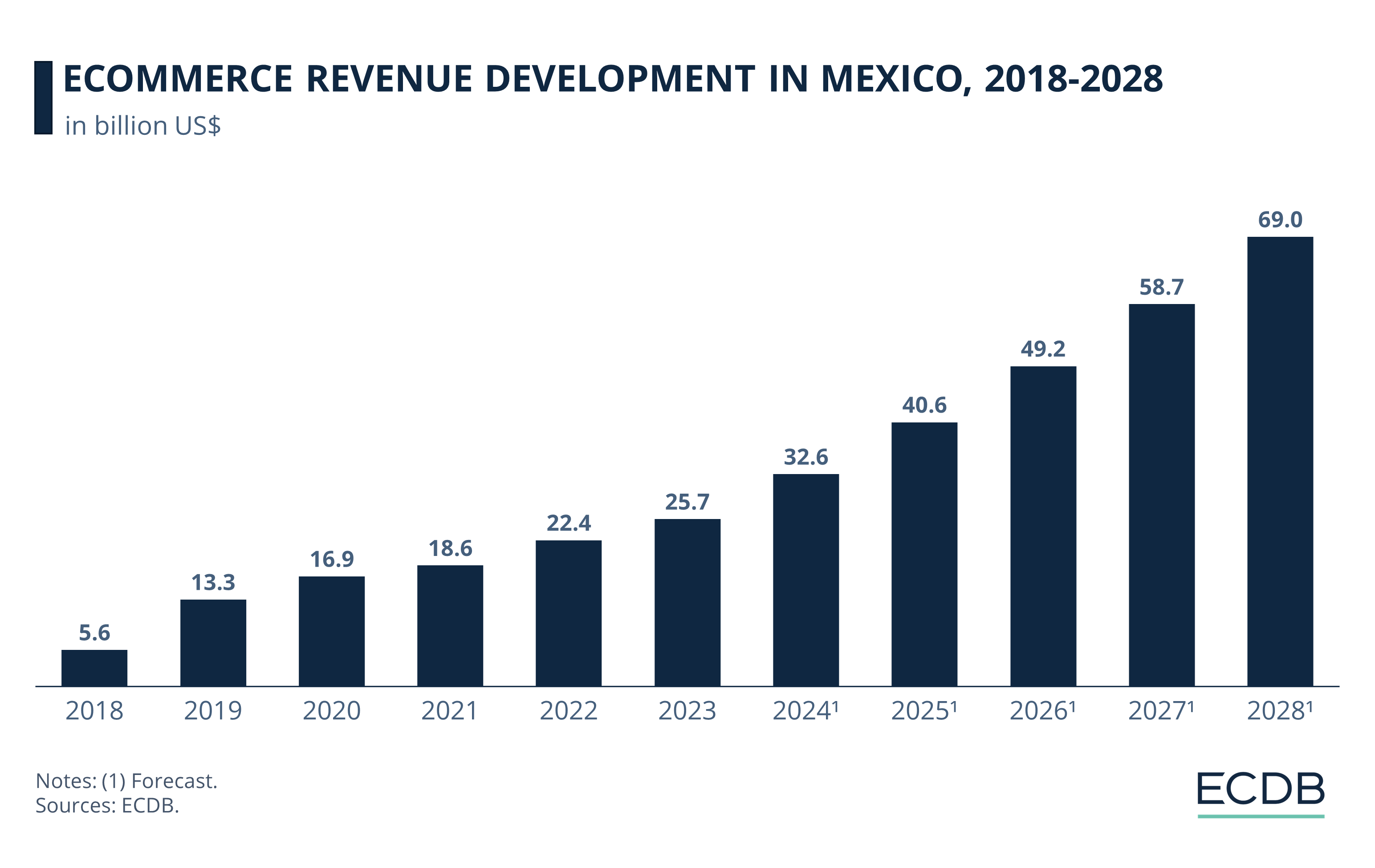

Mexico Is One of the Fastest Growing eCommerce Markets: Mexico's eCommerce revenue development has seen remarkable jumps in recent years. From market revenues of US$5.6 billion just before the pandemic, it is forecast to surpass US$40 billion by 2025.

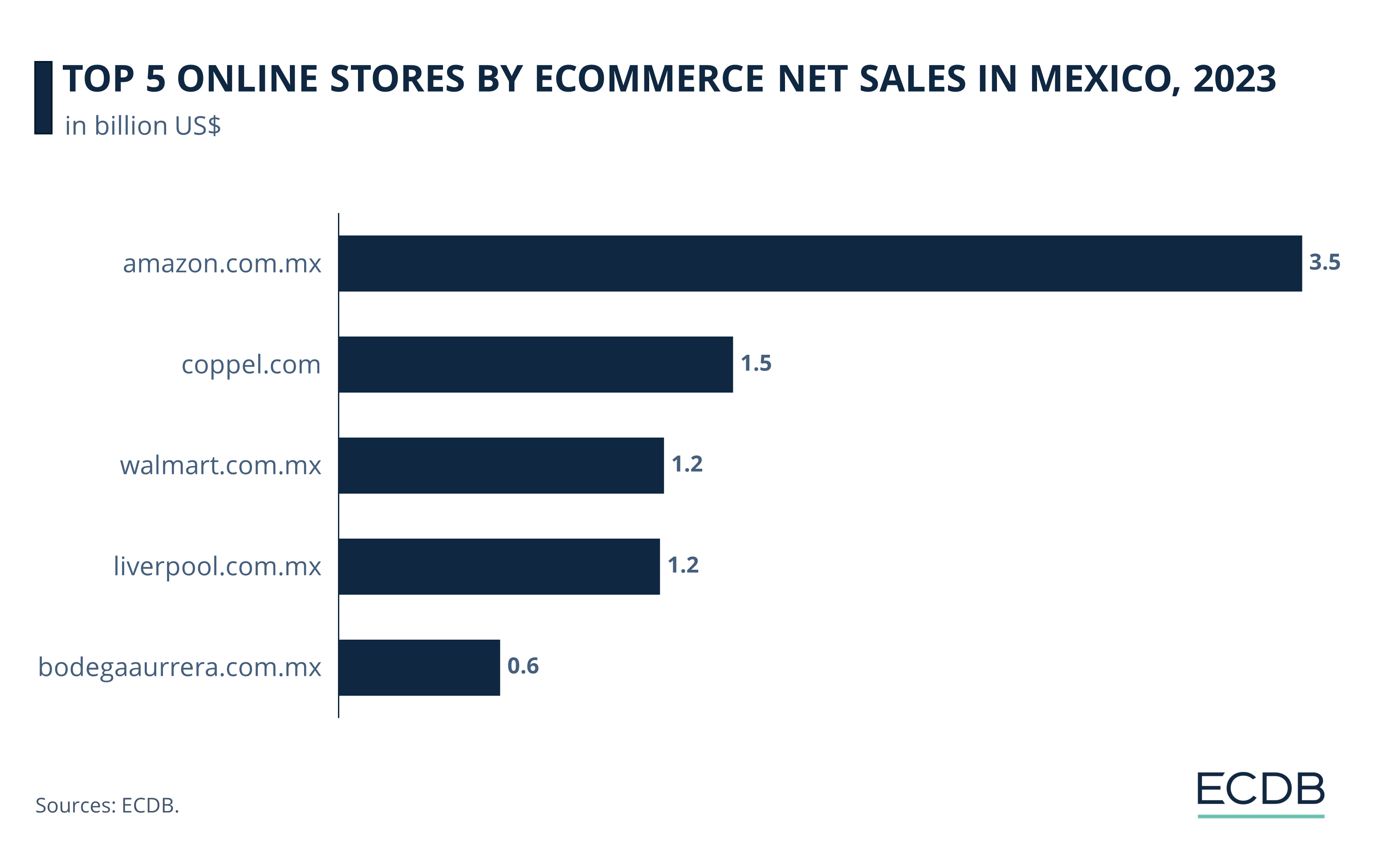

Leading Online Stores: Amazon dominates among all other retailers in Mexican eCommerce. The remaining stores in the top 5 are Mexican department stores or Walmart and its subsidiary Bodega Aurrera.

Market Characteristics and Trends: Cash payments are quite important in Mexico, there is still a portion of the population that is unbanked and without internet access, and almost all internet users connect through smartphones. While these challenges mean high potential for eCommerce growth, social commerce is another likely success factor in the market.

Mexico is one of the fastest growing eCommerce markets in the world. In 2023, Mexico’s eCommerce revenues increased by 26.8% over the previous year, placing it third among the markets with strongest online growth for revenues over US$1 billion.

ECDB also mentions Mexico as one of the countries that stand out for its online pharmacy development. Similar to India, Mexico is in the midst of significant eCommerce and online market development. It is therefore a market to watch.

What does Mexico’s eCommerce look like in more detail? Here is everything you need to know.

Mexico’s eCommerce Revenues Set to Surpass US$40 Billion by 2025

Mexico’s eCommerce market was comparatively small in 2018, before the pandemic sped up its development. The health crisis contributed to a national push for digital development, supported by a government initiative called “Internet Para Todos” (Internet for All).

In 2019, market revenues grew by a little more than double the previous year’s value.

Growth was more moderate up until 2023, when market revenues grew at a CAGR (2020-2023) of 17.7%.

In the subsequent period up to 2028, average growth rates increased to a CAGR (2024-2028) of 21.9%.

A notable aspect of the Mexican online market is the importance of cross-border eCommerce and the prevalence of international players in the market.

Amazon Operates Mexico’s Leading Online Store by a Wide Margin

All online stores in the top 5 by net sales are generalist retailers. In addition to Mexican department and discount store brands, U.S. companies have the greatest impact on the Mexican eCommerce market.

Amazon.com.mx is the largest online store, with an annual revenue of US$3.5 billion in 2023.

In second place is coppel.com, the online platform of the Mexican department store Coppel. It generated US$1.5 billion online in 2023.

Walmart.com.mx ranks third, with eCommerce net sales of US$1.2 billion.

The eCommerce platform of another Mexican department store, liverpool.com.mx, ranks fourth. Its eCommerce net sales are almost as high as Walmart’s, with another rounded US$1.2 billion.

Walmart's subsidiary, Bodega Aurrera, is a Mexican discount store chain that ranks as the fifth largest online store in 2023 with net sales of US$595 million.

Like this insight? It is based on our regularly updated rankings. With our retailer and country rankings, you can learn valuable information about your specific market. Our product category rankings and benchmarks allow you to see where various businesses are currently evolving. This information can aid in your decision-making, whether you are a business developer, shop owner, or CEO of a large eCommerce brand. Stay a step ahead of the market with ECDB.

Features of the Mexican eCommerce Market

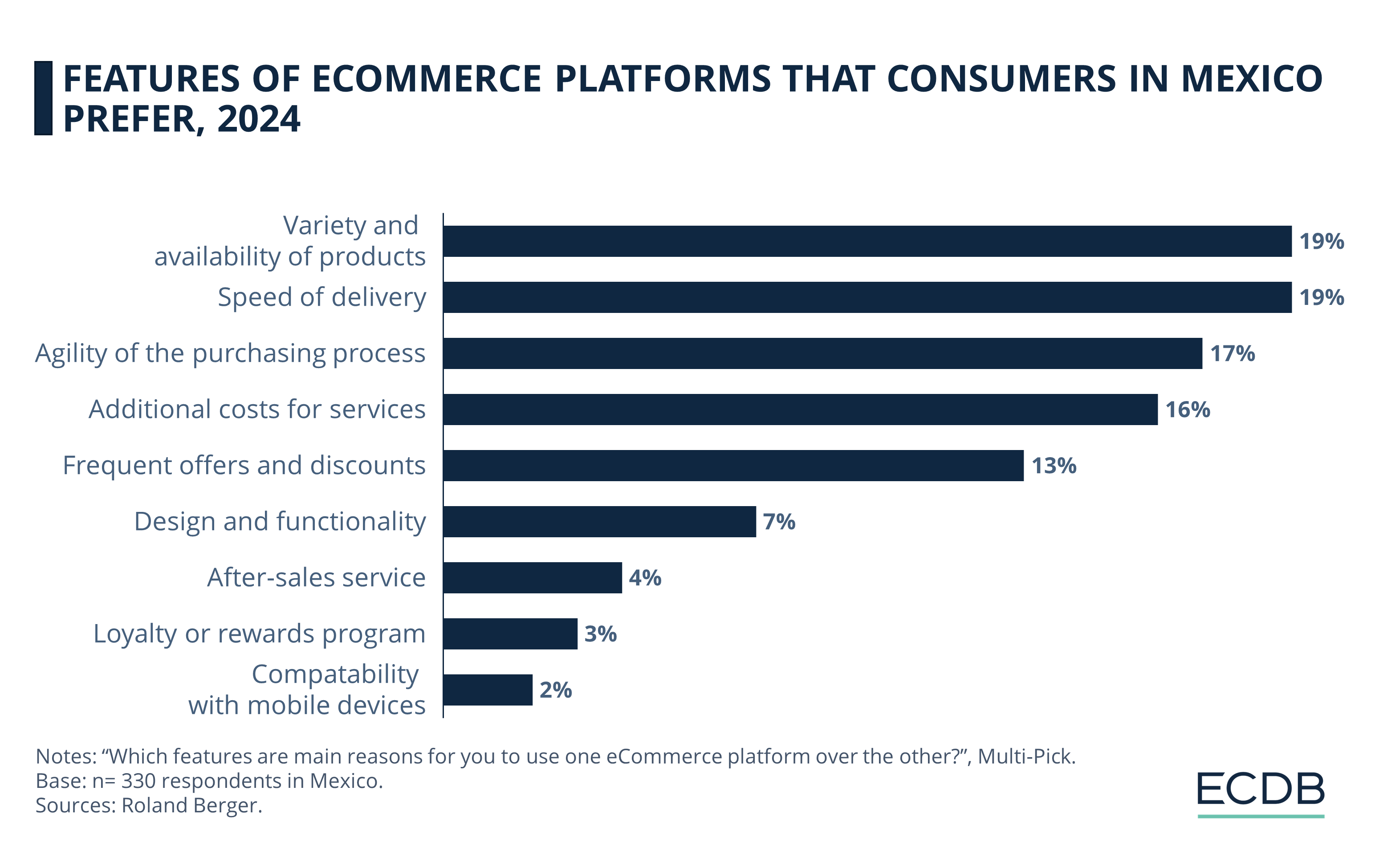

All these leading retailers offer a variety of products, rather than specializing in a particular product category. This is in line with a widespread consumer preference for product variety in Mexico.

The same percentage of consumers, 19%, express a preference for speed of delivery, a service for which Amazon is particularly well known. In general, larger retailers tend to be better able to offer faster delivery, as they tend to have more financial resources that allow for better logistical capabilities.

What other aspects of the Mexican eCommerce market are noteworthy?

1. Trust in eCommerce Is Still Limited

As is quite common in countries where eCommerce is still in its developing phase, consumers tend to be wary of potential scams when ordering online.

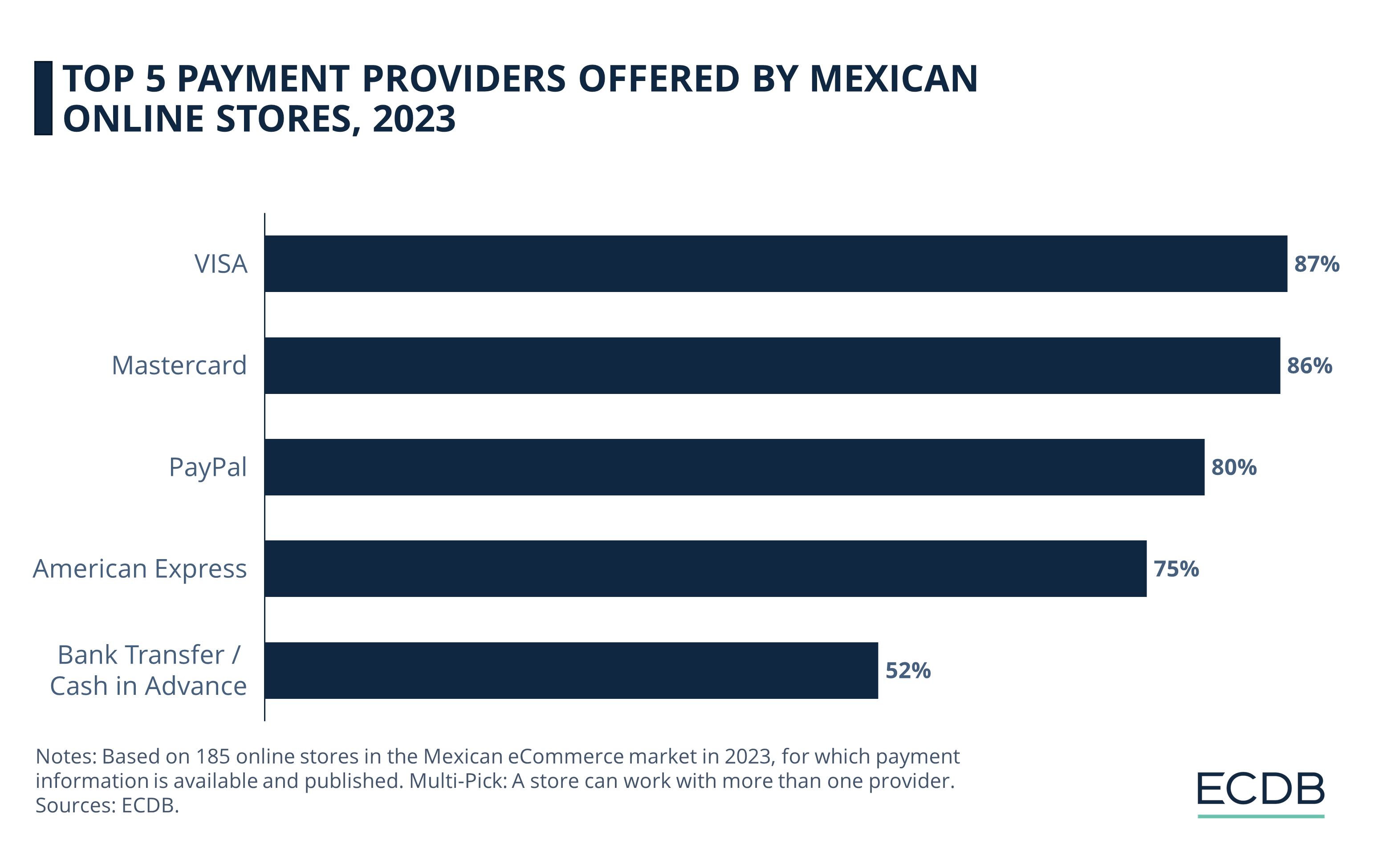

Accordingly, the penetration of card payments and eWallets is still quite low compared to other eCommerce markets.

VISA and Mastercard are the most commonly offered payment methods, with shares of 87% and 86%, respectively.

PayPal, the popular eWallet, is available in 80% of online stores in Mexico, followed by American Express (75%) and bank transfers or cash in advance (52%).

Cash payments are quite common in Mexico, for instance through vouchers acquired at convenience stores. According to the Center for Global Development, less than 40% of Mexican consumers have a bank account.

A prevailing distrust of online shopping may also contribute to the success of large generalist retailers and department stores in the Mexican eCommerce market: Because consumers know these stores well, they are more likely to make repeat purchases from these larger retailers than they are to try lesser-known stores.

A hybrid approach that allows consumers to order online and pick up products while paying for them in-store is sure to further increase trust.

2. Expanding Online Access in Rural Areas

There is a rural-urban divide in Mexico when it comes to internet access: Nearly 82% of city dwellers have internet access, compared to only 56% of rural residents. Overall, it is estimated that 30% of consumers in Mexico do not have any broadband coverage in their community – obviously this segment of the population is completely excluded from eCommerce.

This aspect of the Mexican online market represents an immense opportunity for growth: In line with the government's efforts to increase Mexico's online penetration, as rural access grows, so too will eCommerce opportunities and revenues.

3. Social Commerce and High Smartphone Penetration: A Growth Potential

An overwhelming majority of internet users, 98% to be exact, connect through a smartphone. This makes social commerce particularly appealing in Mexico, where most users are already on social media platforms: Offering the ability to buy through these platforms makes it easier for merchants and consumers to interact.

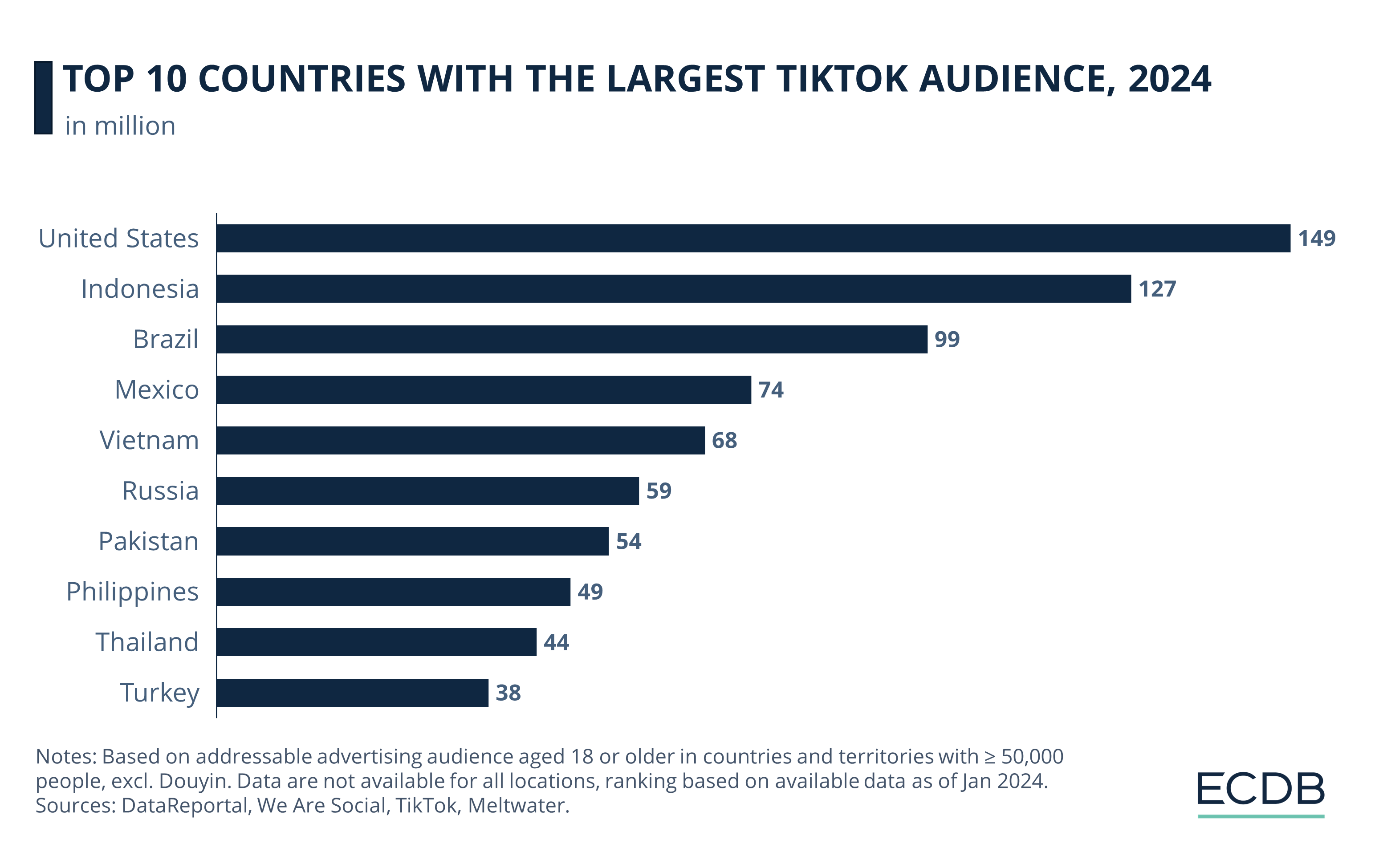

TikTok Shop has not yet launched in Mexico, but the company has announced plans to enter the Mexican eCommerce market during 2024. Mexico is the country with the fourth largest TikTok audience in the world, so this move could lead to big increases in social commerce revenue for all parties involved.

With 74 million TikTok users in 2024, Mexico trails Brazil’s 99 million users. Indonesia and the United States have the highest number of users, with 149 million and 127 million, respectively.

Mexico’s eCommerce Market: Wrap-Up

Mexico is an emerging eCommerce market with the potential to become a leading online economy. The challenges facing this market are also opportunities: A significant portion of the population is unbanked and even without broadband access, meaning that bringing them into the digital economy equals further growth in the coming years.

Businesses looking to enter this market are well advised to take into account the Mexican consumer's habit of connecting through their mobile devices, their preference for a variety of products on one spot, and the great potential for social commerce in this market.

Sources: Cross-Border Magazine – Rapyd – Roland Berger – Trade.gov: 1 2

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

The Customer Journey in Online Shopping: It Begins with Search Engines

The Customer Journey in Online Shopping: It Begins with Search Engines

Deep Dive

Fast Fashion Online Market: Fast Fashion Is Not Fair Fashion

Fast Fashion Online Market: Fast Fashion Is Not Fair Fashion

Deep Dive

Otto: Can the German Retail Company Maintain Relevance and Drive Revenue in eCommerce?

Otto: Can the German Retail Company Maintain Relevance and Drive Revenue in eCommerce?

Deep Dive

What Exactly Are In-Game or In-App Purchases?

What Exactly Are In-Game or In-App Purchases?

Deep Dive

AI in eCommerce: Better Deals, Greater Precision, and Easier Targeting

AI in eCommerce: Better Deals, Greater Precision, and Easier Targeting

Back to main topics