eCommerce: Fashion

H&M Revenue: Online Net Sales Remain High Through 2023

Following the pandemic, the H&M Group successfully grew its online sales share, keeping it at a strong level throughout 2023. Despite this, the company’s overall net sales have declined.

September 26, 2024Download

Coming soon

Share

H&M eCommerce Sales: Key Insights

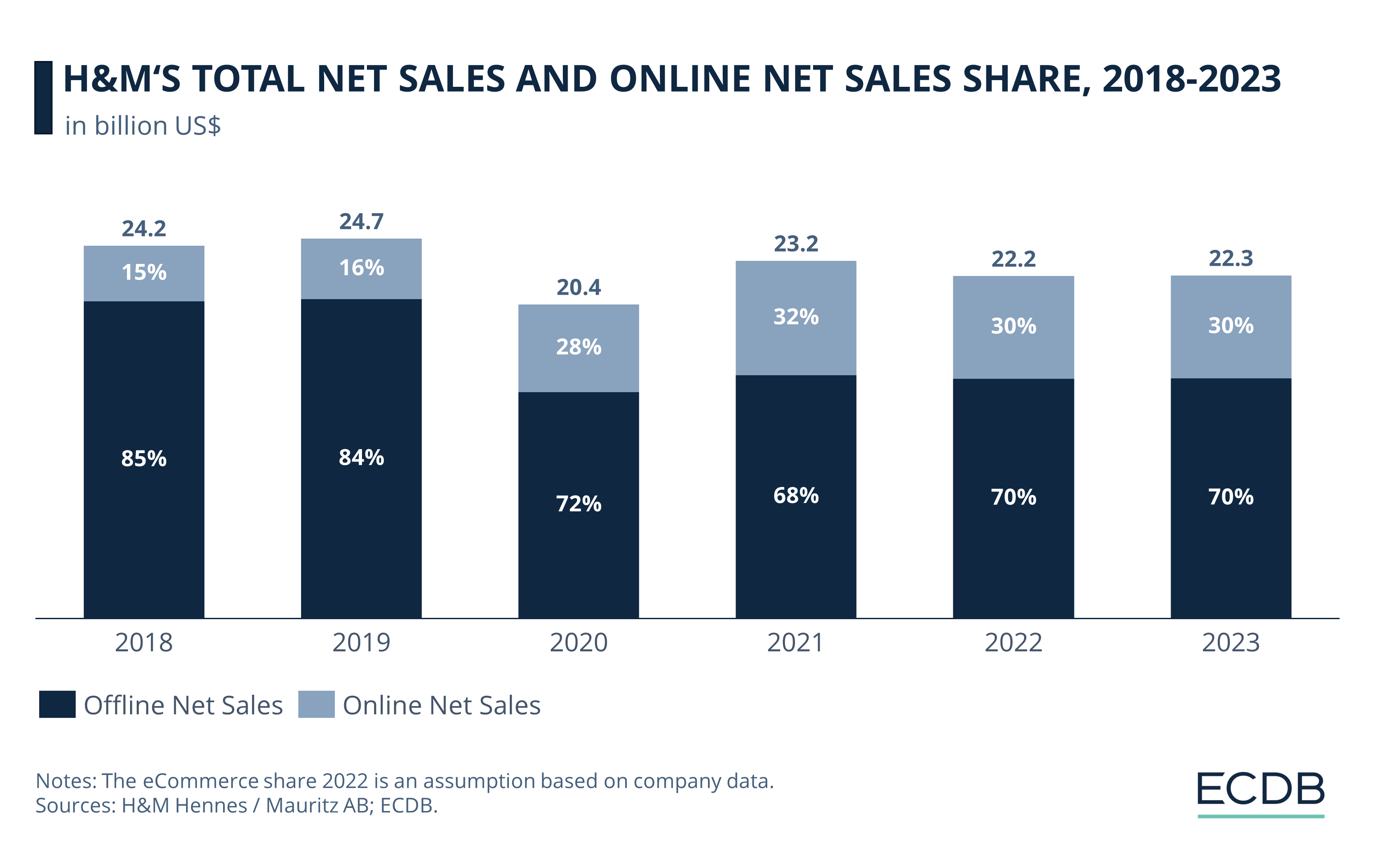

Online Channel to Compensate for Pandemic Losses: Overall net sales decreased by 20% from 2019 to 2020, while the share of online net sales rose from 16% to 28%.

Online Sales Share Remains High: Since 2020, H&M's eCommerce share has been around 30%, a significant increase from pre-pandemic levels. However, overall net sales did not recover to former levels.

Hybrid as a Solution: Despite the reopening of physical stores, it is expected that H&M's online platform will continue to contribute to total net sales. This is expected to be reinforced by a sophisticated hybrid model.

H&M, the Swedish fashion brand known for its affordable and rapidly changing styles, is facing challenges common to the modern fashion industry. Can eCommerce help solve some of the most prevalent ones?

Online Sales Share at 30% Since 2020

Due to pandemic lockdowns and the resulting store closures, H&M's total net sales dropped by 20% from 2019 to 2020. According to a company press release in early 2024, H&M was able to slightly regain sales in 2023 after a drop in total sales the year before.

While the online share was at around 15% before Covid-19 hit the markets, it jumped to around 30% from 2020. The data shows that the online business is an important pillar for H&M, which has started to grow during the pandemic but remained at a high level after the stores reopened.

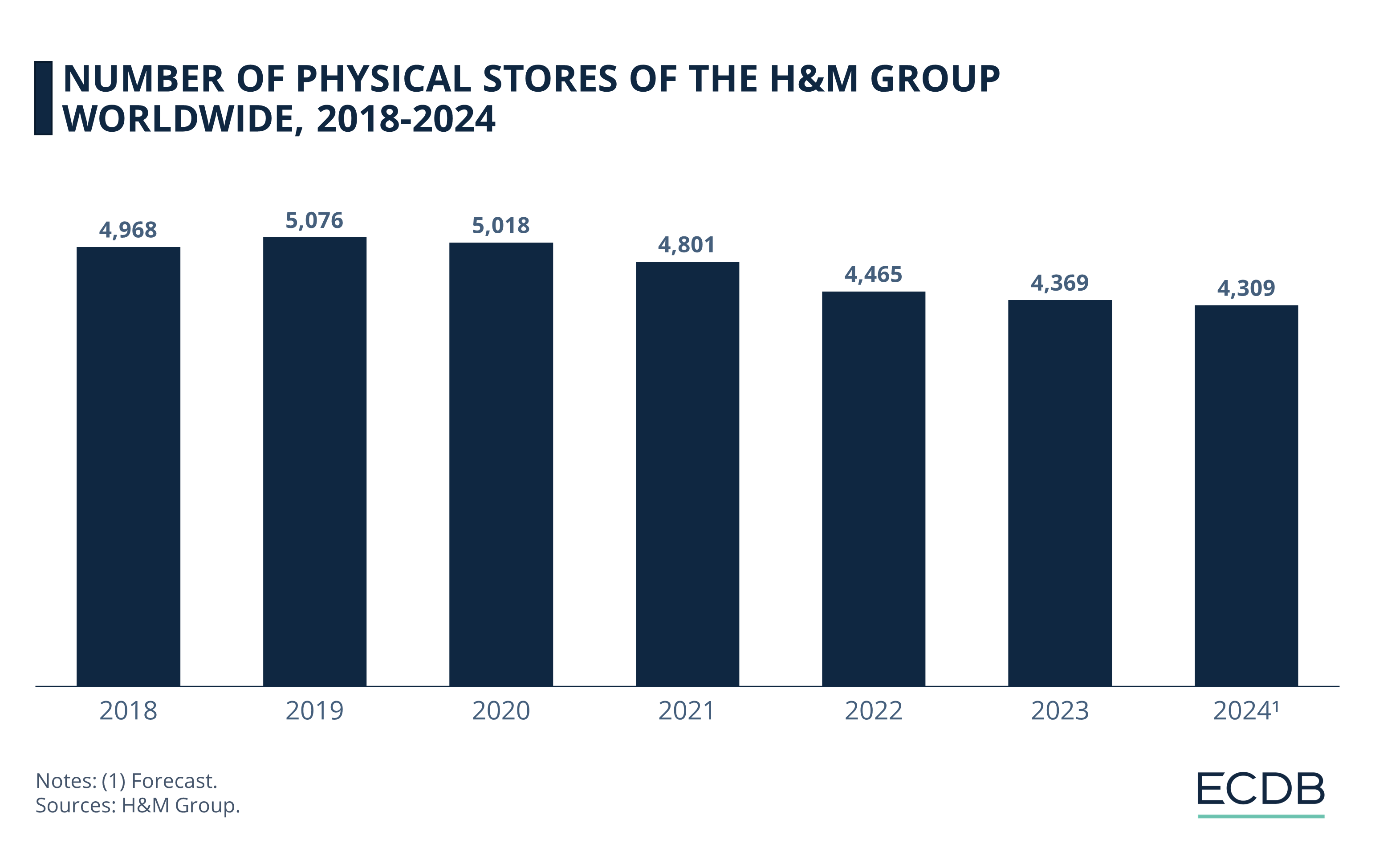

See how the development of H&M's physical store numbers reflects the company's move towards a more integrated omnichannel experience.

Physical Store Closures & Online Expansion

The H&M Group's physical store numbers (which include stores across all brands that belong to the conglomerate), grew steadily until 2019, when the Group reduced its physical store presence each year. Despite the opening of new stores throughout the previous years, especially in emerging markets, the net number of physical stores has steadily decreased since the beginning of the pandemic:

With a peak of 5,076 locations in 2019, the conglomerate shuttered more than 600 stores in the following 3 years, reaching 4,465 in 2022. The H&M Group itself has cited greater efficiency as a reason for the store closures, as the conglomerate intends to focus on a more sophisticated hybrid strategy, integrating online and offline channels more seamlessly while cutting costs.

As a result, the Group itself predicts further closures coming up this year, bringing the total number of stores down to 4,309 over the course of 2024.The strategy is common among established fashion players these days, as new online competitors undercut incumbents on price and the time it takes to release new styles. The hybrid expansion, which comes at the expense of physical retail, increases H&M's digital presence and integrates trends like social commerce into the experience. At the same time, H&M is appearing on the Asian online marketplace JD.com to reach a wider audience.

H&M eCommerce Sales: Final Remarks

The benefits of online sales are becoming increasingly apparent to established fashion retailers, not least as online-only competitors like Shein take the lead in the market. Although the pandemic has had a negative impact on overall net sales, H&M has been able to mitigate some of the losses by focusing on the online platform.

However, recent press releases from the company show that growth since the pandemic slump has been slow and online sales are not sufficient to compensate for losses elsewhere. It remains to be seen how successful the hybrid approach will be in returning to pre-pandemic sales levels.

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

The Global B2B eCommerce Market: Why It Is Beneficial to Sell to Other Businesses

The Global B2B eCommerce Market: Why It Is Beneficial to Sell to Other Businesses

Deep Dive

Top 10 Online Shopping Sites in the USA: Amazon, Walmart, Apple

Top 10 Online Shopping Sites in the USA: Amazon, Walmart, Apple

Deep Dive

Otto: Can the German Retail Company Maintain Relevance and Drive Revenue in eCommerce?

Otto: Can the German Retail Company Maintain Relevance and Drive Revenue in eCommerce?

Deep Dive

Walmart eCommerce Revenue: The U.S. Retail Giant Surpassed US$100 Billion

Walmart eCommerce Revenue: The U.S. Retail Giant Surpassed US$100 Billion

Deep Dive

Top Online Fashion Stores in the United States: Shein Surpasses Walmart and Amazon

Top Online Fashion Stores in the United States: Shein Surpasses Walmart and Amazon

Back to main topics