Future Trends: E-Commerce Market Germany 2023

Germany, Europe's largest economy, has always held a distinct place on the global stage. This prominence extends to the realm of eCommerce, where German companies have showcased innovation, resilience, and adaptability. But what fuels this robust eCommerce engine?

To appreciate the rise of German eCommerce, one must delve into its history. Germany's initial enthusiasm for embracing the digital era has set the stage for its current eCommerce landscape. Over the decades, brands, both nascent and established, harnessed the potential of the internet, pioneering unique selling propositions that catered to the German psyche.

As we approach the release of "E-Commerce Market Germany 2023" (pre-order now!), it is imperative to understand the subtle and overt nuances of the 2022 landscape and beyond.

Deciphering 2021: The Chronicles of eCommerce Evolution

Our E-Commerce Market Germany 2022 report went beyond just numbers, capturing the stories behind the data. These stories emanated from diverse sources like ecommerceDB, EHI, Bundesanzeiger, and Statista, knitting together a tale of business acumen, consumer behavior, and technological innovation.

Amidst these narratives, some findings were particularly revelatory:

Tiered Analysis: The hierarchical structure of eCommerce revenues, as listed before, highlighted not just the monopolistic tendencies of industry leaders, but also underscored the immense potential of mid-tier and emerging platforms.

Category Leaders: While generalist online stores like amazon.de reigned supreme, niche platforms showcased impressive clout within their respective categories, from electronics to fashion.

Let’s go a little deeper and have a look at some of the insights from last year’s report. This will also give you a better idea of what to expect from this year’s release, which is set to be released on 27 September.

Takeaways from the E-Commerce Market Germany 2022 Report

E-Commerce Market Germany 2022 gave us data sets that painted a holistic view of Germany's eCommerce terrain. The figures not only indicated the dominant players but also revealed certain trends about consumer behavior and preferences.

Tiered Dominance in Revenue Streams

The hierarchy of online store performance in Germany, as gauged by their revenue generation in 2021, was nothing short of revealing:

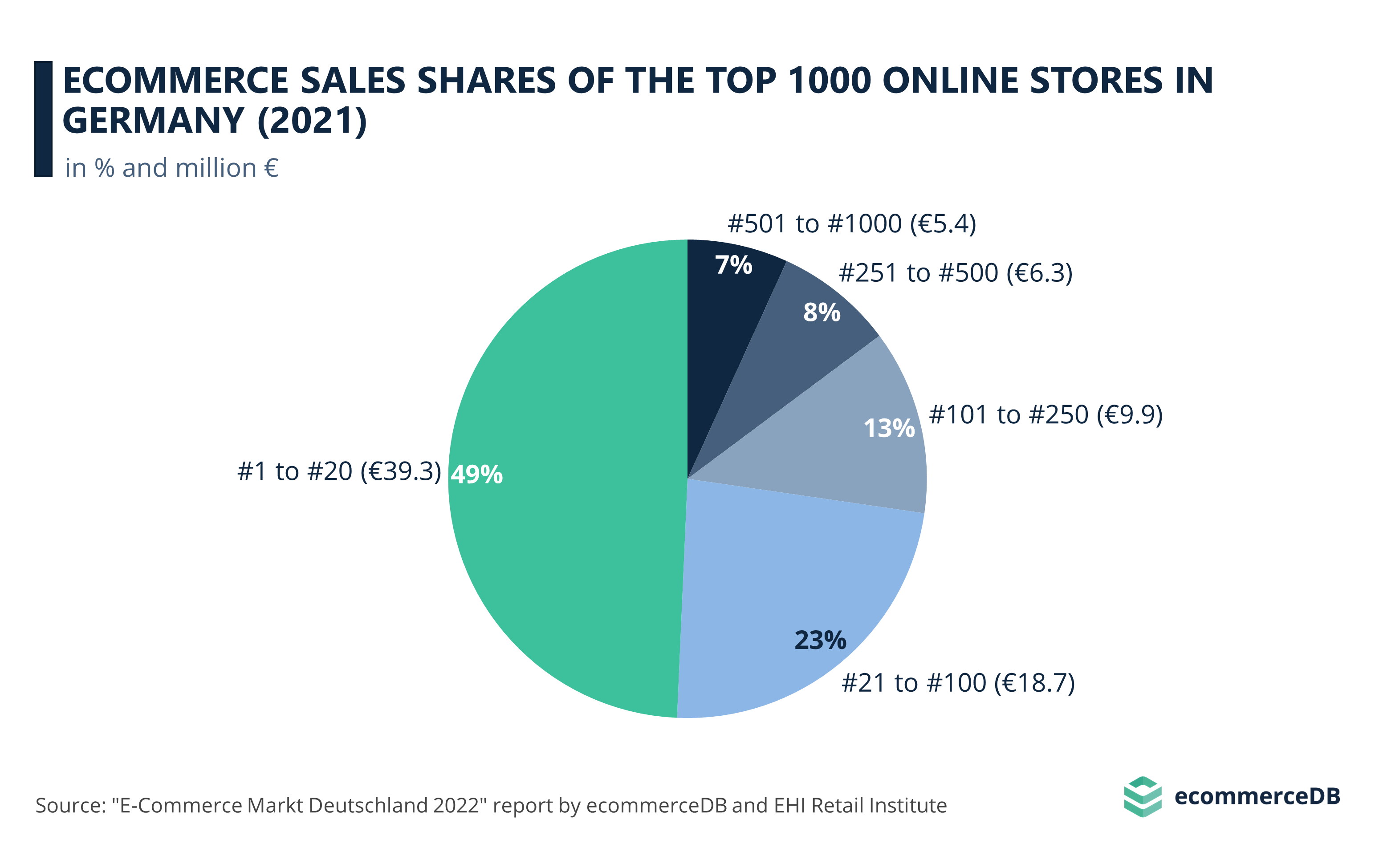

The Powerhouses: The top 20 online stores took the lion's share, accumulating a staggering 39.3 billion euros, which is almost half (49.3%) of the total revenue from the top 1,000 stores.

High Performers: The next tier, stores ranking from 21st to 100th, generated 18.7 billion euros, contributing to 23.4% of the revenue.

Mid-Tier: Stores that ranked from the 101st to the 250th spots garnered 9.9 billion euros, comprising 12.5% of the revenue.

Emerging Leaders: Stores from the 251st to 500th positions raked in 6.3 billion euros, holding an 8% share in the revenue.

Hidden Gems: The ones ranking from 501st to the 1000th positions, often overlooked, still managed an impressive 5.4 billion euros, capturing 6.8% of the revenue pie.

Spotlight on Sectoral Kings

The report wasn't just about overarching figures; it also gave a granular breakdown of who led the charts in specific sectors:

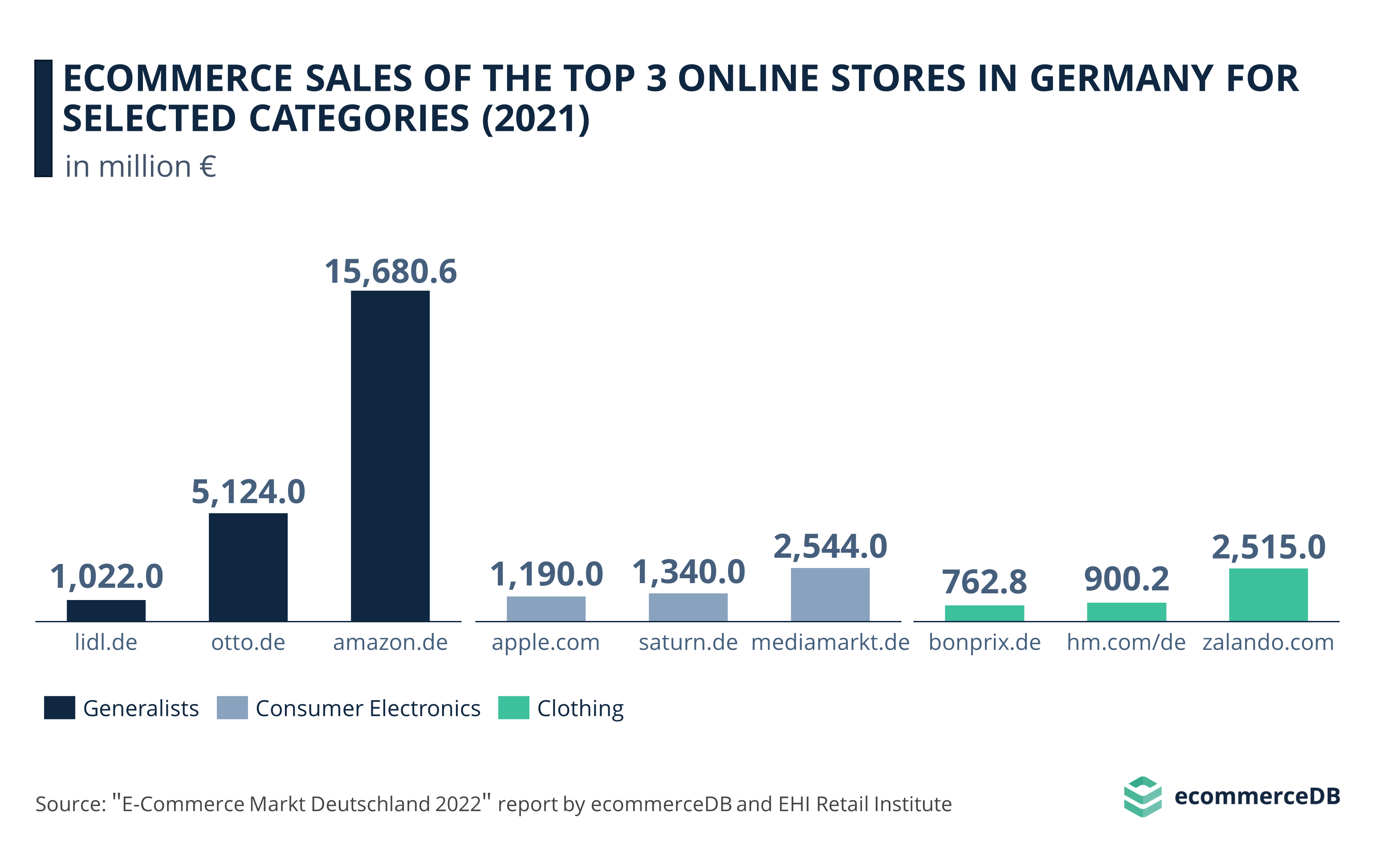

Generalists that Rule: Amazon.de was the titan here, with earnings of 15.6 billion euros. Otto.de and lidl.de trailed but with commendable figures of 5.1 billion and 1 billion euros, respectively.

Electronic Giants: Within consumer electronics, mediamarkt.de topped the list with 2.5 billion euros. Saturn.de and apple.com closely followed with revenues of 1.3 billion and 1.2 billion euros, respectively.

Fashion Front-runners: The apparel sector saw zalando.com taking the crown with 2.5 billion euros. Hm.com/de and bonprix.de added to the sector's might with 0.9 billion and 0.7 billion euros, respectively.

This data gives a snapshot of the previous year's online retail landscape. With such significant figures and sector-specific leaders, the anticipation for the E-Commerce Market Germany 2023 report is palpable.

The evolving dynamics, newer entrants, and potential shifts in consumer preferences will make the upcoming report a must-read for every stakeholder in the German eCommerce ecosystem. The question remains: as the eCommerce terrain shifts, who will rise, who will hold their ground, and who will witness a tumble? The answers await on 27 September.

Eyes on the Horizon: Predictions and Projections

While "E-Commerce Market Germany 2023" focuses on hard data and meticulous analysis, it's equally essential to recognize the broader context in which the digital landscape is evolving. Consider these reflections not as specifics from the report, but as overarching themes shaping the industry's horizon:

Sustainability: The global conversation is increasingly veering towards sustainability. The call for sustainable products and eco-friendly packaging echoes louder every day, hinting at a possible surge in green eCommerce in the not-so-distant future.

Localization: Even as globalization reshapes our world, there's an evident lean towards the local. The desire among German consumers for bespoke experiences suggests businesses may soon need to further tailor their products, content, and strategies.

Mobile Commerce: The universality of smartphones underscores the increasing importance of optimizing for mobile-first shopping experiences. It's a trend that's hard to ignore, even if precise figures remain a topic for future exploration.

Social Commerce: Platforms such as Instagram, TikTok, and Facebook are evolving beyond mere social connectivity. Their potential as eCommerce platforms is evident, even if the exact magnitude of this transition is yet to be fully charted.

While the upcoming report might not delve into granular details for these trends, their significance in shaping the future of online shopping in Germany is undeniable.

E-Commerce Market Germany 2023: Your Guide in the German eCommerce Odyssey

The E-Commerce Market Germany series transcends conventional market reports. It's a symphony of data, trends, and narratives, providing an unparalleled vista into Germany's eCommerce realm.

Each edition builds upon the last, crafting a continuum of insights. This not only provides a roadmap for businesses but also chronicles the ever-evolving relationship between consumers, technology, and commerce.

As we anticipate the latest edition, there's a palpable excitement. What stories will 2023 tell? What paradigms will shift, and which ones will solidify? These questions beckon. However, one thing remains certain: the German eCommerce odyssey is far from over, and its tales are waiting to be told.

For those who aspire to lead with data-driven strategy in the ever-adapting German eCommerce world, pre-ordering "E-Commerce Market Germany 2023" is not just a decision—it’s a leap ahead in the game. Secure your strategic advantage now.

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

The Global B2B eCommerce Market: Why It Is Beneficial to Sell to Other Businesses

The Global B2B eCommerce Market: Why It Is Beneficial to Sell to Other Businesses

Deep Dive

Why Did Amazon Fail in China: Local Competition Defeats the Retail Giant

Why Did Amazon Fail in China: Local Competition Defeats the Retail Giant

Deep Dive

eCommerce in Indonesia: Revenues Projected to Cross US$100 Billion in 2025

eCommerce in Indonesia: Revenues Projected to Cross US$100 Billion in 2025

Deep Dive

Top 10 Online Shopping Sites in the USA: Amazon, Walmart, Apple

Top 10 Online Shopping Sites in the USA: Amazon, Walmart, Apple

Deep Dive

Online Ticketing 2024: Event Pricing, Market Size, & Trends

Online Ticketing 2024: Event Pricing, Market Size, & Trends

Back to main topics