ECOMMERCE: FASHION

Footwear eCommerce in the United States: Revenue Development, Top Online Stores

U.S. consumers have become comfortable shopping for shoes online—but which stores do they frequent? We assess the development of eCommerce revenue and introduce the five bestselling online footwear stores in the United States in 2023.

Article by Nashra Fatima | July 09, 2024Footwear eCommerce in the United States: Key Insights

Top Stores: In 2023, Amazon.com was the top selling online footwear store in the U.S., with revenues of US$2.4 billion. Nike.com was a close second with US$2.1 billion. Walmart.com followed, at US$1.95 billion. Shein.com and Target.com were next, with revenues between US$0.9-1.3 billion.

Revenue: Last year, online sales from footwear generated US$71.2 billion in the United States. The yearly growth was 5%.

Market Projections: Growth will likely remain stable for the U.S. online footwear market in the coming years. Revenues are expected to grow at a CAGR (2024-2028) of 5.1%, and cross US$90 billion by 2028.

The online footwear market in the United States had big shoes to fill, considering consumers had traditionally purchased their footwear in stores with the option to try them out before buying.

But our ECDB data shows that, after all, shoppers are embracing eCommerce for footwear shopping. The footwear online market revenue is on a steady growth path, and the online share is also increasing.

Where do U.S. online shoppers go to meet their footwear needs? How has the revenue developed and what are its growth projections? Find out.

What is the Online Footwear Market?

Per ECDB’s definition, the online footwear market comprises the digital retail of flat shoes, high heels and pumps, active footwear, boots, and sandals.

It does not cover sport-specific and orthopedic footwear.

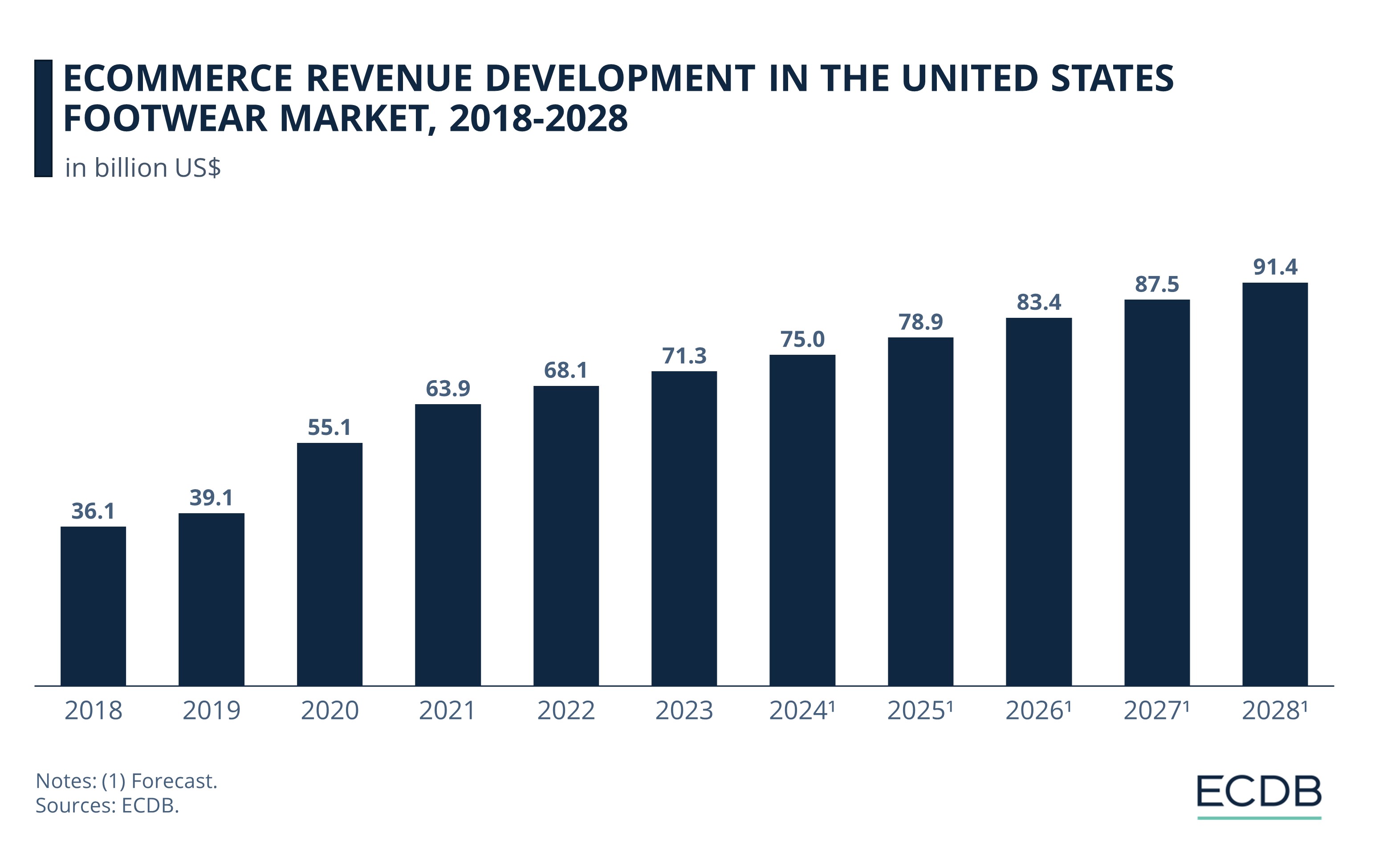

Footwear Market in the United States: eCommerce Revenue, 2018 to 2028

The footwear eCommerce market in the United States has recorded positive development, with its total revenues crossing US$70 billion in 2023.

Between 2018 and 2019, the footwear eCommerce market in the United States was growing. Revenues climbed at a yearly rate of 8%, reaching US$39 billion in 2019.

In 2020 came a bigger boost: revenues jumped to US$55.1 billion, with an unprecedented year-over-year increase of 41%. The Covid impact, which accelerated eCommerce globally, can be credited with speeding up online sales for footwear as well.

At 16%, growth was more moderate in 2021. But notably, the return to in-store shopping in 2022 did not shrink online revenue for footwear, which increased to US$68 billion.

In 2023, net sales were US$71 billion, with a promising growth rate of 5%. Similar developments are expected to take place this year, with revenues predicted to hit US$75 billion.

Going forward, the footwear eCommerce market is anticipated to grow at a compound annual growth rate (CAGR 2024-2028) of 5.1%. Revenues are likely to cross US$90 billion by 2028.

Footwear’s online market share had climbed considerably by 2021, when it accounted for 32.6% of all retail sales in this category. Though online share dipped in the next two years – to 30.2% in 2022 and further down to 29.7% in 2023 – the revenues continued to increase.

Moreover, projections are positive, with online share likely to recover to 32% this year. By 2028, online sales are expected to account for 40% of the entire market.

The largest sub-category within footwear in the U.S. market is boots, which accounted for 39.4% of its total revenue in 2023. Active footwear was second, with 22.1%, followed by sandals at 14.7%. The remaining revenue was generated by high heels and pumps (10%), other footwear (9%), and flat shoes (4.8%).

Which online stores are frontrunners in the U.S. footwear market?

Top 5 Footwear Online Stores in the U.S.: Amazon.com and Nike.com Dominate

The footwear online market in the United States is led by well-known names.

Notably, four out of the top five online stores generated sales of over a billion dollars. As a subcategory, footwear accounted for 33% of net sales of its main category of Fashion.

In 2023, the top online stores for shoes were:

1. Amazon.com

Amazon.com was the leading online store for footwear in the United States, with a filtered revenue of US$2.43 billion in 2023. The store’s total revenues in the country were US$135 billion, attesting to its status as eCommerce kingpin. However, its yearly growth was modest at 4%.

Amazon.com offers helpful features to shoppers, not least of which is virtual try-on for footwear. Through augmented reality integration in the iOS Amazon Shopping app, people can use their phone cameras to visualize how shoes they wish to buy look on their feet.

As a marketplace, Amazon.com has an edge over other competing stores. A wide variety of brands and independent sellers list their products, with competitive price points. It is possible to browse the app and try out shoes from multiple brands, including adidas, Reebok, and Puma.

2. Nike.com

With 2023 revenues of US$2.19 billion, Nike.com took the second place in the online footwear market. Despite being a dedicated brand store, it holds its own against Amazon, achieving revenues close to the top contender as well as a higher positive yearly growth of 8.4%.

Nike has established its brand identity amongst consumers and is a recognized name in the footwear industry – a likely reason behind its online store’s success. Its eCommerce sales are strengthening as it scales back its physical stores. By total revenue, it ranked seventeenth in the U.S., with US$5.8 billion.

In 2019, Nike broke off its partnership with Amazon and stopped selling its products wholesale to the marketplace. Today, Nike shoes that are sold on Amazon are through third-party sellers. Nike chose to put a greater focus on direct-to-consumer strategy, which is paying off, as the revenues show.

3. Walmart.com

Walmart.com ranks third, with online footwear sales of US$1.95 billion in 2023.

Owned by Walmart Inc., it is the second largest online store in the U.S., with revenues worth US$65 billion generated last year. Its yearly growth was a solid 24%.

Walmart.com made its mark as a one-stop shop within the U.S. – a strategy that started with its chain stores, but which it replicated on its online platforms. The familiarity and convenience may motivate consumers, particularly from the older demographic, to buy footwear as they are shopping for other items on Walmart.com.

4. Shein.com

With revenues of US$1.29 billion, Shein.com was the fourth biggest online footwear store. Overall, it ranks sixth in the United States, where it generated half of its total revenues of US$36.5 billion.

An identifiable name by now, Shein.com rose to the top ranks in a relatively short period. In the United States fashion market, it ranks third overall. Despite criticisms of its fast fashion focus, it has achieved success, thanks to its high-volume production, aggressive pricing, and a receptive consumer base comprising Gen Z and Millennials.

Compared to other stores on the list, Shein.com recorded the highest yearly growth rate in 2023, at approximately 40%.

5. Target.com

Ranking fifth in the online footwear market is Target.com, with revenues of US$0.97 billion. Overall, also, this store is the fifth largest online store in the U.S., where it derived all its sales worth US$19.4 billion in 2023.

Target.com sells shoes from brands as well as its own private label brands. Factors such as low pricing, same day delivery, and free shipping at US$35 make it an attractive platform to shop for U.S. consumers.

Still, Target.com is feeling pressure from its counterparts like Temu and Shein that have disrupted the U.S. market. Although fighting to offset the competition – for example, through its under-one-dollar brand – the store’s growth rate between 2022 and 2023 dropped to -3.2%.

Online footwear stores ranking sixth to tenth in the United States include Kohls.com, Macys.com, Dsw.com, Dickssportinggoods.com, and adidas.com. Their revenues ranged from US$721 million to US$962 million.

Footwear eCommerce Market in the U.S.: Closing Thoughts

Online footwear is part of the biggest product category, Fashion, in the United States eCommerce market. Despite the slowdown observed after the pandemic high in online footwear sales, this sub-segment is not likely to lose money online in the future.

The growing online share of the market further suggests that the consumer shift to eCommerce channels for footwear purchase will strengthen, particularly as more stores opt for tech-driven and customer-centric solutions to streamline online footwear shopping.

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

The Global B2B eCommerce Market: Why It Is Beneficial to Sell to Other Businesses

The Global B2B eCommerce Market: Why It Is Beneficial to Sell to Other Businesses

Deep Dive

Why Did Amazon Fail in China: Local Competition Defeats the Retail Giant

Why Did Amazon Fail in China: Local Competition Defeats the Retail Giant

Deep Dive

eCommerce in Indonesia: Revenues Projected to Cross US$100 Billion in 2025

eCommerce in Indonesia: Revenues Projected to Cross US$100 Billion in 2025

Deep Dive

Top 10 Online Shopping Sites in the USA: Amazon, Walmart, Apple

Top 10 Online Shopping Sites in the USA: Amazon, Walmart, Apple

Deep Dive

Online Ticketing 2024: Event Pricing, Market Size, & Trends

Online Ticketing 2024: Event Pricing, Market Size, & Trends

Back to main topics