eCommerce: Opticians

Fielmann: Revenues, Online Strategy & Growth

Fielmann, a renowned optician in Germany, has been in business for more than five decades. A combination of online and offline sales keeps the family-owned company competitive in today's market. Find out what other factors contribute to Fielmann's success.

Article by Nadine Koutsou-Wehling | January 19, 2024Download

Coming soon

Share

Fielmann is a household name among opticians in Germany. The company is a perfect example of a family-owned business that has managed to integrate the online experience into its operations, thereby complementing its brick-and-mortar sales.

As the firm generates most of its sales in its home country of Germany, this insight focuses on its German domain fielmann.de. But what exactly is it that makes Fielmann stand out in the German market?

Fielmann Online Sales: Fashion Accessories & Care Products

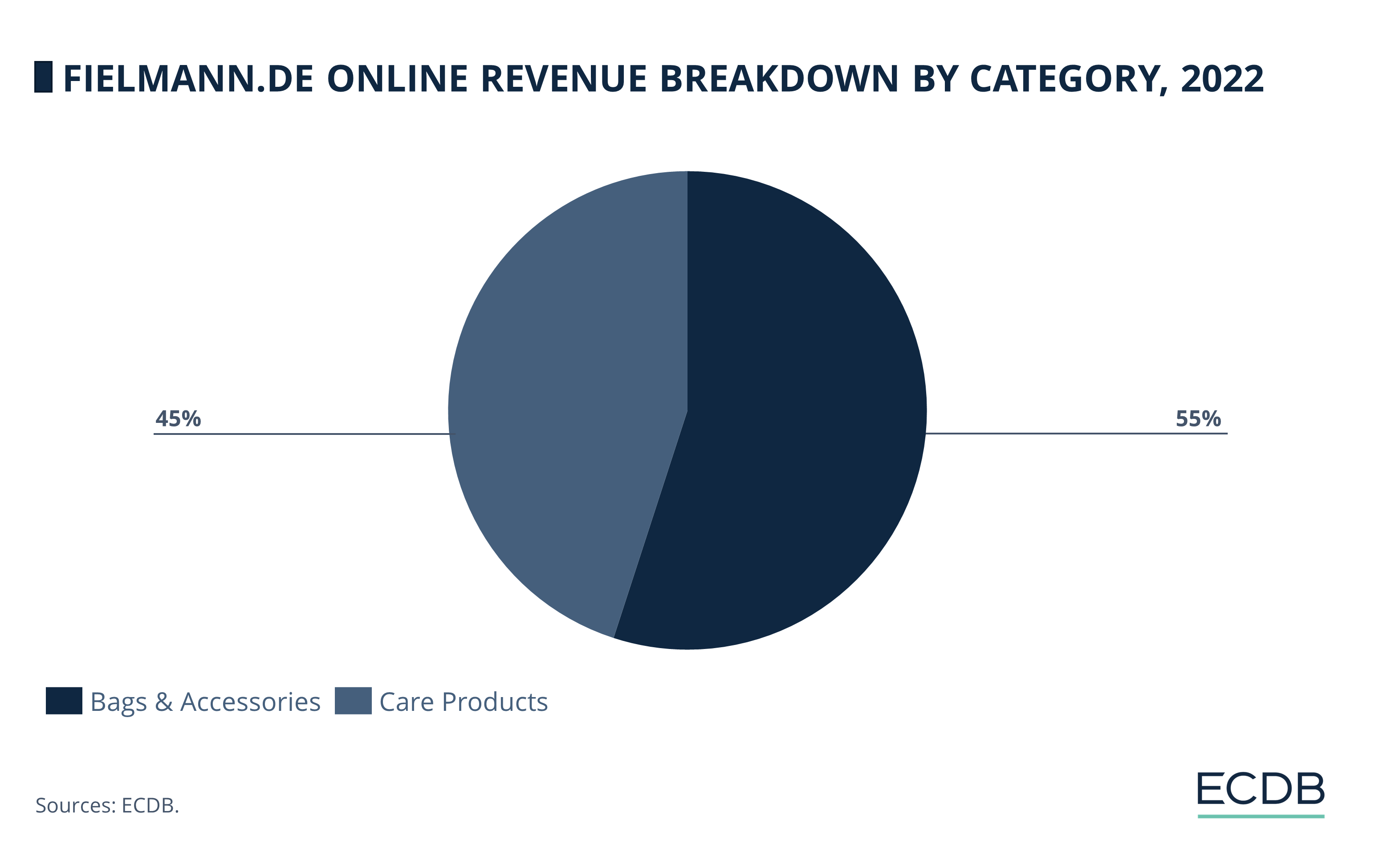

Glasses, Fielmann's flagship product, which ECDB subsumes under the Fashion category and the Bags & Accessories subcategory, are what the business has specialized in since its inception in 1972.

The category glasses includes all types of eyewear, such as regular prescription glasses, sunglasses, safety glasses, and accessories that complement their use, such as: glasses chains, anti-fogging agents, and cleaning kits.

As shown in the chart below, glasses and related product categories accounted for 55% of the eCommerce net sales generated on Fielmann's German domain in 2022:

The remaining 45% consists of Care Products, i.e. lenses and hearing aids. The optician also offers additional services to customers, such as eye tests and free hearing tests. However, as ECDB does not count services in the database, these are excluded from the sales figures presented.

Online Revenue: Steady Increase Since 2018

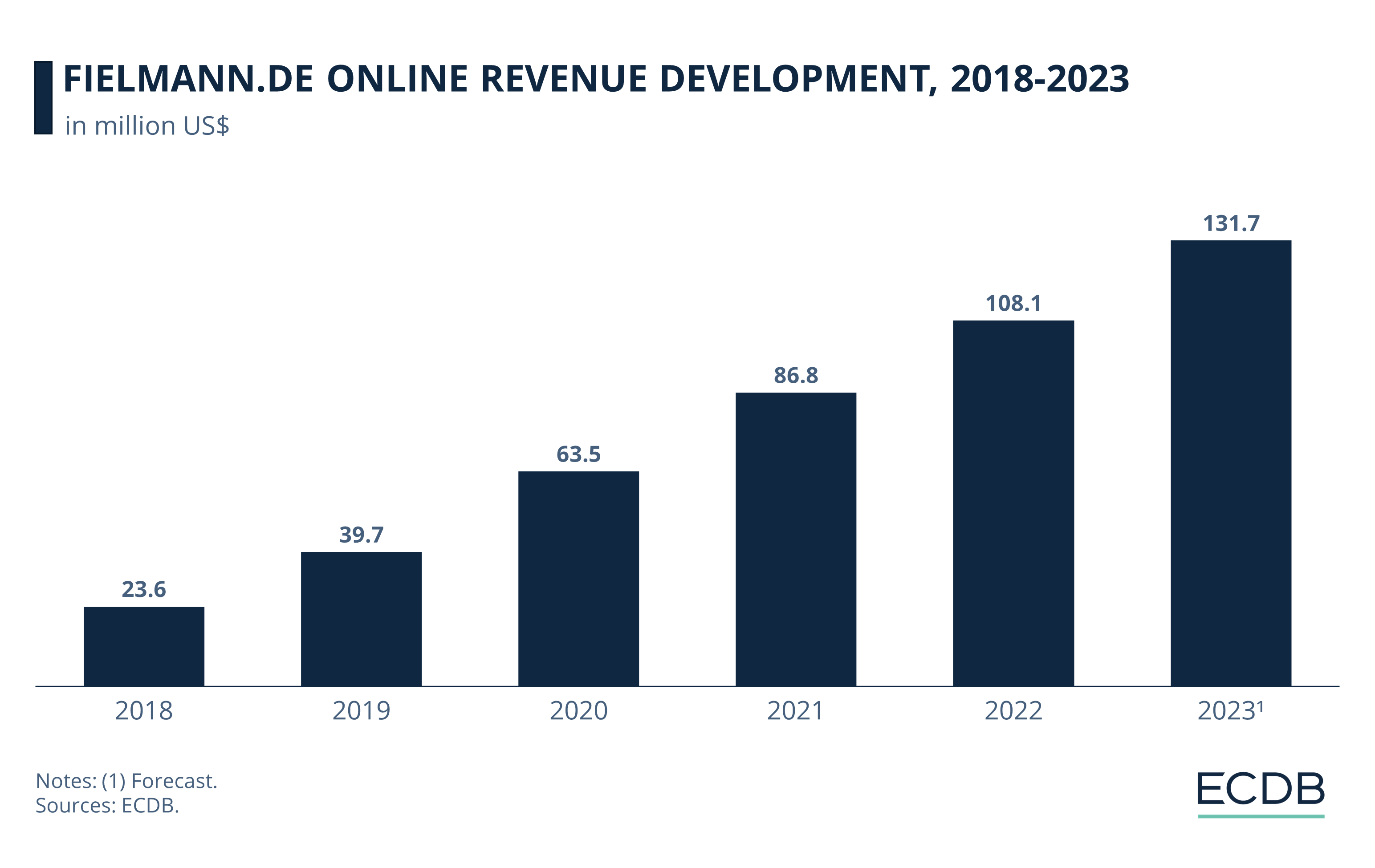

Since before the pandemic, net sales generated via Fielmann's German online domain have been growing steadily.

Like in other industries, the online market for eyewear and related products experienced a surge during the pandemic in 2020. While online sales at fielmann.de were at a comparatively low level in 2018 and 2019, at US$23.6 million and US$39.7 million respectively, this figure grew to exceed the US$60 million mark in 2020.

Offering customers the opportunity to select the perfect pair of glasses from a wide range of products via the internet and to check the size and fit in person has proved to be a viable business model for opticians everywhere. As a result, Fielmann's online sales continued to grow even after the pandemic restrictions were lifted. With US$86.8 million in 2021 and US$108.1 million generated online in 2021 and 2022, respectively, the viability of omnichannel solutions for opticians is becoming increasingly apparent.

Accordingly, the forecast for 2023 predicts a further rise in online revenues, reaching US$131.7 million.

Fielmann.de: Annual Growth Rates Since 2019

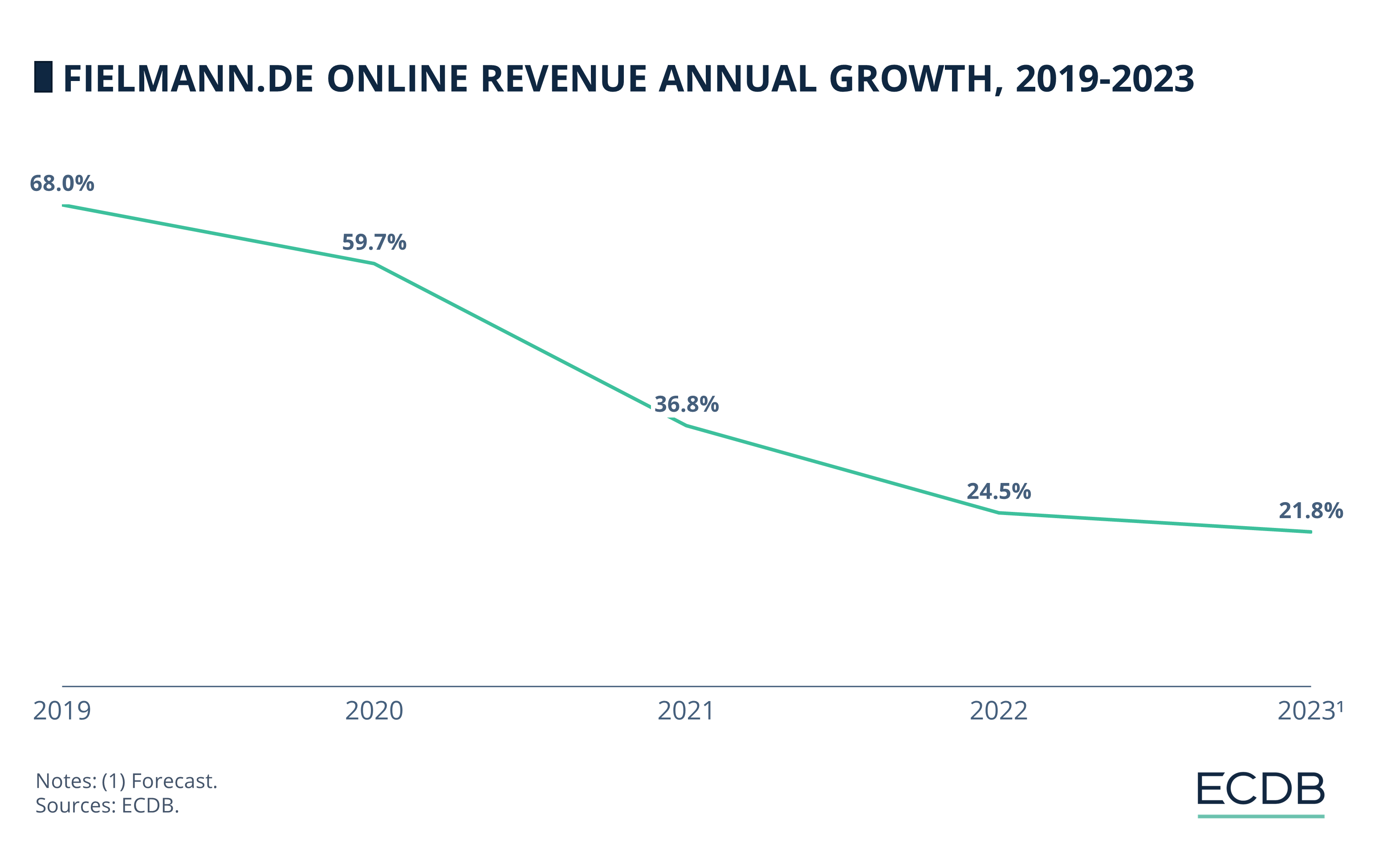

Annual growth rates, which describe how much online revenue has increased from the previous year, are shown in the chart below.

As Fielmann's online store was still in its initial phase in 2018, the growth rates of the following year in 2019 reflect the rise of this platform, with online net sales rising by 68% year-on-year.

With the pandemic curtailing brick-and-mortar sales, an increase in online revenues offset the losses suffered during this period. As a result, online sales grew by 59.7% from 2019 to 2020. Although growth slowed in the following years, the rates still remained positive, reaching a forecast growth rate of 21.8% in 2023.

The Fielmann Group continues to invest in international business and start-ups working on innovative technologies, ultimately contributing to a network of enterprises that combine operations and help to keep prices competitive.

Fielmann's Investments: International Markets & the Future of Eyewear

Fielmann has not only expanded into European markets outside of its home country of Germany, but is also continually investing resources in new software, technology, eyeglasses and lenses. While the "smart glasses" trend has not yet taken hold in the mainstream, Fielmann has invested in deep-tech companies that specialize in the development of everyday wearable solutions for smart glasses.

Smart glasses are technologically advanced eyewear that integrate augmented reality (AR) capabilities, providing users with real-time information and interactive experiences directly in their field of vision.

Getting an early grasp on the necessary data for development as well as networking with according specialists to gain access to the field of innovative glasses and lenses is a step that will likely secure Fielmann's top position among opticians worldwide for the years to come. It is not without reason that market forecasts place Fielmann near the top of the German online market for glasses and lenses.

Another important aspect of Fielmann's strategy is the seamless integration of multichannel capabilities. As the pandemic has demonstrated the importance of a viable online platform, Fielmann offers customers the opportunity to choose the perfect pair of glasses in a mix of offline and online steps. Ultimately, it is the combination of the latest eyewear styles, customer-oriented services and investment that distinguishes success from failure among online opticians.

Fielmann.de Business Strategy: Closing Remarks

Fielmann's product range, consisting mainly of glasses and care products, and their investment in innovative technologies and international markets, particularly smart glasses, set it apart in the industry. As offline and online services continue to merge, Fielmann is expected to maintain its leading position, with forecasts predicting further growth in online sales in the coming years.

Sources: Fielmann ‒ Fielmann Group AG

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

Birkenstock Business Model: Marketing Strategy & eCommerce Sales

Birkenstock Business Model: Marketing Strategy & eCommerce Sales

Deep Dive

Fast Fashion Online Market: Fast Fashion Is Not Fair Fashion

Fast Fashion Online Market: Fast Fashion Is Not Fair Fashion

Deep Dive

Shein Business Model: Growth Strategy, Audience, Marketing & Competition

Shein Business Model: Growth Strategy, Audience, Marketing & Competition

Deep Dive

Fanatics Launches New NHL Collection in Cooperation with Lululemon

Fanatics Launches New NHL Collection in Cooperation with Lululemon

Deep Dive

South Korean Online Fashion 2024: Revenue, Stores & Trends

South Korean Online Fashion 2024: Revenue, Stores & Trends

Back to main topics