eCommerce: Etsy

Etsy: Its Business Model & Recent Sales Performance

Etsy connects online shoppers with sellers who make original goods with an original touch. But the platform has recently struggled with stagnation. Here's what Etsy is all about.

Article by Nadine Koutsou-Wehling | August 20, 2024

Etsy's Performance and Strategy: Key Insights

Platform Strategy: Etsy is an online marketplace where sellers offer their crafted and vintage goods to users looking for exclusive products. Merchant services and advertising are Etsy's source of income.

Distinct Market Segment: Etsy started in 2005 as a niche player, but now defines the previously untapped market for handmade and vintage products. Etsy has expanded its product selection notably since then. However, the platform is not immune to the low-cost competition currently emerging.

Mostly One-Person Female Sellers: A large majority of Etsy sellers run their shops from their homes, most of them are female and sell alone. But latest developments have called into question Etsy's user handling and authenticity.

Etsy is a C2C (consumer-to-consumer) online marketplace for sellers with a category focus on handmade items, vintage goods, and unique pieces of art. Etsy originally started out in 2005 as an eCommerce platform for handmade products alone, but it has since widened its scope to include all kinds of categories.

Its marketplace gained significant traction during the pandemic, but growth has stagnated since then. The company's Q2 earnings report of 2024 reveals that GMV is down slightly, while revenue is up 3% year over year due to an increase in payment and transaction fees.

Shares of Etsy fell more than 15% after the most recent earnings report. Let's take a closer look at its performance.

Etsy: GMV Increased During Pandemic

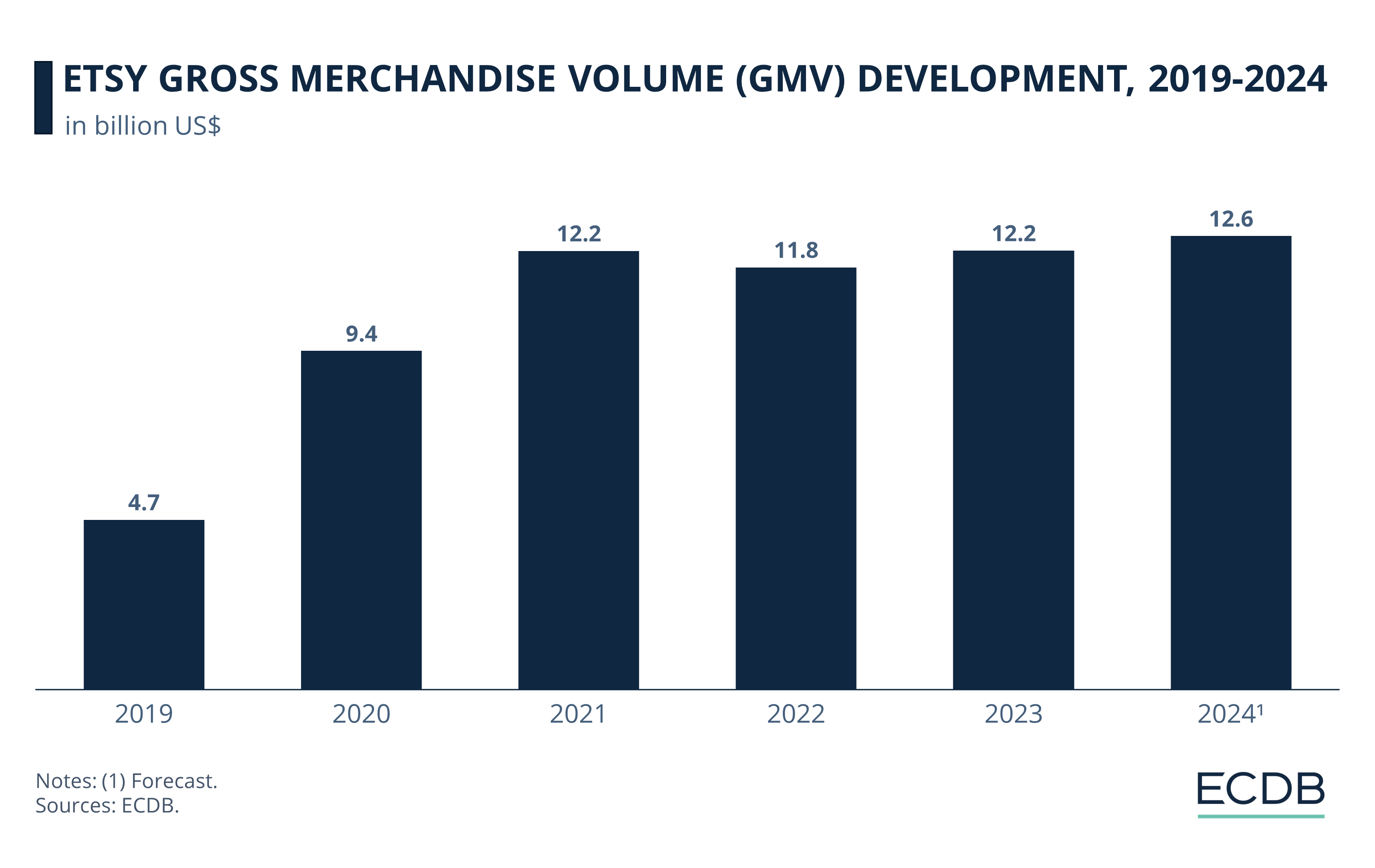

Etsy’s gross merchandise volume (GMV) spiked during the pandemic, and the platform has managed to stay at high levels ever since.

GMV depicts the value of goods sold on a marketplace during a given time frame. It is used to gauge marketplace activity and is not to be confused with revenue.

Before the pandemic, in 2019, transactions on Etsy totaled US$4.7 billion, a figure only slightly higher than in the previous years.

With the pandemic restrictions and the subsequent shift to online, activity on Etsy surged, first reaching US$9.4 billion in 2020 and then US$12.2 billion in 2021.

As a result, pandemic growth rates indicate that GMV doubled in 2020 and increased by 29.5% in 2021.

As the necessity to shop online decreased, so did consumer demand for online marketplaces, which in the case of Etsy slowed down. Therefore, GMV stayed below its 2021 peak at US$11.6 billion in 2023 and is forecast to see a sluggish recovery in 2024 and 2025.

Etsy's Q2 earnings report in 2024 shows that GMV is down 2.1% from the previous year, while revenue is up 3%. Gifting items is still a growth market for Etsy, as it has been increasing by more than 4%.

Part of Etsy's mixed performance can be attributed to the emergence of competitiors with lower prices like Temu or with an eerily similar strategy like MakerPlace.

To defend against these rivals and survive in a challenging macro environment, Etsy is focusing on AI features and deeper personalization. Etsy is also currently beta testing a paid membership model with free shipping and special offers.

The numbers of buyers and sellers reflect recent sales trends.

Etsy Sellers Are at 7.5 Million Since 2021

The number of global Etsy sellers has spiked during Covid, growing from around 2 million before 2020 to 4.37 million in 2020 and 7.52 million in 2021. This represents growth rates of 61.9% in 2020 and 72.1% in 2021.

The most recent seller statistics available from Etsy refer to 2022, when the number of sellers diminished to 7.47 million, following the same pattern as GMV. As such, the number of sellers is expected to grow in line with GMV in 2023 and 2024.

Etsy Buyers Surpassed 95 Million in 2021

Etsy’s buyer numbers follow a similar pattern, with one small difference: The bulk of the pandemic spike occurred in 2020, when numbers jumped from 46.4 million buyers to 81.9 million, a 76.7% increase. From 2020 to 2021, the number of buyers grew at a more moderate rate of 17.6%, reaching 96.3 million.

It is reasonable to assume that the number of buyers will follow the patterns discussed above, having recovered from a slight decline to 95.1 million in 2022 and resuming growth in the years thereafter.

The ratio of buyers to sellers has decreased over time when comparing the numbers. While there were 17 buyers per seller before the pandemic, the ratio dropped to around 13 buyers per seller after 2021.

The decrease in the ratio of buyers to sellers shows that while both numbers increased significantly during the pandemic, competition on the platform also increased. As a result, sellers need to differentiate themselves from other sellers because there are now fewer buyers available per listing.

But what does the profile of a typical seller on Etsy look like?

Typical Etsy Sellers: Home-Based, Women-Led, One-Person Enterprises

Etsy’s unique selling point is tied to its connection to the small businesses and individuals that characterize the brand as the accessible platform with original offerings for which it is known.

97% of vendors on the platform run the Etsy businesses from their homes.

82% of Etsy shops are run by one person, whereas 80% identify as women. Almost as many, 79%, consider their Etsy shop a business.

Fewer sellers, 54%, distribute their products through multiple channels outside of Etsy, implying that there are a substantial number of sellers whose only distribution channel is through Etsy.

In keeping with the private nature of most shops on the platform, 44% of sellers use their Etsy earnings to cover household expenses like rent or groceries.

Just over one-third of sellers (34%) identified their creative business as their sole occupation, while 25% live in rural areas, making the majority of Etsy sellers urban dwellers.

Etsy Business Model: Closing Thoughts

Etsy established its brand as a haven for users looking to buy or sell unique products. The concept has grown since then, but Etsy’s focus on small businesses and individual sellers is still what sets the site apart from larger rivals like Amazon or Alibaba.

However, latest scandals could harm Etsy's reputation. Allegations of items falsely labeled as handmade and Etsy's treatment of sellers, including withholding 75% of their earnings in response to protests over fee increases, raise doubts about Etsy’s viability. Particularly given Etsy’s IPO (initial public offering) and its position among the top 10 U.S. eCommerce companies by market capitalization, the repercussions of these scandals could have a significant impact on investor confidence and consumer trust in the platform's long-term sustainability.

Sources: BBC – Etsy: 1 2 – Harvard Digital Initiative – The Strategy Story

FAQ

Why is Etsy so successful?

The factors that contribute to Etsy’s continued success enable sustained growth, increasing transactions and users on the platform. It has maintained relevance in a competitive market amid other online marketplaces vying for traffic and business.

Market Positioning: Etsy began as an online marketplace for crafted and vintage goods, which was an untapped market back in 2005. Although the company has since expanded its product range, Etsy’s branding remains distinct from other generalist marketplaces such as Amazon and Alibaba.

Loyal Seller Network: Etsy offers small businesses and individual sellers the ability to create a personalized storefront that uses video to introduce themselves and the history of their products, build a network of like-minded sellers, and connect with a wide audience.

Good User Experience: The C2C marketplace recognized early on the importance of providing a satisfying user experience, which is achieved through personalized recommendations using algorithms, establishing easy communication with sellers around the world and creating a transparent review and rating system.

Platform Relevance: By providing value-added services that leverage network effects, Etsy ensures that it is more profitable for buyers and sellers to use Etsy as an intermediary than to do business outside of the platform. This includes add-on features such as advertising, advanced technology for easy navigation and communication, strong security measures, and delivery services.

How does Etsy make money?

Etsy generates revenue from a variety of sources, which diversifies its portfolio and insulates it from losses on a larger scale. For its services, Etsy charges

Listing fees: A fee of US$0.2 is charged for each item that sellers list on the platform.

Transaction fees: Each sale results in a transaction fee that sellers pay to Etsy. The fee is 6.5% of the item price, including shipping and handling.

Advertising and promotion fees: There are two types of advertising fees: One is for advertising directly on Etsy’s platform, and the other is for off-site advertising, where sellers only pay if a sale is made through those ads.

Subscription fees: The company charges US$10 per month for Etsy Plus services, which include advanced editing options for sellers' stores and site credits.

Payment processing fees: For each transaction processed through Etsy Payments, Etsy charges a fixed fee as a percentage of the total sale price, including all applicable fees.

Pattern fees: Sellers have the option to use Etsy Pattern to create a personalized website that is connected to, but separate from, the Etsy storefront and operates under its own domain. Etsy Pattern sites are free from Etsy guidelines and cost US$15 per month.

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

Artificial Intelligence in Italy eCommerce: Consumer Behavior & Preferences

Artificial Intelligence in Italy eCommerce: Consumer Behavior & Preferences

Deep Dive

Online Sexual Wellness Market: Top Stores & Market Development

Online Sexual Wellness Market: Top Stores & Market Development

Deep Dive

NFL in eCommerce: Online Store Analysis, Partnerships & Strategy

NFL in eCommerce: Online Store Analysis, Partnerships & Strategy

Deep Dive

Online Purchase Returns in the United States 2023: Product Categories by Gender and Generation

Online Purchase Returns in the United States 2023: Product Categories by Gender and Generation

Deep Dive

Artificial Intelligence (AI) in eCommerce: U.S. Consumer Expectations, Concerns & Awareness

Artificial Intelligence (AI) in eCommerce: U.S. Consumer Expectations, Concerns & Awareness

Back to main topics