eCommerce: Key Players in China

Bilibili Business Model: eCommerce Revenues on the Decline

Bilibili is a Chinese video broadcasting and livestreaming platform that enjoys high consumer awareness in the market. But its revenues have been declining in recent years. Here's why.

Article by Nadine Koutsou-Wehling | June 28, 2024Download

Coming soon

Share

Bilibili Business Model: Key Insights

Platform Strategy: Bilibili has evolved from a niche platform for anime and related interests to a broader audience. It is particularly popular for its interactive features, which foster a sense of community among users.

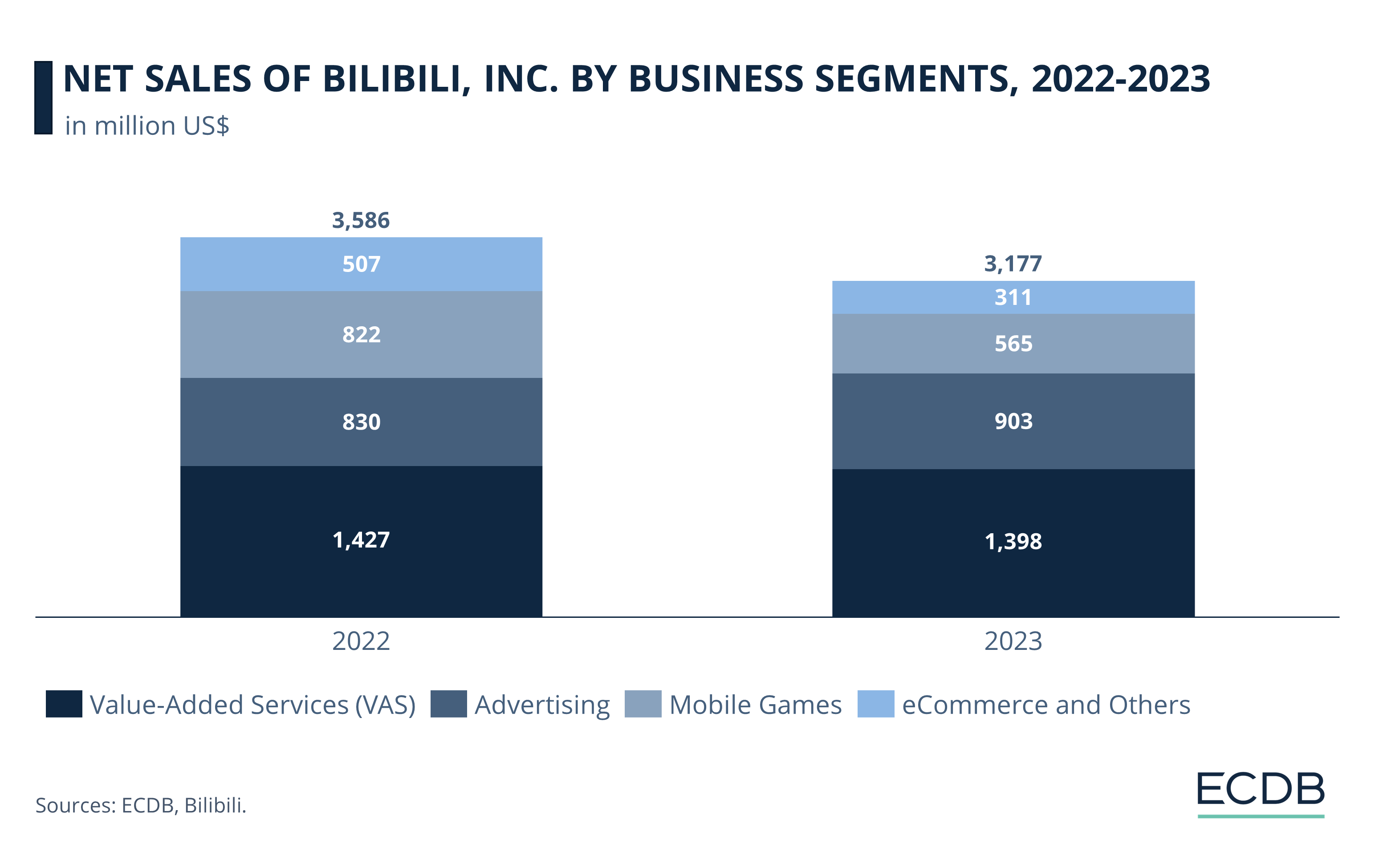

Recent Revenue Decline: Earnings declined in all revenue segments in 2023, with the exception of advertising revenue. This is due to the challenging macroeconomic climate in China at the time.

Audience Statistics: While bilibili's awareness among consumers in China is high, its core audience is younger. This means that bilibili's clientele

tends to have less purchasing power.

Bilibili is a Chinese video streaming platform that mainly provides user-generated content, with monthly active users (MAU) of around 340 million.

As Bilibili recently published its earnings report for fiscal year 2023, this insight discusses the company's business model and performance over the past few years.

What Is Bilibili's Strategy?

Bilibili is a video streaming and live broadcasting service that started out as a niche platform for content in the category of Anime, Comics, Games and Novels (ACGM), but has since evolved to include more mainstream tastes. More specifically, this encompasses topics such as lifestyle, technology, and general knowledge.

In essence, Bilibili is a virtual place for communities to form and gather, a fact that is enhanced by the platform's interactive features: Users can post real-time comments that pop up on the screen ("bullet chatting"), like, follow, give virtual gifts and rewards, and engage in communication gimmicks like membership challenges.

Business Intelligence: Our rankings, updated regularly with fresh data, offer valuable insights to boost your performance. Which stores and companies are the leaders in eCommerce? What categories are generating the most sales? Explore our detailed rankings for companies, stores, and marketplaces.

Unlike other video streaming platforms in China, Bilibili's streamers comprise mostly individuals or small studios, which adds a level of relatability that its direct competitors lack: Other video streaming services like iQIYI, Tencent Video, Youku, and Mango TV offer mostly professionally produced content, which is more in line with the business model of Netflix, Disney+, and HBO. While there is also studio-produced content on Bilibili, it just is not the main focus of the site.

For users with specific tastes, Bilibili appears as a platform where they can interact with their hobbies, for example by having the exclusive rights to broadcast certain e-sports tournaments. Bilibili's business model is therefore very similar to YouTube in concept, but not so much in the way it generates revenue.

What Are Bilibili's Revenue Streams?

The company's latest earnings statement from 2023 shows that each business segment experienced losses from the previous year, except for advertising revenues, which increased.

Value-added services (VAS) account for the largest share of revenues. VAS includes revenue from premium subscriptions, live streaming fees, and related platforms with specialized content. Revenues from VAS dropped from US$1.42 billion in 2022 to US$1.39 billion in 2023.

The second largest earnings segment is advertising revenue, which increased in size from 2022 to 2023. Specifically, advertising revenue grew from US$830 million to US$903 million year-over-year.

Mobile games follows as the third largest segment, which also experienced degrowth due to macroeconomic challenges in China. Therefore, Bilibili's revenues from mobile games decreased from US$822 million in 2022 to US$565 million in 2023.

The remaining share of revenue comes from eCommerce activity, more specifically, the merchandise sold by content creators through Bilibili's platform. This share of revenue decreased from US$507 million in 2022 to US$311 million in 2023.

Bilibili's eCommerce Revenue Spiked in 2022

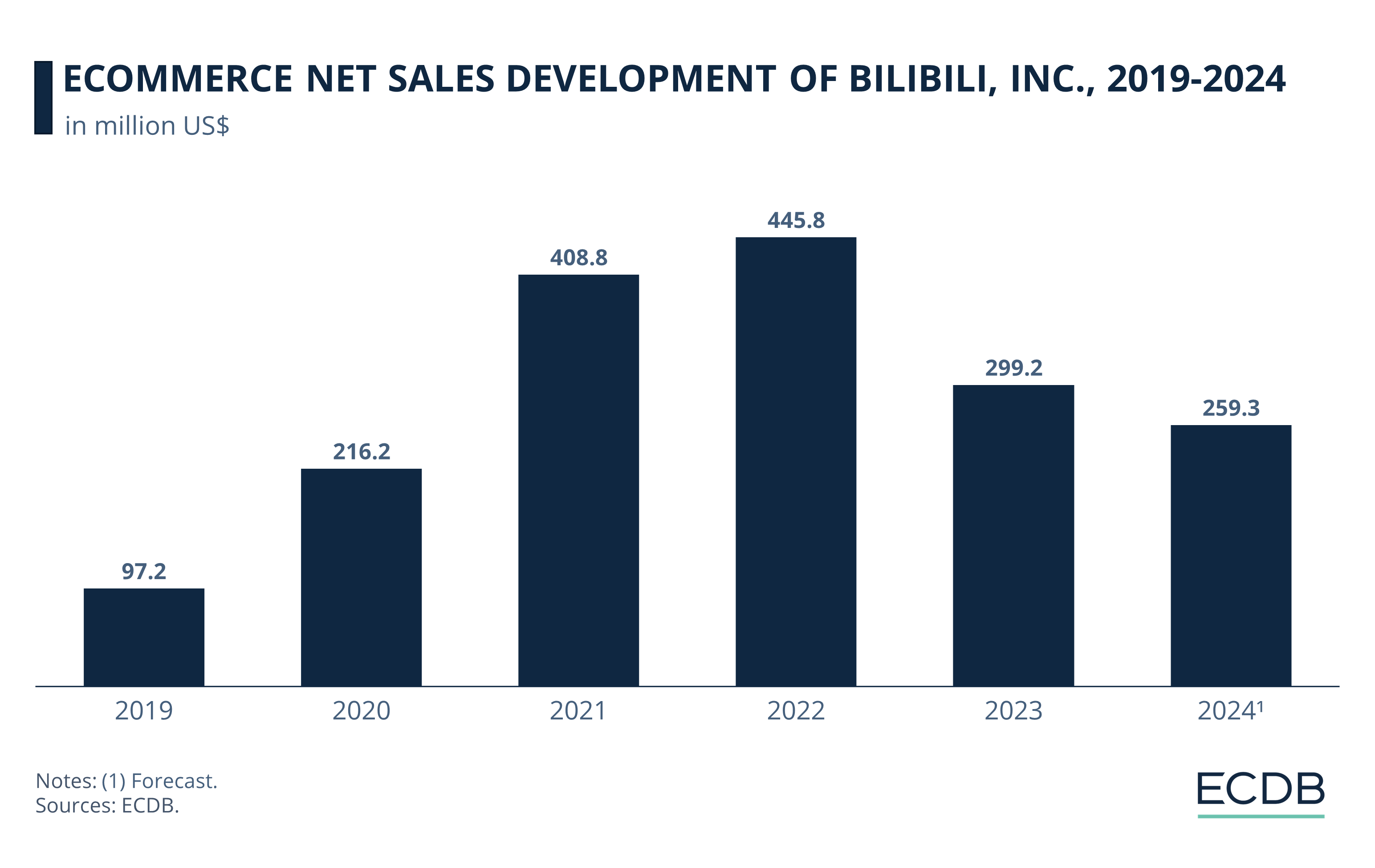

A look at Bilibili's eCommerce revenues shows that the company is struggling to maintain the growth rates that spiked during the pandemic.

While eCommerce revenues were still higher in 2023 than they were in 2020, they are forecast to continue declining further to US$259.3 million by 2024.

According to market researchers, Bilibili's eCommerce platform does not provide sellers with the services they need to grow their businesses. On top of that, the platform's audience is mostly younger and visits bilibili to engage with their niche interests, making it difficult for merchants to consistently sell relevant products to them.

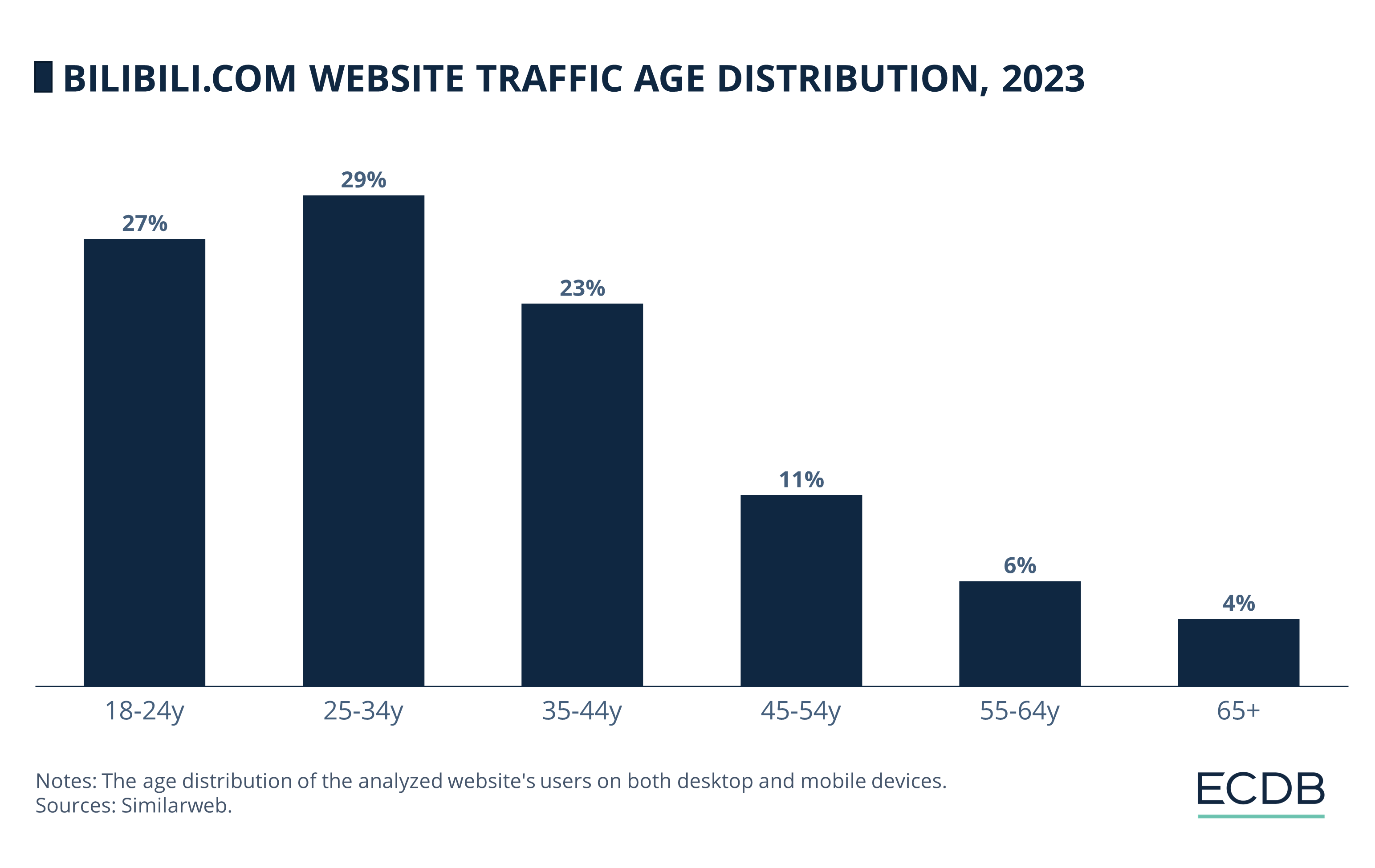

Bilibili's Users Are Mostly Younger Than 35

Similarweb's data provides information about the age distribution of Bilibili's audience:

Traffic analysis of Bilibili shows that the largest segment of Bilibili's users is between 18 and 34 years old, which together make up 56% of the user base.

The 35-44 age group is still significant at 23%, but consumer segments in their mid-40s and older are less prevalent at 21%.

Bilibili Is the Most Popular Livestream Platform Among Users in China

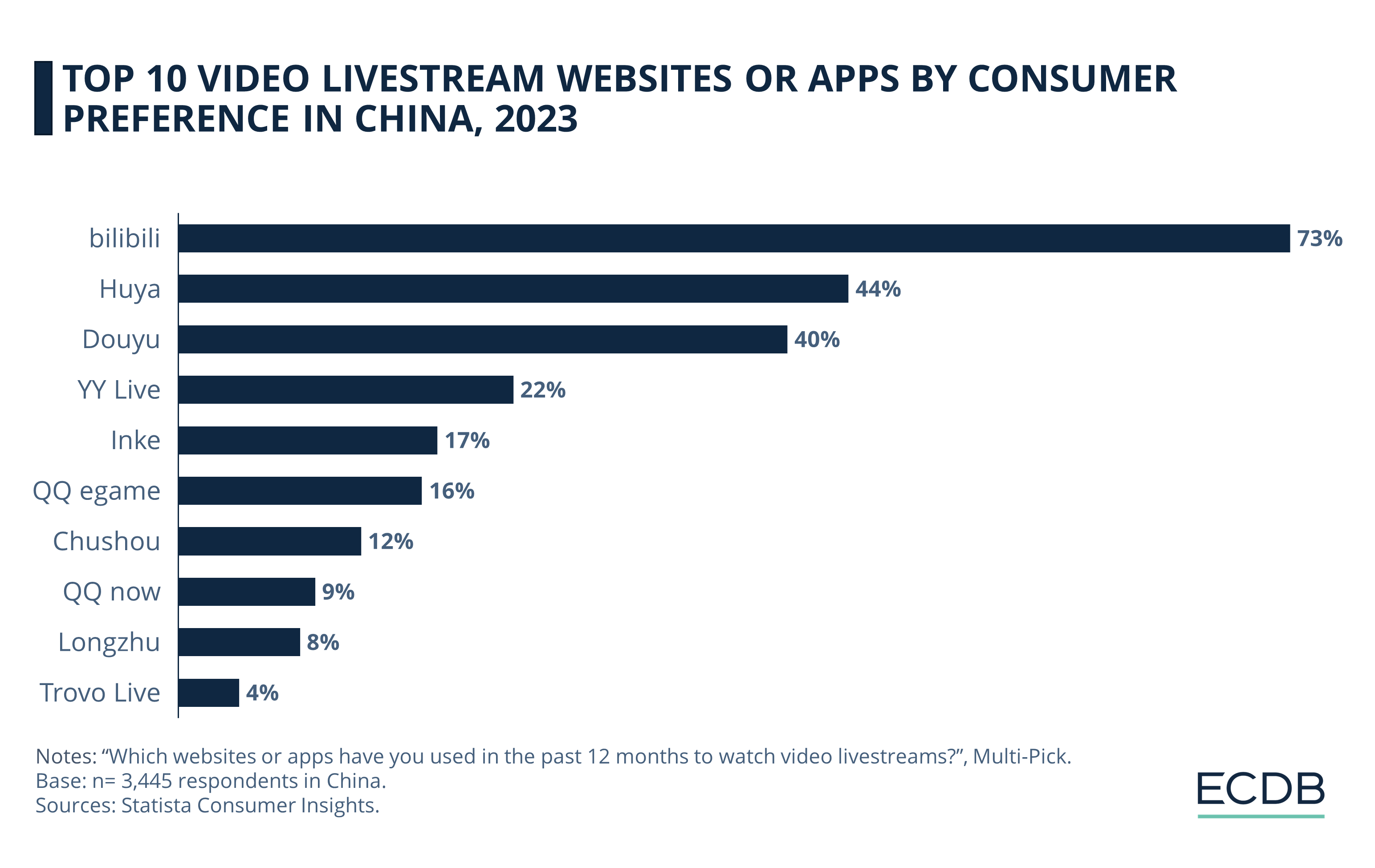

Live broadcasting is one of Bilibili's strongest customer segments, as evidenced by Statista Consumer Insights, where 73% of consumers in China said they have watched video livestreams on Bilibili in the past 12 months.

This is supported by the fact that Bilibili's largest revenue segment is value-added services, which includes the fee bilibili charges for providing the platform and transactions made during livestreams.

Bilibili's dominance can be explained by the platform's exclusivity rights to in-demand broadcasting events, which attract customers to the site.

Challenges to Bilibili's Business Model

Bilibili's main problem is said to be the lack of incentive for users to leave more money on the platform. Despite the growing number of monthly active users, its primarily younger and niche audience does not generate the kind of revenue needed to sustain the platform's business model.

Another challenge is the highly competitive environment of the platform, given the variety of content it provides (user-generated content, live shows, high-quality original content, online games, etc.). This puts bilibili into the direct comparison with other players in the domestic and international entertainment industry.

Bilibili's Business Model: Wrap-Up

Largely coined as China’s YouTube, Bilibili is similar in some respects, but differs in its platform focus and revenue model. Bilibili generates additional revenue by publishing mobile games and it has the exclusive rights to international high-quality content, also fostering customer relationships by leveraging key partnerships for diverse interests in niche categories.

While the live broadcasting and advertising model continue to account for Bilibili's recognition and success, there are some difficulties regarding the platform's viable profitability and value proposition. Bilibili will therefore need to address its weaknesses to regain growth.

Sources: Bilibili: 1 2 – Daxue Consulting – Equal Ocean – FBICGroup – SCMP – Technode

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

ByteDance Is Big on Personal Care, Powered by Content on Douyin and TikTok Shop

ByteDance Is Big on Personal Care, Powered by Content on Douyin and TikTok Shop

Deep Dive

Birkenstock Business Model: Marketing Strategy & eCommerce Sales

Birkenstock Business Model: Marketing Strategy & eCommerce Sales

Deep Dive

Kaspi to Acquire Stake in Hepsiburada, Expanding Presence in Turkey

Kaspi to Acquire Stake in Hepsiburada, Expanding Presence in Turkey

Deep Dive

Jumia Business Analysis: Top Markets, Revenue, GMV & eCommerce in Africa

Jumia Business Analysis: Top Markets, Revenue, GMV & eCommerce in Africa

Deep Dive

Wayfair’s Shopping Way Day: Analysis & Market Insights

Wayfair’s Shopping Way Day: Analysis & Market Insights

Back to main topics