Retail Media Advertising

Retail Media Advertising: Zalando, eBay, and Amazon Are the Top 3 in Europe

Ad spending on digital retail media is expected to grow rapidly, doubling from US$10.5 billion in Europe in 2023 to US$21.9 billion in 2026. Who are the leading networks driving the rise?

Article by Nitika Lobo | July 31, 2024Download

Coming soon

Share

Retail Media Advertising: Key Insights

Retail Media Advertising Defined: Retail media advertising involves retail platforms offering advertising spaces on their eCommerce websites and apps, allowing third-party brands to target customers at critical buying moments.

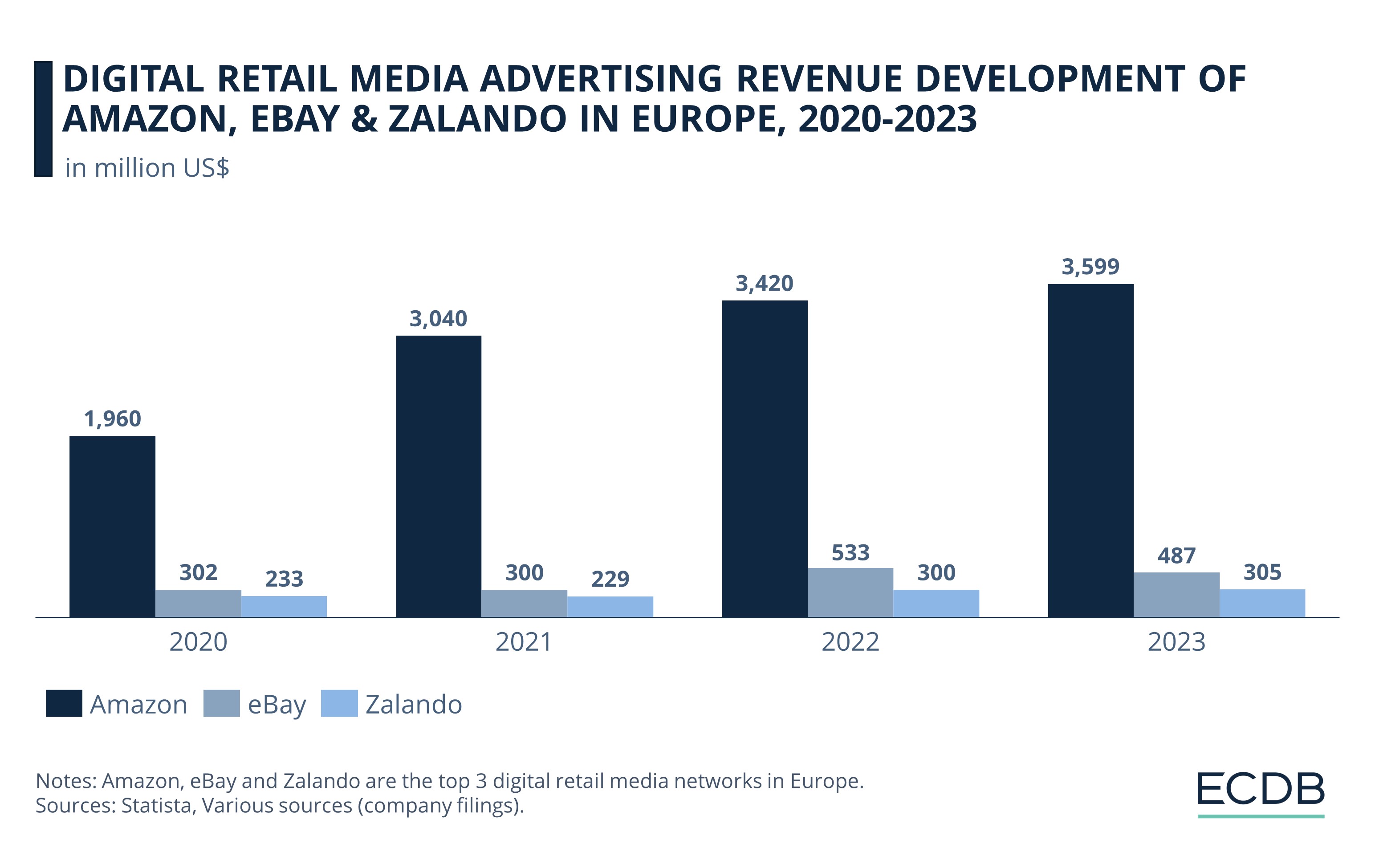

Amazon's Unmatched Growth: Amazon leads the European digital retail media market with revenues of US$3.6 billion in 2023, showing consistent growth from 2020 to 2023 with an 83.6% increase.

Competitive Landscape: While Amazon exhibits consistent growth, competitors like eBay and Zalando have experienced fluctuating revenue patterns. Nonetheless, all three companies highlight the significant potential of digital retail media advertising in the eCommerce sector.

Advertising in general plays an important role for brands and companies to reach their customers. From online pop-ups on the phone to giant billboards across the street, there are now endless opportunities for advertising.

In the eCommerce scene, there is Retail Media Advertising, which is used by big players like Amazon. But how does it work? Who is taking advantage of it? Let's explore through data.

What Is Retail Media Advertising?

Retail media advertising is a type of sponsored ad marketing. It refers to the practice of retailers using their own platforms and customer data to enable brands to advertise to shoppers. This means, that retailers such as Amazon offer space within their eCommerce infrastructure, such as websites and mobile apps, for third-party brands to advertise.

Brands take advantage of these retailers' data-rich environments to target shoppers precisely at the peak of their purchase decisions, such as at checkout or during product selection.

Like this insight? It is based on our regularly updated rankings. With our retailer and country rankings, you can learn valuable information about your specific market. Our product category rankings and benchmarks allow you to see where various businesses are currently evolving. This information can aid in your decision-making, whether you are a business developer, shop owner, or CEO of a large eCommerce brand. Stay a step ahead of the market with ECDB.

Top Digital Retail Media Advertising in Europe

It is attracting more and more investment from brands and has proven to be a powerful advertising tool. In fact, according to a FOMA survey, digital retail media is predicted to be the most sought-after digital advertising trend in Germany by 2023.

In particular, marketers are opting for advertising slots on leading eCommerce platforms, generating significant revenue for these site owners.

1. Amazon

In 2023, Amazon secured a significant chunk of the digital retail media market in Europe with revenues of US$3.6 billion, accounting for 54% of the total market. This places Amazon at the forefront, leaving other players far behind in revenue terms.

Not just in absolute values, Amazon's growth in digital media ad revenue has been impressive and consistent over recent years:

From 2020 to 2023, Amazon experienced an unparalleled 83.6% growth in ad revenues.

Specifically, in 2020 and 2021, the company enjoyed YoY growth rates exceeding 50%, which represents a 2021 figure of over US$3 billion.

Although 2022 saw a slight slowdown with a 13% increase and revenues of US$3.4 billion, it's clear that Amazon's growth trajectory has largely been on the rise.

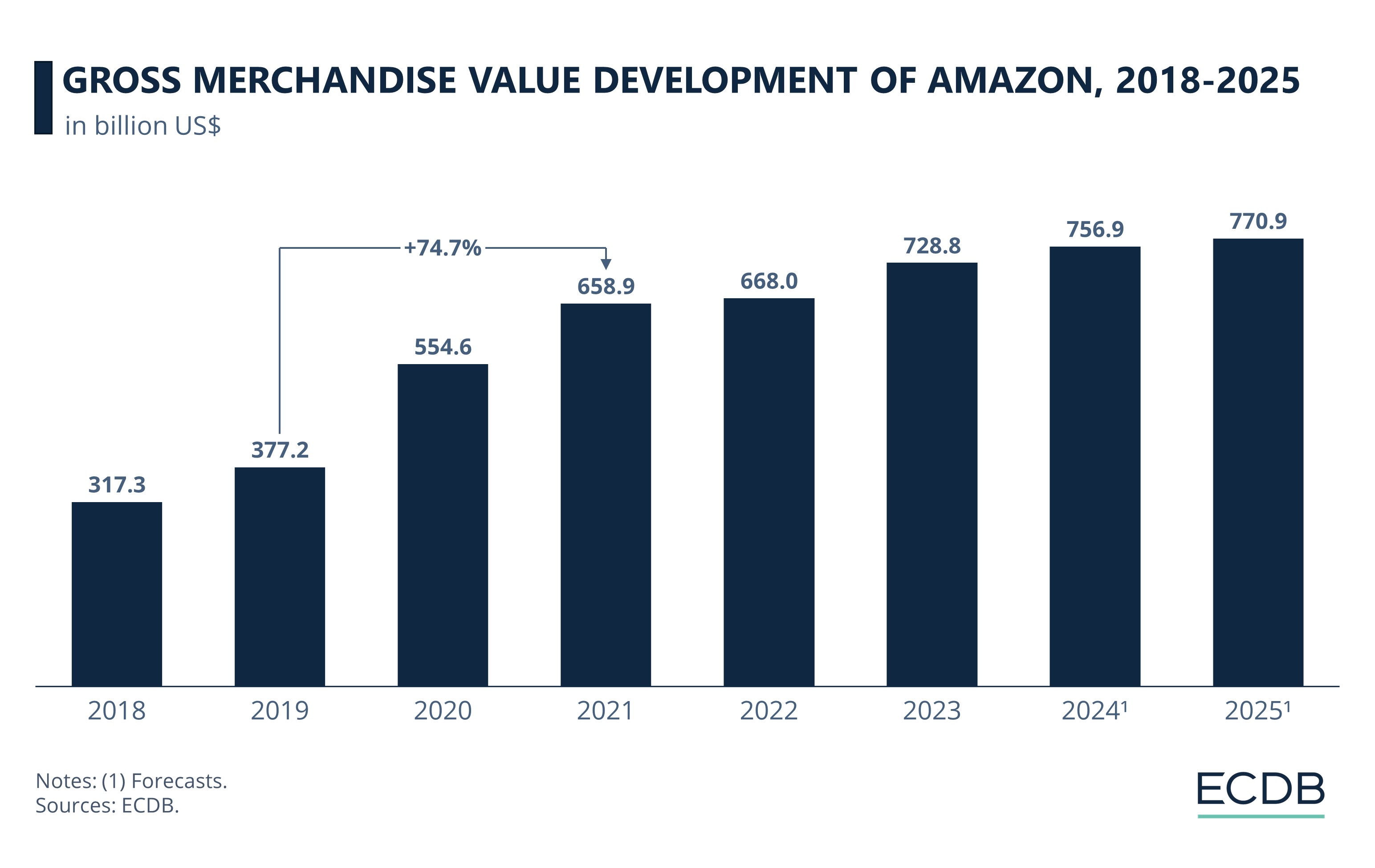

Not only did Amazon's digital retail advertising revenue perform well last year, but its GMV showed gains as well:

The pre-pandemic years saw stable YoY growth. From 2018 to 2019, the value climbed from US$317.2 billion to US$377 billion – an annual increase of 18.9%.

Along the COVID-19 pandemic, Amazon took great advantage, with the GMV jumping 74.7% between 2019 and 2021, reaching US$658.9 billion in 2021.

Amazon is one of the rare cases that did not lose value after the pandemic. In 2023, the U.S. tech giant increased by 1.4%, not as much as in previous years, but still positive.

For the coming years, Amazon's GMV is projected to continue to augment.

2. eBay

The U.S. giant experienced a 1% decline in retail media ad revenue from revenues of US$302 million in 2020 to US$300 million in 2021. The subsequent year brought a significant rebound with a 77% YoY growth to over US$530 million in 2022, followed by an 8% decline to US$487 million in 2023. Over the three-year period from 2020 to 2023, eBay generated total growth of 61%.

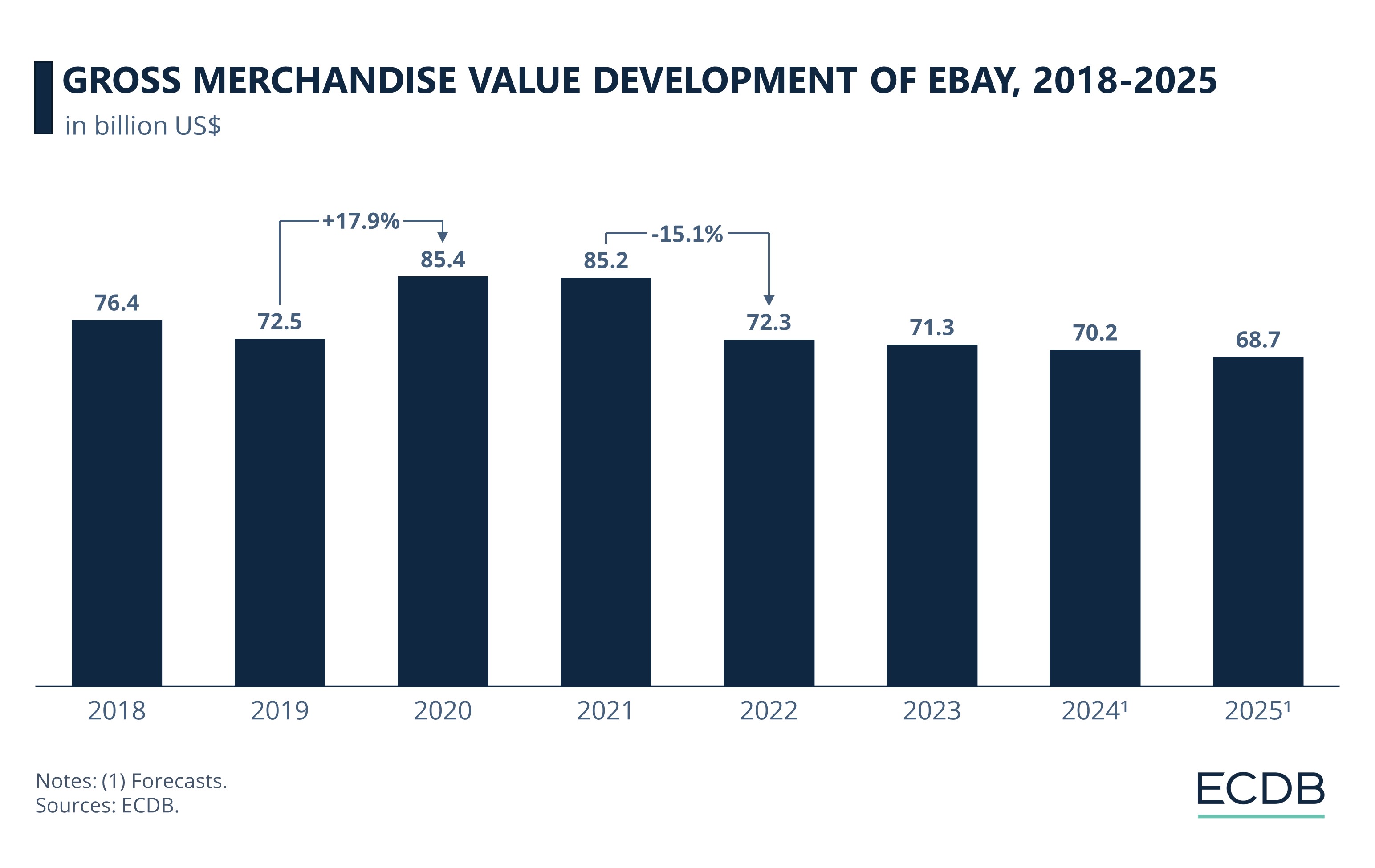

Meanwhile, eBay's gross merchandise value (GMV) didn't perform as well over the same period:

Prior to 2020, eBay's overall GMV slowed, declining from US$76.4 billion in 2018 to US$72.5 billion in 2019.

With the start of the COVID-19 pandemic, the growth trend changed significantly. From 2019 to 2020, GMV increased to US$85.4 billion, representing a 17.9% year-over-year growth.

However, the U.S. marketplace couldn't sustain this trend and its GMV stagnated the following year, until it lost 15.1% of its GMV from 2021 to 2022 with US$72.3 billion.

With the end of the Corona pandemic in 2022, eBay began a new growth trend. The marketplace giant's GMV decreased by 1.5% in 2023 and is set to maintain this trend in the future.

3. Zalando

The fashion player saw its highest growth in 2023, with a 24% increase in digital retail media ad revenue from a lower 2020 figure of US$233 million to a substantial US$305 million in the past year.

2021 was a bit more challenging with a slight revenue decline to US$229 million, but 2022 ended on a positive note with 31% growth and revenues of US$300 million. Overall, Zalando generated 31% growth over the three-year period from 2020 to 2023.

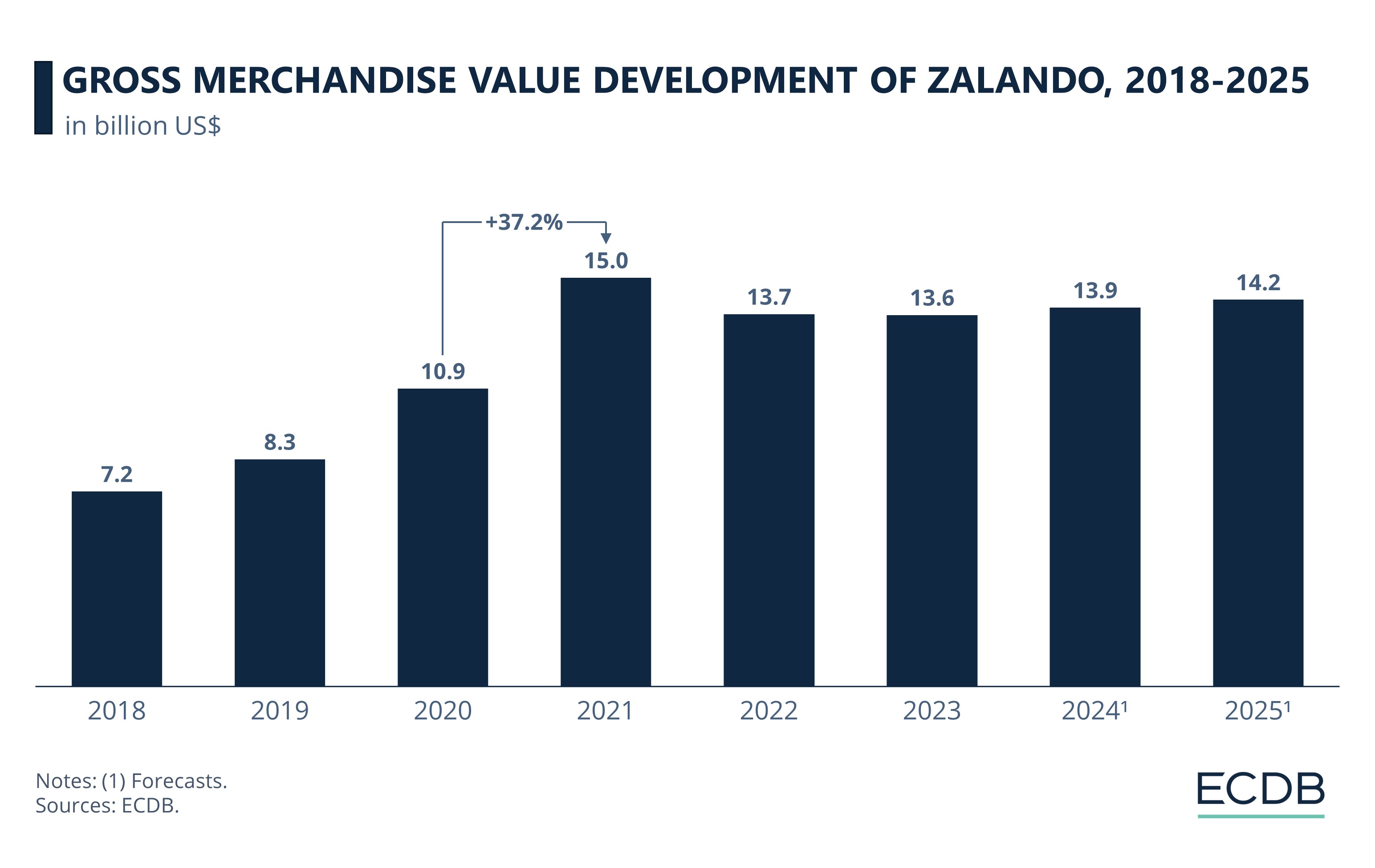

In parallel, the fashion retailer's gross merchandise value (GMV) also showed some positive developments:

Even before the eCommerce boom brought about by the pandemic, Zalandos' GMV saw a healthy upward trend. Between 2018 and 2019, it climbed by 16.5%, reaching US$8.3 billion in 2019.

Zalando particularly benefited from the corona pandemic in 2021, when its GMV jumped to US$15 billion, an augmentation of 37.2%.

Similar to eBay, Zalando's GMV slowed in 2022, losing 8.9% in value. Nevertheless, the fashion player seems to recover from this and will start a new but smaller growth trend of around 2% for the next two years.

All three major players – Amazon, eBay, and Zalando – demonstrate the potential and profitability of digital retail media advertising for eCommerce platforms. But in terms of total revenue, Amazon remains unparalleled, setting a high benchmark for competitors.

Retail Media Advertising: Closing Thoughts

Advertising in digital retail media will continue to grow in value, thanks in part to the shift from physical to online shopping behavior. In particular, the top 3 networks in Europe - Amazon, eBay, Zalando - are benefiting from this positive development. In addition, enabling highly personalized customer experiences is becoming easier with AI.

“Retail Media is becoming the new battleground” – FOMA-Trendmonitor 2023

At the same time, smaller companies are starting to hop on the retail media advertising bandwagon, a trend that may continue. They benefit from the large networks of the larger companies and reach an audience that they could not otherwise reach as quickly. As a result, collaborations are key for smaller players when it comes to retail media advertising.

Sources: ECDB, secondary sources in the referenced articles.

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

eCommerce in Canada: Top Stores, Market Development & Trends

eCommerce in Canada: Top Stores, Market Development & Trends

Deep Dive

Top Online Stores in Europe: Amazon Accounts for 40% of Top 20's Sales

Top Online Stores in Europe: Amazon Accounts for 40% of Top 20's Sales

Deep Dive

Top eCommerce Companies by Market Cap 2024

Top eCommerce Companies by Market Cap 2024

Deep Dive

Online Shopping in the United States: Where Consumers Prefer to Shop Online

Online Shopping in the United States: Where Consumers Prefer to Shop Online

Deep Dive

Alibaba Competitors: Which Companies Are Alibaba’s Biggest eCommerce Rivals?

Alibaba Competitors: Which Companies Are Alibaba’s Biggest eCommerce Rivals?

Back to main topics