eCommerce: Top Companies

Amazon Plans to Launch New Discount Segment in Response to Temu and Shein

Amazon announced the launch of a new discount segment to compete with low-cost platforms like Temu and Shein. Does this move make sense from a data standpoint? ECDB has the answer.

Article by Nadine Koutsou-Wehling | July 11, 2024Download

Coming soon

Share

Amazon's New Discount Segment: Key Insights

Adopting the C2M Approach: A consumer-to-manufacturer model cuts out the intermediary to lower costs and speed up logistics operations. Shein and Temu are prominent examples of low-cost businesses with a successful C2M approach.

Amazon to Launch New C2M Segment: In response to Temu's meteoric rise, Amazon seeks to beat the discount platform Temu at its own game.

PDD Holdings' Development May Pose Threat: As of now, Temu does not pose a credible threat to Amazon's dominance in eCommerce. However, a look at its sister company Pinduoduo shows that growth may catch up sooner than one might think.

Amazon announced plans to launch a new discount segment in response to the disruptive market entry of low-cost competitors. Since Temu and Shein can offer lower prices based on their strategy of shipping goods directly from manufacturers to consumers (C2M) in China, Amazon is taking the same approach for a distinct new section of its business.

Here is what the new discount segment on Amazon could look like, and what ECDB thinks the probability of its success is.

Reasons for Amazon to Launch the New Segment

But first things first, why is Amazon responding at all? According to GMV across all of its marketplace domains, Temu is not a real threat.

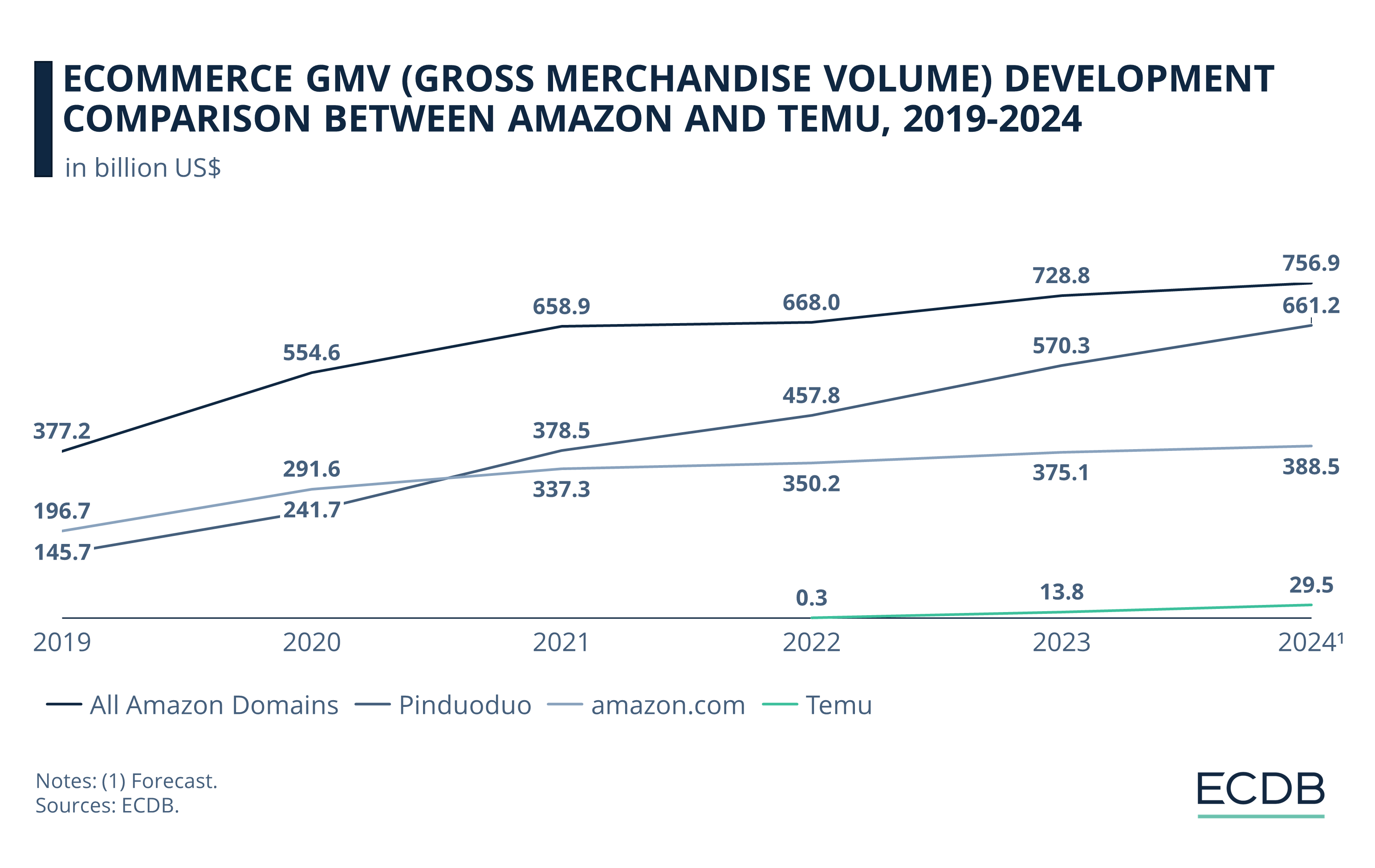

During the pandemic years, GMV soared on Amazon and Pinduoduo. Temu did not launch until late 2022.

While growth on all Amazon domains began to stagnate in 2022, activity on Pinduoduo was still on the rise. Pinduoduo continues to close the gap in the following years. Accordingly, Temu launched in the same year and generated a GMV of around US$300 million.

The ECDB forecast for 2024 predicts slight gains for Amazon (including its main .com domain). Pinduoduo is set to continue growing, while Temu is just getting started, likely approaching a GMV of US$30 billion.

It is clear that Amazon is worlds ahead of Temu's GMV across all of its marketplaces. The startling fact about Temu’s performance, however, is that it started so recently.

Taking into account the development of its sister company Pinduoduo, a further look into the future may justify Amazon's concerns: Pinduoduo was launched in 2015, and one year later, in 2016, it already generated US$3 billion. Compared to amazon.com, Pinduoduo surpassed amazon.com’s GMV in 2021 and is now approaching the GMV that Amazon is expected to generate across all its domains by 2024.

In this light, Amazon's response makes more sense: To prevent Temu's rise early on, the eCommerce leader is working to beat Temu and PDD Holding at their own game. Amazon certainly has the resources to build a comparable division. The question is whether consumers will follow.

The Outlook: Amazon’s Discount Unit – A Recipe for Success?

Because Amazon plans to ship products directly from China to the United States, delivery times will be equal to Shein’s and Temu’s, which are between 9 and 11 days. By taking advantage of the de minimis rule, goods can be imported duty-free for packages under US$800.

The question, however, is whether Amazon is hurting itself in the long run with this strategy: Having gained global recognition for its consumer-centric approach and speedy delivery, the company is now trading speed for ever-lower prices. The problem is the questionable quality of the products, which may discourage customers from making repeat purchases.

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

eCommerce in Canada: Top Stores, Market Development & Trends

eCommerce in Canada: Top Stores, Market Development & Trends

Deep Dive

Top eCommerce Companies by Market Cap 2024

Top eCommerce Companies by Market Cap 2024

Deep Dive

Online Shopping in the United States: Where Consumers Prefer to Shop Online

Online Shopping in the United States: Where Consumers Prefer to Shop Online

Deep Dive

Alibaba Competitors: Which Companies Are Alibaba’s Biggest eCommerce Rivals?

Alibaba Competitors: Which Companies Are Alibaba’s Biggest eCommerce Rivals?

Deep Dive

The Global B2B eCommerce Market: Why It Is Beneficial to Sell to Other Businesses

The Global B2B eCommerce Market: Why It Is Beneficial to Sell to Other Businesses

Back to main topics