Quick Commerce & Grocery Shopping

Latest Grocery Market Developments With Uber Eats Gaining Influence

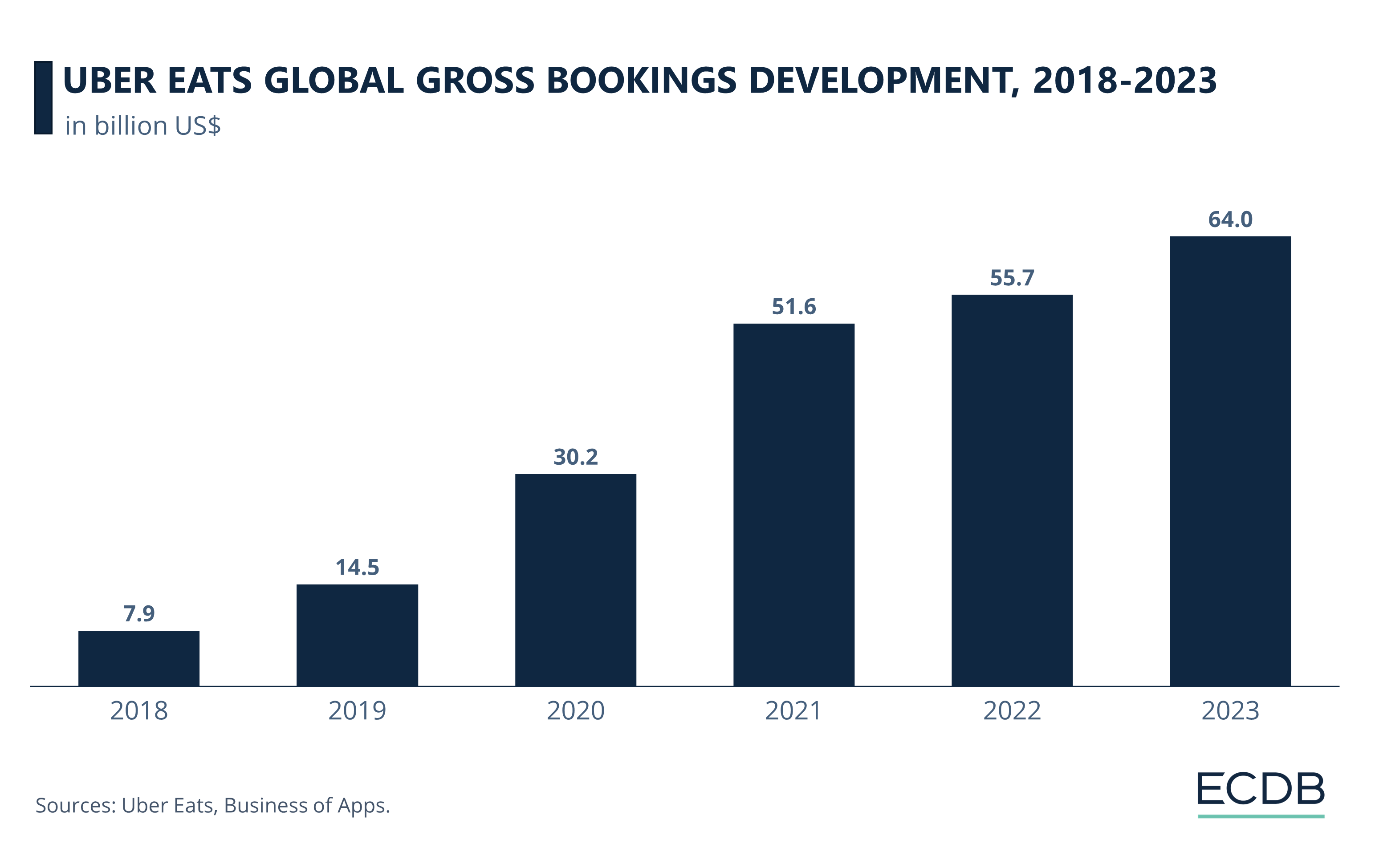

Uber Eats' growth was driven by the pandemic, and has continued in the years since. While grocery is one of the leading categories for eCommerce growth globally, recent market shifts reveal that challenges lie ahead.

Article by Nadine Koutsou-Wehling | July 19, 2024Online food delivery has sustained pandemic growth and continues to stay relevant to this day. Forecasts predict that the largest sector of this industry – grocery delivery – will almost double in revenue in the next four years. At the same time, the trend is toward faster and cheaper food delivery – something that Uber Eats has also recognized.

In a strategic move at the end of 2023, Uber Eats aligned with quick commerce company Getir in Europe to expand its ultra-fast delivery of food and consumer goods. But Getir has since announced to exit most of its markets altogether.

Other collaborations with retailers such as Carrefour are driving Uber Eats' growth. These collaborations not only diversify Uber Eats' product portfolio, but could also turn the company into an online food delivery all-rounder.

What Does the Online Food Delivery Market Consist Of?

As per Statista's definition, the online food delivery market splits into two big segments, meal delivery and grocery delivery, each with two to three other segments. The meal delivery market includes restaurant and platform delivery, like Deliveroo and Uber Eats, while the grocery delivery market comprises of retail and meal kit delivery, as well as quick commerce also known as qCommerce.

Among the segments mentioned, grocery delivery has the biggest potential for growth.

Great Growth Potential for Global Online Food Delivery

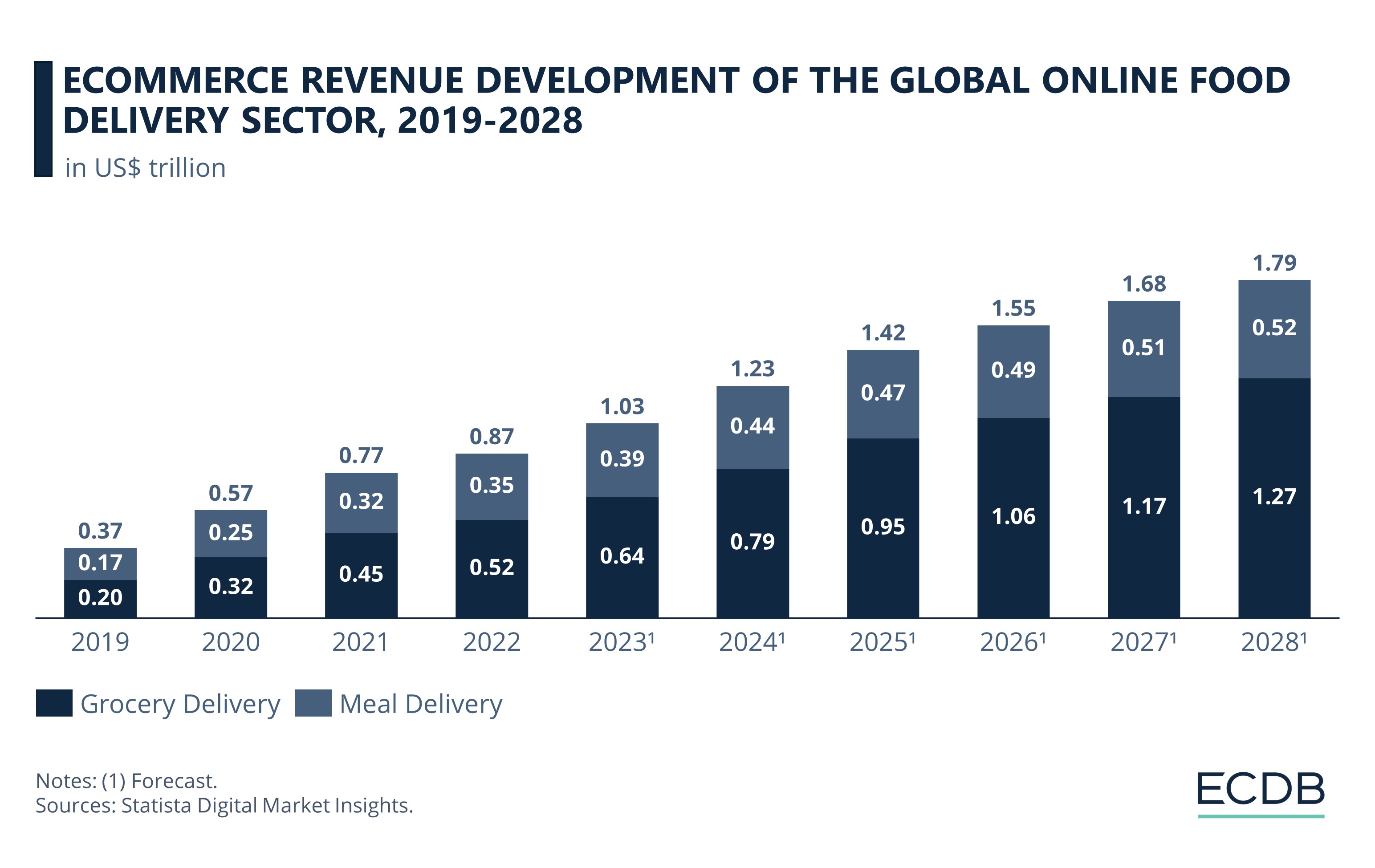

Before the pandemic, grocery and meal delivery services generated comparable revenues, but their penetration was significantly lower than today. Global revenues of US$200 billion for grocery delivery and US$170 billion for meal delivery by 2019 suggest a less prevalent need for these services among consumers.

Although meal and grocery delivery had been around for some time, it was the pandemic that sparked the widespread surge of online food delivery as we know it today:

The COVID-19 pandemic led to an abrupt shift where people had to stay home, and restaurants had to close. As a result, there has been a general growth in online food delivery, while deliveries have become faster. Whereas grocery deliveries took days to weeks before the pandemic, purchases can now be delivered within a few hours, making online food delivery a lasting trend.

Grocery Delivery May Reach US$1.28 Trillion in 2028

The data reflects this popularity, too:

From US$370 billion in revenues for both meal and grocery delivery services in 2019, revenues increased by about 178% over the next four years, resulting in total net sales of US$1.03 trillion by 2023.

Over the same period, grocery delivery sales outpaced meal delivery services, resulting in global revenues in 2023 of US$640 billion compared to US$390 billion for meal delivery.

Predictions for the coming years indicate that grocery delivery revenues will experience a more significant increase compared to meal delivery, which is anticipated to see a more modest growth.

While overall revenue growth after 2023 is projected to be lower than from 2019 to 2023, grocery delivery is still expected to nearly double between 2023 and 2028, reaching almost US$1.27 trillion.

Of this forecast figure, 70% is projected to come from grocery delivery sales, while meal delivery is anticipated to reach a total of US$520 billion.

Consumers Spend the Most for Grocery Deliveries

Focusing on the spending of the average revenue per user (ARPU) of the market, we can further elaborate on these findings:

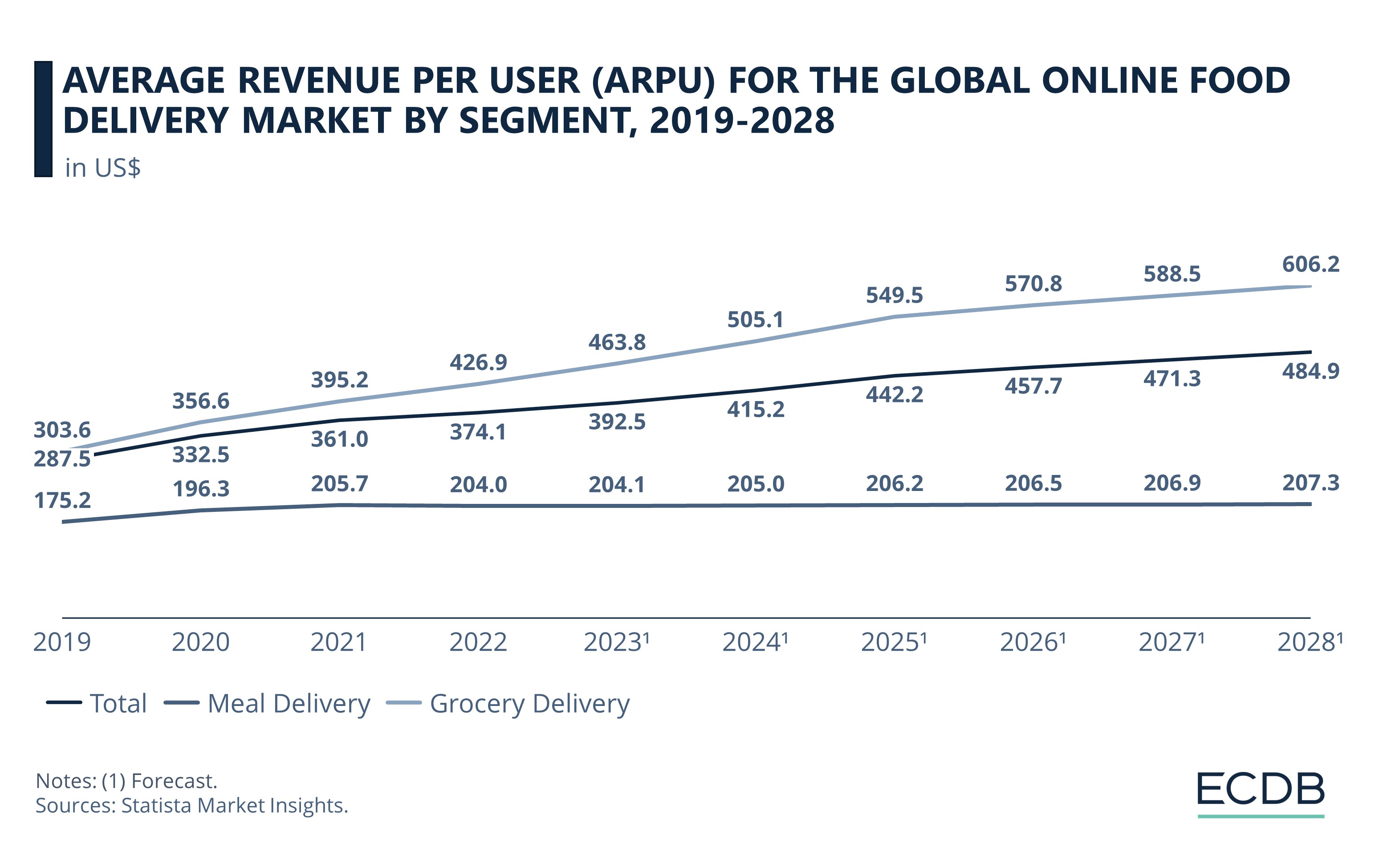

Given the projected market development above, average consumer spending is anticipated to gradually grow. More specifically, while online food delivery users are expected to increase their spending on online groceries over the years, there is a lower propensity to spend more on meal delivery.

Online Grocery Services to Trigger Higher Spending

The pandemic has led to an uptick in annual spending on both online groceries and meals. However, only the grocery services are projected to expand their market share substantially in the coming years.

One likely reason for these projected figures is market saturation. The grocery delivery sector has witnessed significant innovation in recent years, in contrast to the meal delivery sector, which has remained relatively stable and thus has limited potential for drastic transformation.

Given the room for innovation that is still prevalent in the grocery sector, the typical online food delivery consumer is expected to increase consumption in the coming years, while more users are likely to enter the sector and try these services.

With a parallel increase in supply and convenience, i.e. faster delivery times, greater accessibility and a suitable product range, the average consumer could spend up to US$606 in 2028 on online groceries.

For meals, however, the average annual spends hovers around an estimated US$207.

More than Half of Uber Eats Consumers Are Under 34 Years Old

Turning to the delivery platform Uber Eats, we explore consumer demographics and the company’s move to integrate grocery delivery and quick commerce into its service. In doing so, the next sections elaborate on the market difficulties that qCommerce has experienced and the viable solutions that an established online player like Uber can provide in fostering partnerships and catering to consumer preferences.

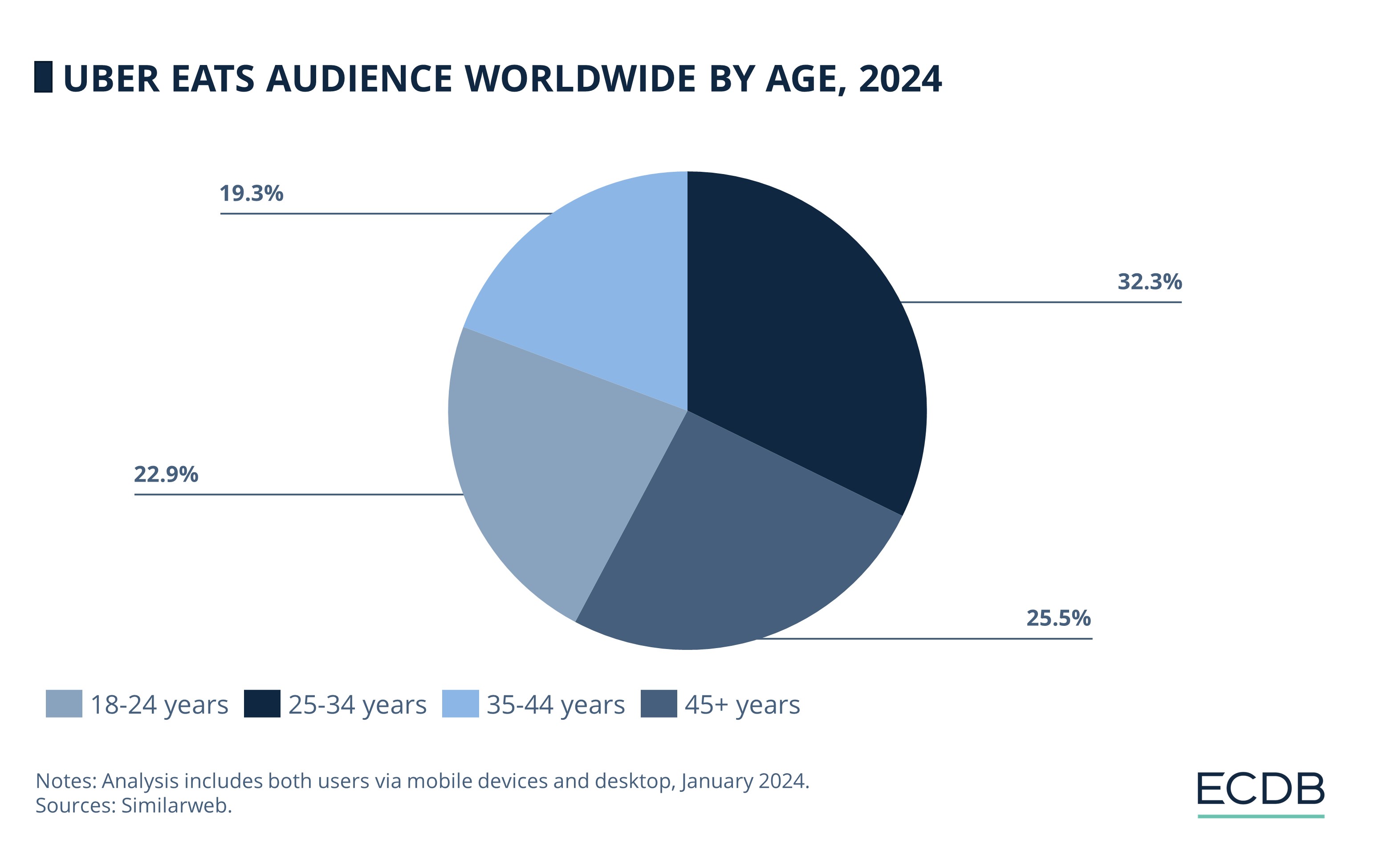

Based on data from Similarweb, the chart below illustrates the age distribution of global Uber Eats consumers:

Most Uber Eats users (74.5%) are between the ages of 18 and 44.

The largest segment is 25- to 34-year-olds, with 32.3% of global Uber Eats users in this age group.

The second largest segment is the youngest, 18- to 24-year-old users, at 22.9%.

After that, older users are less likely to use the service, starting with users between the ages of 35 and 44 (19.3%) and moving to older cohorts, which together comprise about 25.5%.

Younger Users Drive Innovation

Given the general assumption that younger demographics are driving the trend of quick commerce adoption, which is based on the familiarity with electronic devices and a preference for immediacy, younger users are expected to have significant potential for qCommerce growth.

Their propensity to use such services, combined with the continued influx of younger individuals turning 18 and joining the consumer market, suggests a likely expansion of the qCommerce business model. What’s more, as public awareness of these services increases, the integration of new technologies and food delivery services into daily routines could further boost sales.

Shifting the focus to the company’s strategic moves, Uber Eats has been actively forging partnerships in line with innovations in online grocery as well as delivery quick commerce and has managed to integrate deliveries under one hour for grocery deliveries.

Overcoming qCommerce's Initial Gold Rush

The quick commerce sector entered the eCommerce world with high hopes, as evidenced by the initial venture capital investments in major players such as Getir and Flink. Over time, however, the qCommerce landscape concentrated on a few large players who bought out the less profitable ones that could not sustain themselves in the long run.

Because of the high operating costs, at least in the first five years, many smaller players found it difficult to finance their business in the long term. In a highly competitive landscape such as the emerging qCommerce sector, companies are vying for consumer attention and (recurring) orders, while at the same time having to cover the costs of dark stores, drivers, and marketing campaigns.

Discover Our Data: Our frequently updated rankings provide essential insights to help your business thrive. Wondering which stores and companies are excelling in eCommerce? Interested in the top-performing categories? Find the answers in our rankings for companies, stores, and marketplaces. Stay competitive with ECDB.

Consumer Expectations: Cheaper, Faster & 24/7 Available

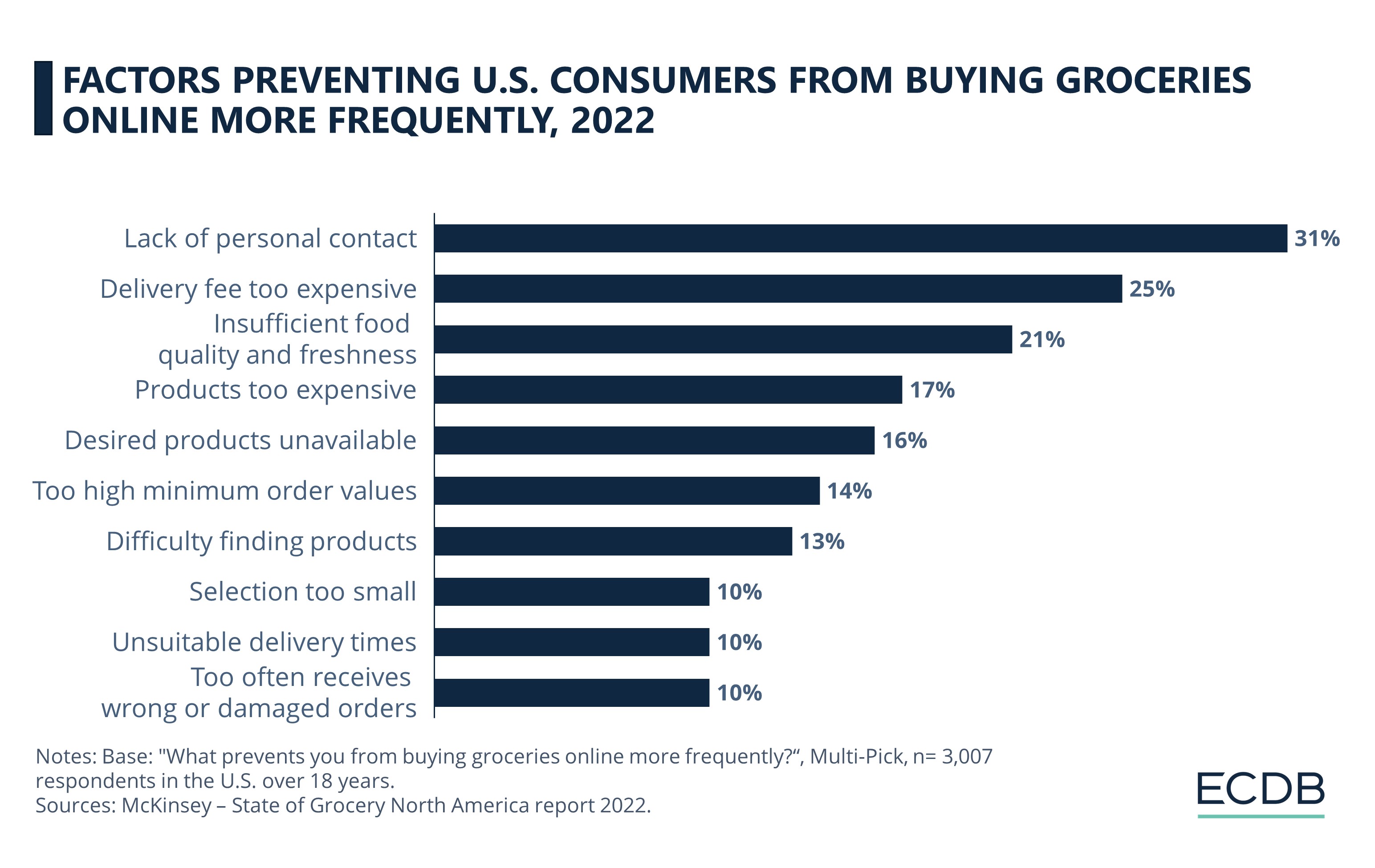

Consumers, on the other hand, have certain expectations when it comes to ordering groceries online, as seen in the example of U.S. users below.

According to the McKinsey data, high delivery fees, product prices and minimum order values are among the most prominent problems consumers have with qCommerce. Therefore, incumbents with an existing network that can offer faster delivery of cheaper items with no to very low delivery costs have a clear advantage over newer competitors trying to gain a financially viable foothold in the market.

Uber Eats: A Future-Proof eCommerce Concept?

This is where Uber Eats comes in. It is common for meal delivery services to partner with restaurants to offer customers a wider variety of cheaper meal options. But Uber Eats is going a step further.

Launching in the U.S. for the first time in fall 2022, additional partnerships with retailers and supermarket chains like Costco and Carrefour allow Uber Eats to offer a greater product range outside of meal delivery, thereby eliminating the dark store concept and the costs associated with it.

While Uber Eats is pursuing the same retail partnership strategy in the UK, the story is a bit different in the rest of Europe. Customers who order food via Uber Eats can add products from locations on the driver's route to their shopping cart without incurring additional delivery fees. This increases convenience for customers who want to add snacks and other consumables such as alcohol, cigarettes or household items to their order.

Uber Eats' partnership with former market leader Getir at the end of 2023 was turned upside down when Getir exited most European markets earlier this year. Getir's business model was not sustainable in the long run, because of the high fixed costs of its dark stores meeting fluctuating consumer demand and low order values.

All the better for Uber Eats: The company is backed by a thriving U.S. conglomerate to sustain its business, so it does not meet the hurdles more independent startups face. The stores that formerly partnered up with Getir, as well as the customers, are left to do business with Uber Eats instead.

And most likely, this is what the long-term vision of online food delivery will look like: A sophisticated network of partnerships, with companies providing the ordering platform and delivery drivers, while affiliated restaurants and retailers supply the products.

With other innovations that companies like Uber Eats and Grubhub are testing in the U.S., such as robot delivery and a diversified offering that includes prescription drugs, the focus on customer convenience combined with automated delivery and extended delivery times has room to transform quick commerce and online food delivery in general as we know it today.

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

Who Are the Number One Shop Software Providers in Each European Country?

Who Are the Number One Shop Software Providers in Each European Country?

Deep Dive

The United States Takes the International Lead in eCommerce Revenue per Capita

The United States Takes the International Lead in eCommerce Revenue per Capita

Deep Dive

Valentine’s Day Drives eCommerce Revenues for Flowers & Gifts

Valentine’s Day Drives eCommerce Revenues for Flowers & Gifts

Deep Dive

Shopify Is the Most Used Shop Software Globally, But Magento Dominates in Europe

Shopify Is the Most Used Shop Software Globally, But Magento Dominates in Europe

Deep Dive

Why the Online Pharmacy Trend Has Continued Beyond the Pandemic

Why the Online Pharmacy Trend Has Continued Beyond the Pandemic

Back to main topics