Online vs. Offline Sales

Online vs. Offline Shopping – What Do European Consumers Prefer?

Which do Europeans prefer: online shopping or physical stores? Read on to learn about trends and analysis comparing eCommerce platforms to brick-and-mortar stores.

Article by Cihan Uzunoglu | August 30, 2024The growth of eCommerce in Europe, particularly for physical products, is unmistakable. Online shopping across devices like desktops, tablets, and smartphones has surged dramatically.

Meanwhile, traditional shopping methods, including physical stores, telesales, and mail orders, have seen a decline.

Are Europeans leaning more towards online or in-store shopping? We've examined the data to uncover where their spending is truly going.

Online Retail vs. Offline Retail: Europe Analysis

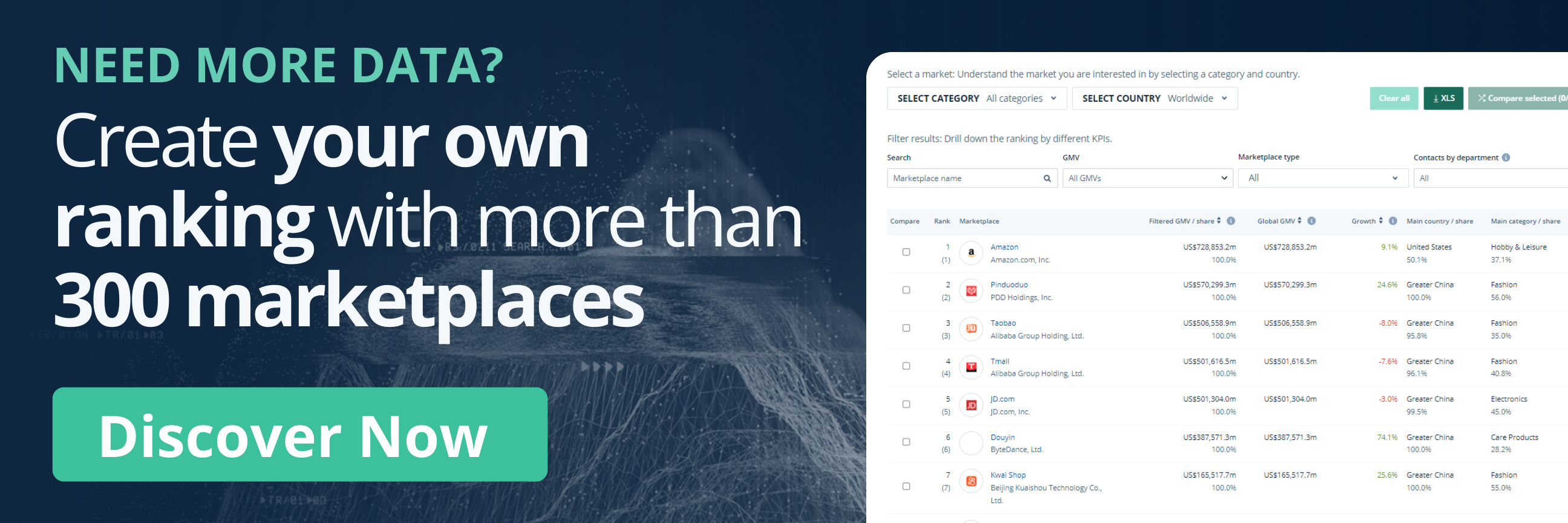

As per our numbers, the balance between online and offline commerce has shifted over the years:

Online share of retail sales in Europe stood at 12% back in 2017. Making almost one percent jump, this share was 12.9% by 2019.

A particularly significant surge was noted between 2019 and 2020 when online figures leaped to 16.6%.

Although there was a momentary dip from 2021’s 17.4% to 15.2% in 2022, this figured stayed about the same last year at 15.3%.

The future looks promising for European eCommerce, as online retail’s share is not expected to go below pre-pandemic levels: Projections suggest an increase to an impressive 20.4% by 2028.

Online Shopping vs. In-Store Shopping

in Europe: Top 3 eCommerce Markets

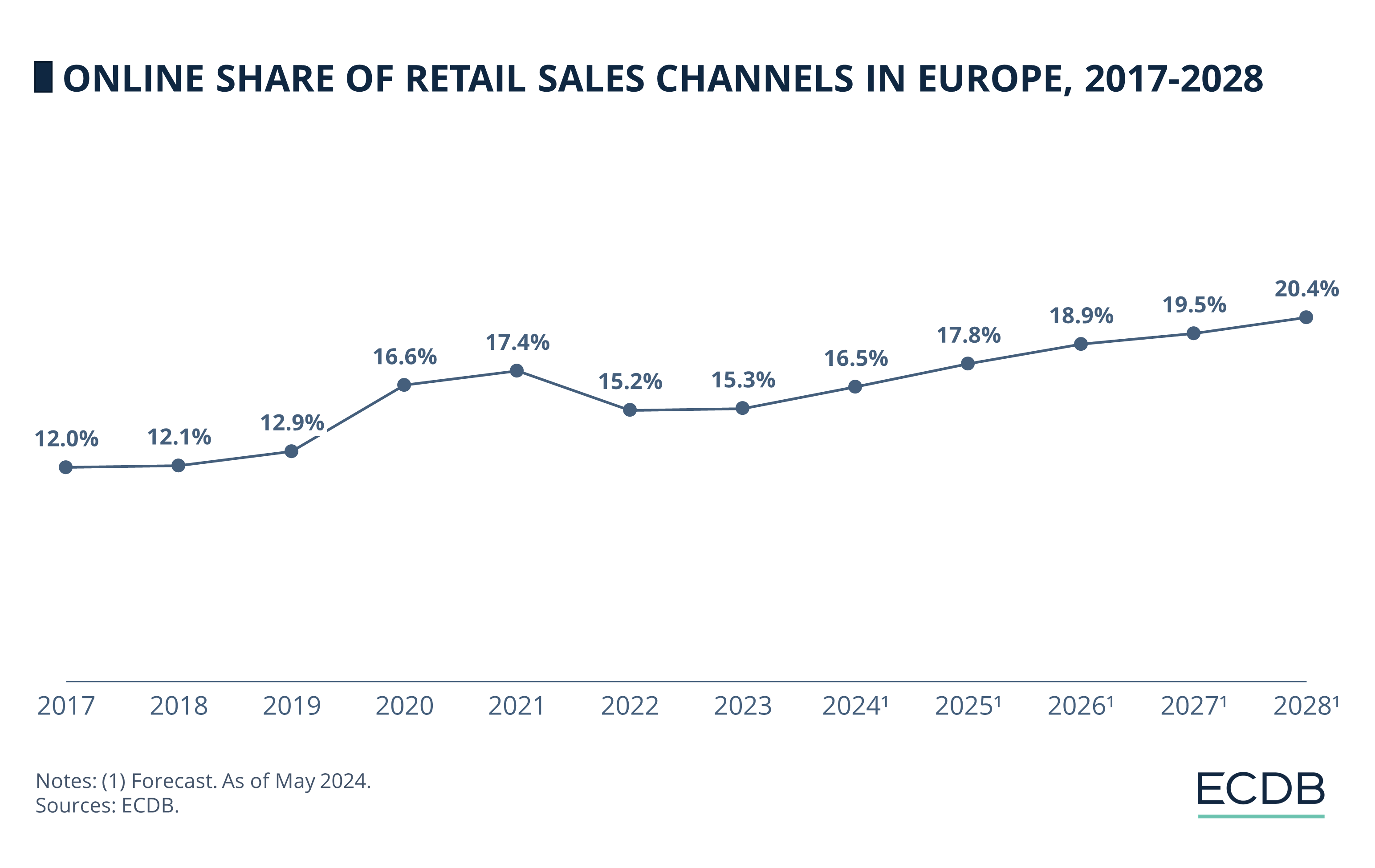

Top 3 eCommerce markets of Europe are the United Kingdom, Germany and France, which doesn’t come as much of a surprise since these countries also have the highest Gross Domestic Product (GDP) of the continent.

Our numbers provide a snapshot of Europe's top eCommerce markets:

The UK led the way for online shopping in 2019, with online channels accounting for almost a quarter of the retail market in the country.

Germany and France followed suit, registering online shopping rates of 11% and 10% respectively.

With the pandemic, the market shifted significantly. From 2020, all three markets saw a large increase in the share of online retail: By 2021, the UK was at 28%, while Germany was at 18% and France at 17%.

Despite the overall decline in online retail share for all these countries in 2022, the balance is expected to remain fairly even by the end of this year.

Consumer Preference Leans Towards

Online Shopping

In early 2023, a worldwide survey by Klarna gauged consumer preferences for online versus in-store shopping. For context, it’s worth mentioning that the unspecified percentages in these figures indicate consumers with a neutral preference.

The UK's results showed 35% leaning towards online and 26% for in-store. While Germany had 33% preferring online shopping and 25% in-store, 32% of consumers in France favored in-store shopping, slightly surpassing the 31% that preferred online.

Offline Shopping Leads in Shopping Frequency

The distinction between shopping preference and actual frequency offers a comprehensive understanding of the retail landscape. By considering shopping frequency, the aforementioned Klarna study reveals that despite a rise in online shopping interest, physical stores remain dominant in Europe, with consumers visiting them regularly.

In the UK, 51% of consumers turn to online shopping weekly, while 76% patronize offline outlets. Similarly, in Germany, 45% venture online for their purchases each week, while a robust 82% opt for physical stores. France demonstrates a weekly online shopping trend of 32%, with its offline counterpart at 72%.

Discover Our Data: Our frequently updated rankings provide essential insights to help your business thrive. Wondering which stores and companies are excelling in eCommerce? Interested in the top-performing categories? Find the answers in our rankings for companies, stores, and marketplaces. Stay competitive with ECDB.

Online vs. Offline Retail: Pandemic’s Impact

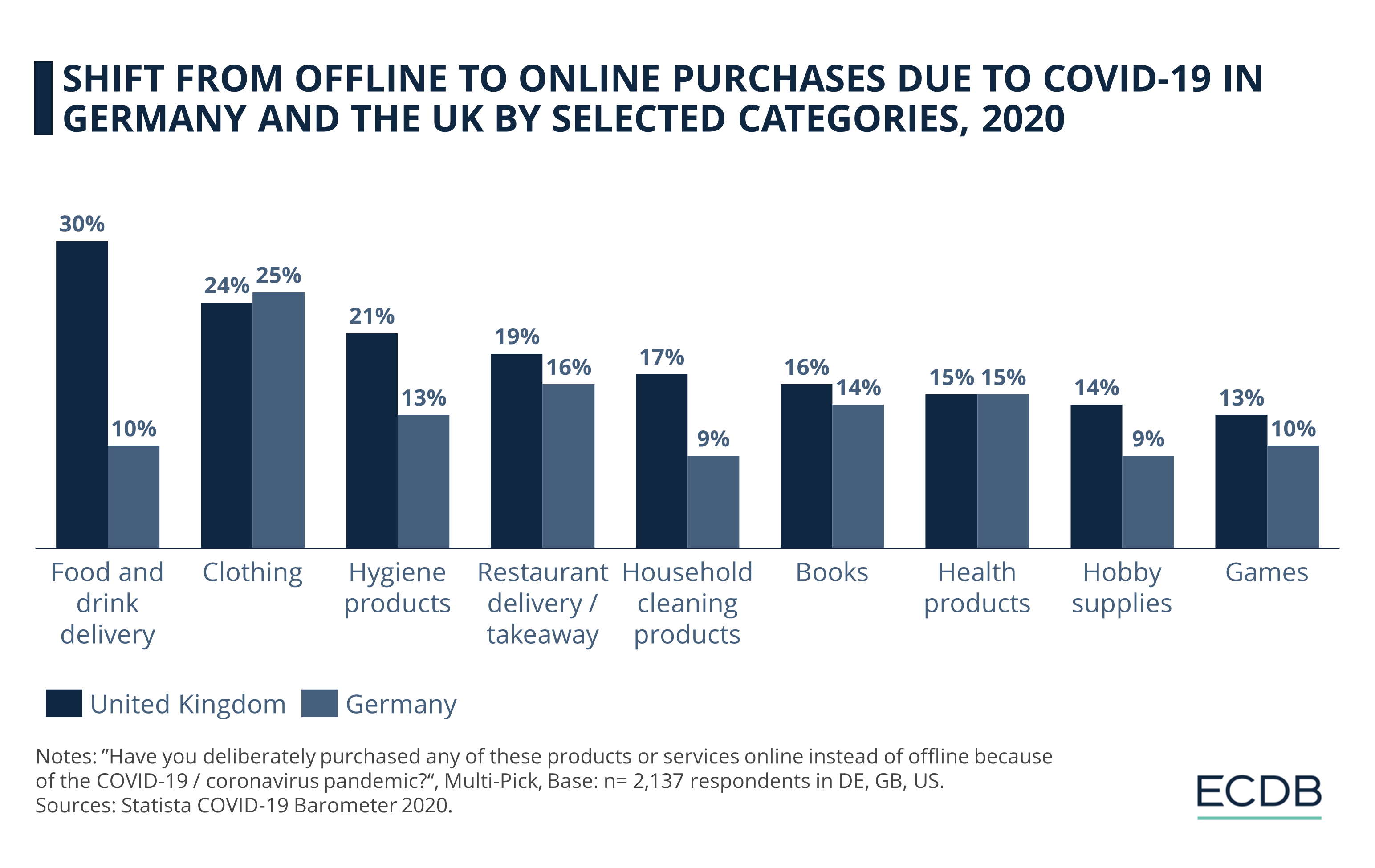

The COVID-19 pandemic irrevocably altered the world in numerous ways, including reshaping consumer buying patterns. In Germany, according to Statista's report COVID-19 Barometer 2020 on purchasing behavior during the COVID-19 pandemic:

The highest shift from offline to online purchases was in "Clothing" with 25%, followed by "Restaurant delivery/takeaway" at 16%, and "Health products" at 15%.

In Germany, 47% of respondents did not shift from offline to online purchases for any products or services.

In the UK, "Food and drink delivery" saw a 30% shift to online, with "Hygiene products" at 21% and "Clothing" at 24%. About 35% reported no change.

The UK led in "Food and drink delivery" online shifts at 30% compared to Germany's 10%, and "Hygiene products" at 21% vs. Germany's 13%.

"Household cleaning products" saw a 17% shift to online in the UK, compared to Germany's 9%.

German Retail: FMCG Still Strong in

Offline Channels

As we drill down into specific product categories, we find that not all items are created equal in the online and offline realms.

As per a survey published by HDE (Handelsverband Deutschland) in 2021, the distribution of industries in online and offline retail volume in Germany highlighted notable disparities across various product categories.

When examining online sales channels, we see that Fashion & Accessories (23.6%) and Electronics (22.3%) dominated the landscape, suggesting a robust inclination among German consumers to purchase these items digitally. Free Time & Hobbies also held a relatively higher online share at 15.3%.

The Fast-Moving Consumer Goods (FMCG), which refers to consumer goods that are sold quickly and at relatively low cost, category made up 41.3% of offline retail volume. This indicates that, while Germans use digital channels for certain products, daily goods are primarily bought from physical stores.

Categories like Home & Furnishing (9.4% online) and Health & Wellness (6.3% online) also exhibited significant online traction, but the stark contrast between FMCG's online and offline share stands out, as the category makes up only 12.1% of online retail in Germany.

Upon closer inspection, it's evident that Electronics, Fashion & Accessories, Free Time & Hobbies, Home & Furnishing, Health & Wellness, Jewelry & Watches, and Office Supplies all have a higher share in online sales channels compared to their respective offline percentages.

Online Shopping vs. In-Store Shopping

in Europe: Closing Thoughts

As we look to the future, several questions remain open: How will emerging trends like voice search and mobile-first experiences further shape consumer preferences and the retail landscape? Will the integration of AI and other digital tools continue to blur the lines between online and physical stores, promoting a more seamless shopping experience? And importantly, how will economic factors like inflation influence online spending habits and consumer choices?

The ongoing evolution in shopping behaviors suggests a promising yet uncertain future for the retail sector, both online and offline. As companies adapt to these changes, factors such as consumer preference, technological advancements, and economic conditions will dictate the next phase of retail in Europe.

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

Who Are the Number One Shop Software Providers in Each European Country?

Who Are the Number One Shop Software Providers in Each European Country?

Deep Dive

The United States Takes the International Lead in eCommerce Revenue per Capita

The United States Takes the International Lead in eCommerce Revenue per Capita

Deep Dive

Valentine’s Day Drives eCommerce Revenues for Flowers & Gifts

Valentine’s Day Drives eCommerce Revenues for Flowers & Gifts

Deep Dive

Shopify Is the Most Used Shop Software Globally, But Magento Dominates in Europe

Shopify Is the Most Used Shop Software Globally, But Magento Dominates in Europe

Deep Dive

Why the Online Pharmacy Trend Has Continued Beyond the Pandemic

Why the Online Pharmacy Trend Has Continued Beyond the Pandemic

Back to main topics