Trend Report

“E-Commerce Market Germany 2023” - The Top Three Marketplaces and Amazon’s Role

Our study “E-Commerce Market Germany 2023” provides valuable insights into the German eCommerce landscape, some aspects of which are presented below.

Article by Nadine Koutsou-Wehling | October 10, 2023In collaborative effort with the EHI Research Institute, the German eCommerce market is being examined in depth for the 15th consecutive year. Before you order the report here and receive the full 60-page analysis with detailed sales data, GMV insights, and other market indicators, take a look at the preliminary findings regarding the top online marketplaces in Germany below.

What are the top 3 best-selling marketplaces in German eCommerce? What role does Amazon play? And can you guess which marketplaces rank fourth and fifth? The following preview answers all of these questions.

Amazon.de Generated a GMV of €46.3 Billion in Germany in 2022

Gross Merchandise Value (GMV) is the total value of transactions conducted on a marketplace during a given time period. It's important to note that GMV is different from the revenue generated by a marketplace provider, as they typically earn a percentage of the GMV as profit.

Our “E-Commerce Market Germany 2023” study highlights the top 10 B2C marketplaces in Germany, three of which are shown below.

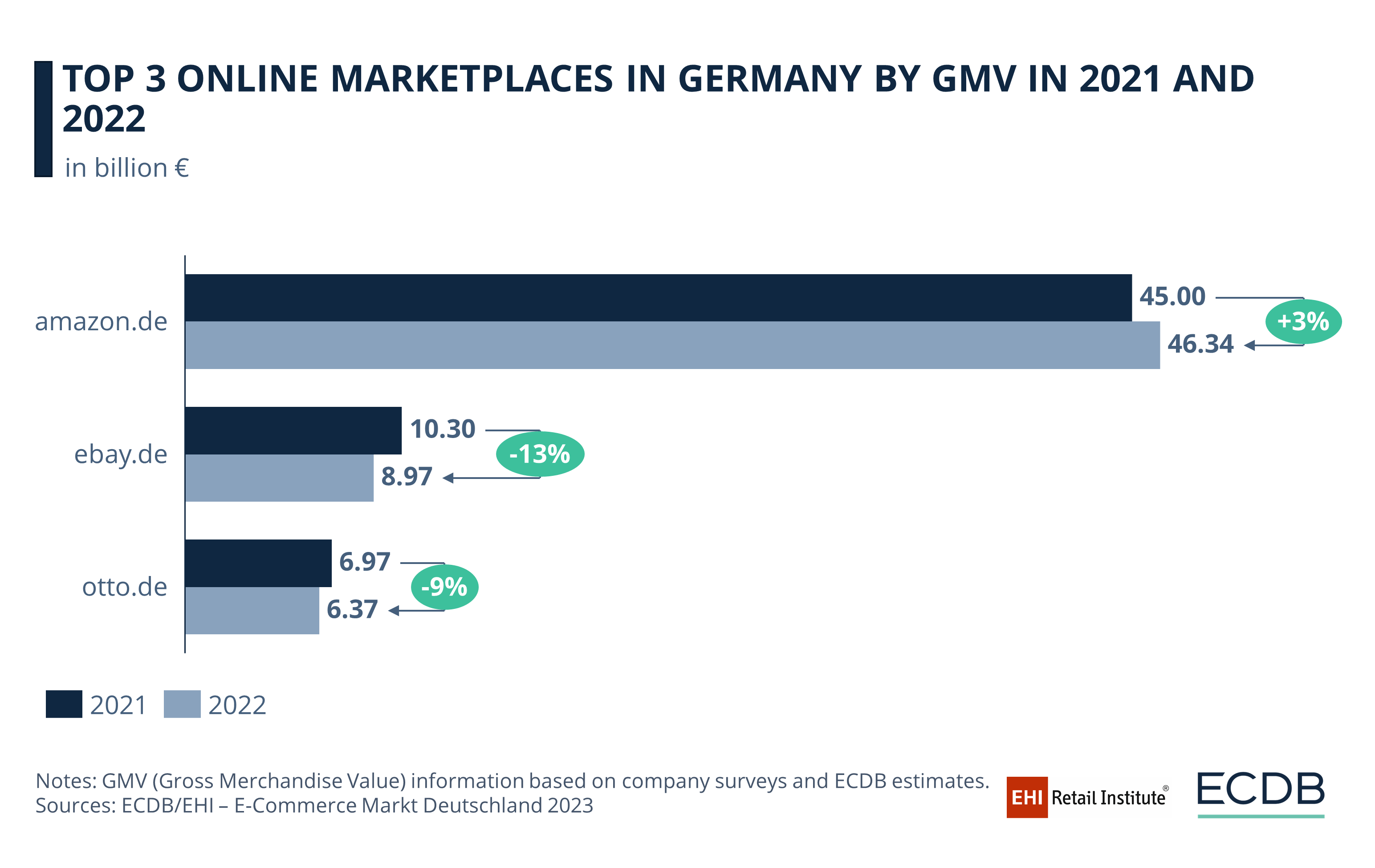

As seen in our previous preview, Amazon not only leads the top online stores in Germany, but also ranks first in its function as a marketplace. In this regard, Amazon’s marketplace business is thriving considerably, generating three times the net sales of approximately €14.4 billion that the company generates from selling its own products. In 2022, amazon.de recorded €46.3 billion in GMV, an increase of 3% from the previous year.

Amazon’s position as the number one go-to marketplace for German eCommerce is undisputed, as evidenced by the fact that the other rankings are positioned so far behind.

Second and Third Marketplaces in Germany Are Far Behind Amazon's GMV

Both the second- and third-ranked marketplace domains on this list, ebay.de and otto.de, have lost percentages of their 2021 GMV year-over-year. eBay experienced GMV losses of 13%, with approximately €9 billion worth of transactions on its marketplace in 2022. Third-ranked Otto lost 9% since 2021, with a GMV of €6.4 billion in 2022.

Can you guess which marketplaces rank fourth and fifth in German eCommerce? Representing the two popular product segments of fashion and electronics, it is Zalando in fourth place and Media Markt in fifth. Check out the report if you’re interested in more GMV data and the other five marketplaces that made the list.

As the largest marketplace in Western eCommerce, Amazon warrants a closer look, something which “E-Commerce Market Germany 2023” provides.

Online Stores Using an Amazon Account in 2022 Totaled 46.6%

As Germany’s largest online marketplace, Amazon hosts a substantial share of online stores that sell their products on the site. Our next metric examines this share in more detail.

Of the top 1,000 online stores in Germany, 466 have an account on Amazon, resulting in a 46.6% share of online stores. Looking at the previous two years, this share grew from 44.8% with an Amazon account in the midst of the pandemic in 2020, while subsequently dropping to 43.6% in 2021. 2022 appears to have been a successful year for Amazon’s marketplace, as indicated by the increased number of online stores selling their products on the site, as well as the rising GMV.

More information can be found in the “E-Commerce Market Germany 2023” report, some of which includes:

Of the 46.6% of stores with an Amazon account, 62% have customer reviews of their products that are less than 12 months old.

Of these 62%, or 288 in absolute terms, 93.1% have positive reviews as an average of the reviews left on all online stores.

"E-Commerce Market Germany 2023" - Order the Report Now

Curious about more information on the German eCommerce landscape, including leading players, product categories, and revenue distribution? Secure your copy of the 2023 report here.

ECDB, in partnership with the EHI Retail Institute, presents these and numerous other data points on relevant aspects of eCommerce, charting the evolution of the German online market in 2022.

For global eCommerce updates and the latest trends, connect with us on LinkedIn.

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

ByteDance Is Big on Personal Care, Powered by Content on Douyin and TikTok Shop

ByteDance Is Big on Personal Care, Powered by Content on Douyin and TikTok Shop

Deep Dive

Walmart Passes Apple as Amazon’s Lead in U.S. Online Store Ranking Diminishes

Walmart Passes Apple as Amazon’s Lead in U.S. Online Store Ranking Diminishes

Deep Dive

eCommerce in Canada: Top Stores, Market Development & Trends

eCommerce in Canada: Top Stores, Market Development & Trends

Deep Dive

Top Online Stores in Europe: Amazon Accounts for 40% of Top 20's Sales

Top Online Stores in Europe: Amazon Accounts for 40% of Top 20's Sales

Deep Dive

Top eCommerce Companies by Market Cap 2024

Top eCommerce Companies by Market Cap 2024

Back to main topics